Factoring In Business

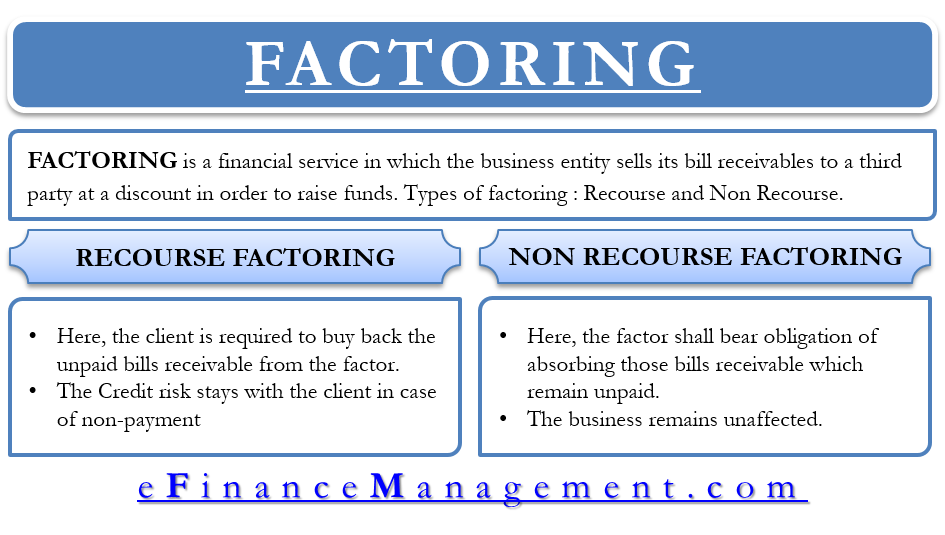

There s also the risk of upsetting customers if the factor is unprofessional or heavy handed when collecting the debt and you can end up out of pocket if a recourse invoice lands back on your books.

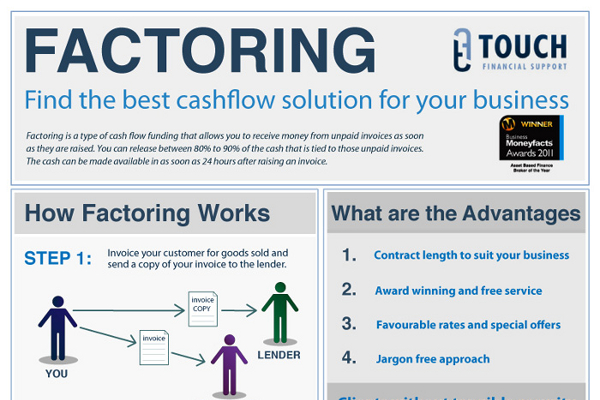

Factoring in business. Invoice factoring allows businesses access to funds against what is often their most significant asset their debtor book. Around 45 000 businesses in the uk currently use factoring abfa as at q3 2015 2 also known as. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. A financing method in which a business owner sells accounts receivable at a discount to a third party funding source to raise capital entrepreneur small business encyclopedia.

Factoring implies a financial arrangement between the factor and client in which the firm client gets advances in return for receivables from a financial institution factor. This usually involves accounts that are difficult for the business to collect. Supporting clients of all sizes from start ups to corporates it can be particularly useful for businesses who want to build working capital to grow without the burden of fixed cost lending such as traditional bank loans. It can be hard to break the cycle of relying on factoring for working capital once you ve gone down that road.

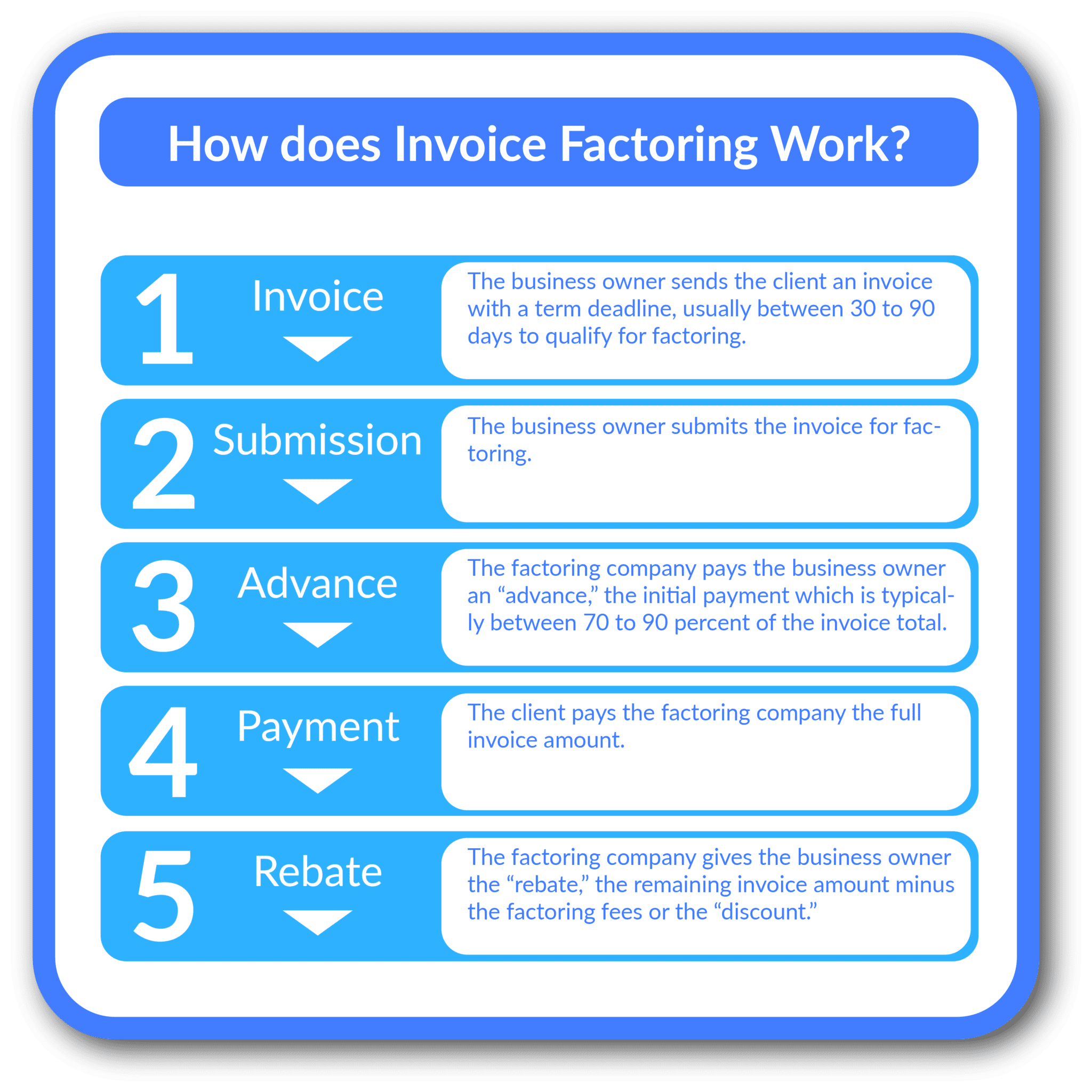

Factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context. Factoring allows a business to obtain immediate capital or money based on the future income attributed to a particular amount due on an account receivable or a business invoice. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Factor at discounted prices.

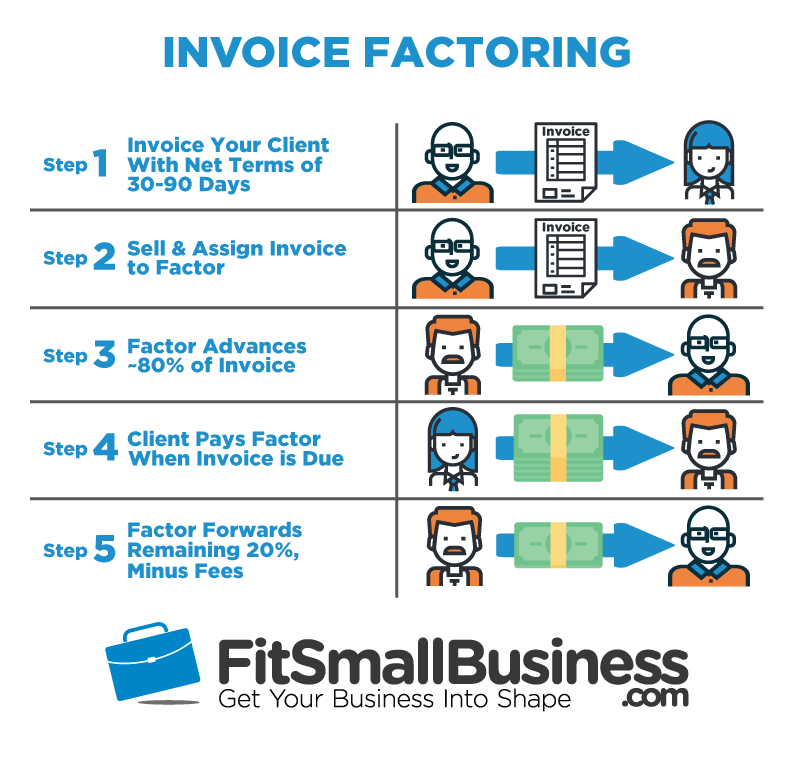

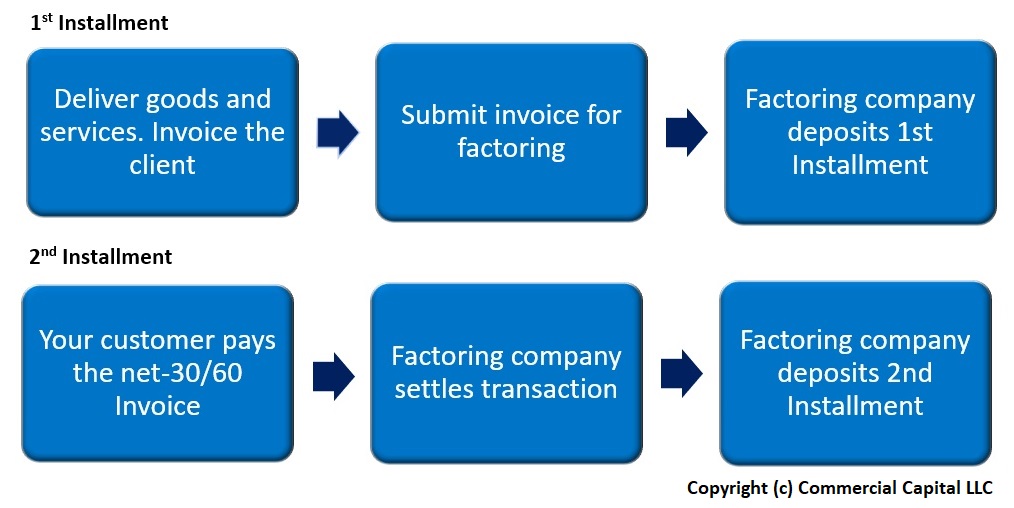

Factoring is sometimes referred to as accounts receivable financing. The business selling their ar make at least a little cash on something that might normally be written off as a bad debt. Invoice factoring can be provided by independent finance providers or by banks. Factoring is when a factoring company purchases your open invoices.

The factoring company then collects payment on those invoices from your customers. You usually receive payment for those invoices within 24 hours. It is a financing technique in which there is an outright selling of trade debts by a firm to a third party i e. Invoice factoring is a way for businesses to fund cash flow by selling their invoices to a third party a factor or factoring company at a discount.