Factoring Invoicing

Has an annual turnover typically above 250 000 would like support to manage your credit control activities.

Factoring invoicing. Sells products or services on credit to other businesses generating invoices for payment. Invoice factoring can be provided by independent finance providers or by banks. That s why there is a great boost up this service has taken in last few years. This factoring service is common in united states of america.

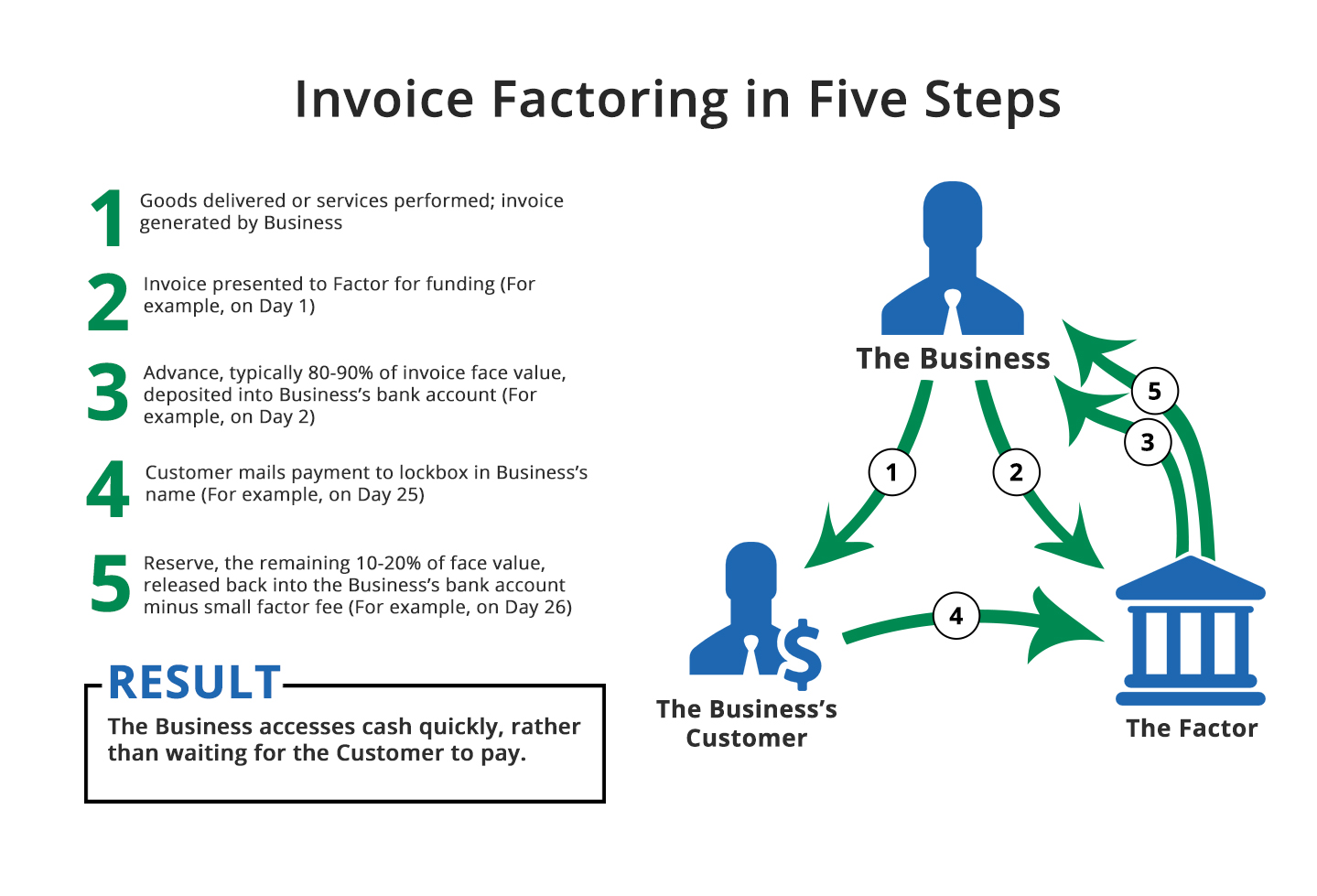

Invoice factoring allows businesses to release cash tied up in outstanding invoices and is efficient because we manage your sales ledger credit control and collect payments from your customers. Technically invoice factoring is not a loan. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Invoice factoring or debt factoring gives you instant access to cash tied up in your unpaid invoices while an expert credit management team look after the collection of payments on your behalf.

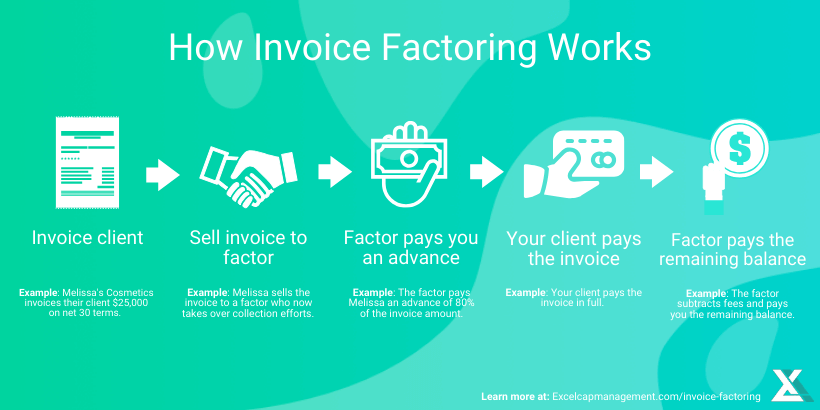

Factoring company advances your business cash based on a percentage of invoice value. It improves your cash flow and can free up your time because we manage your invoicing and debt collection processes. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Invoice factoring is a best way to avoid such practices.

Around 45 000 businesses in the uk currently use factoring abfa as at q3 2015 2 also known as. Invoice factoring is a way for businesses to fund cash flow by selling their invoices to a third party a factor or factoring company at a discount. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Invoice factoring is a useful source of financing for businesses that may not qualify for a business loan or business line of credit.

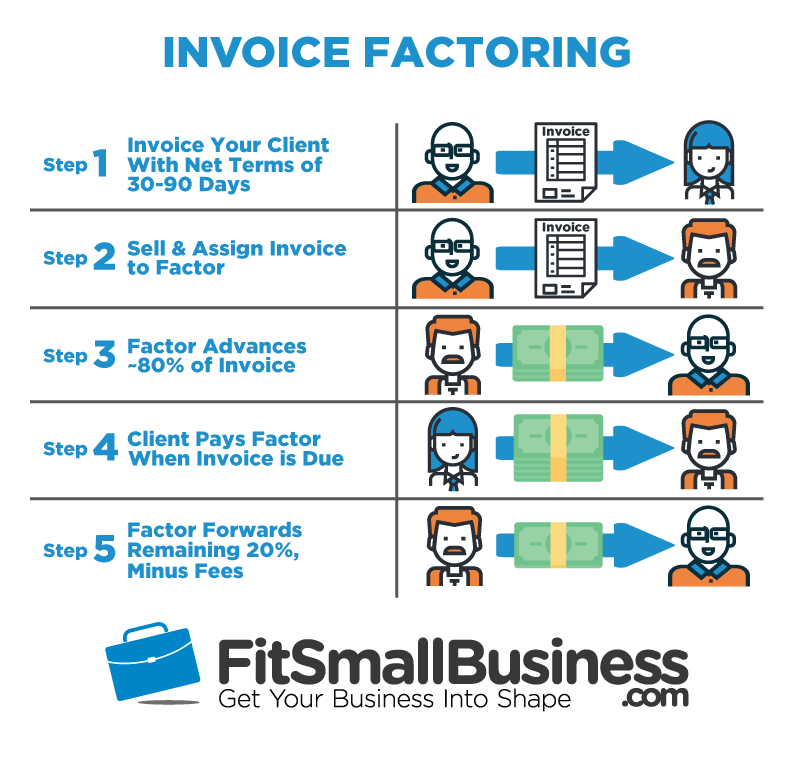

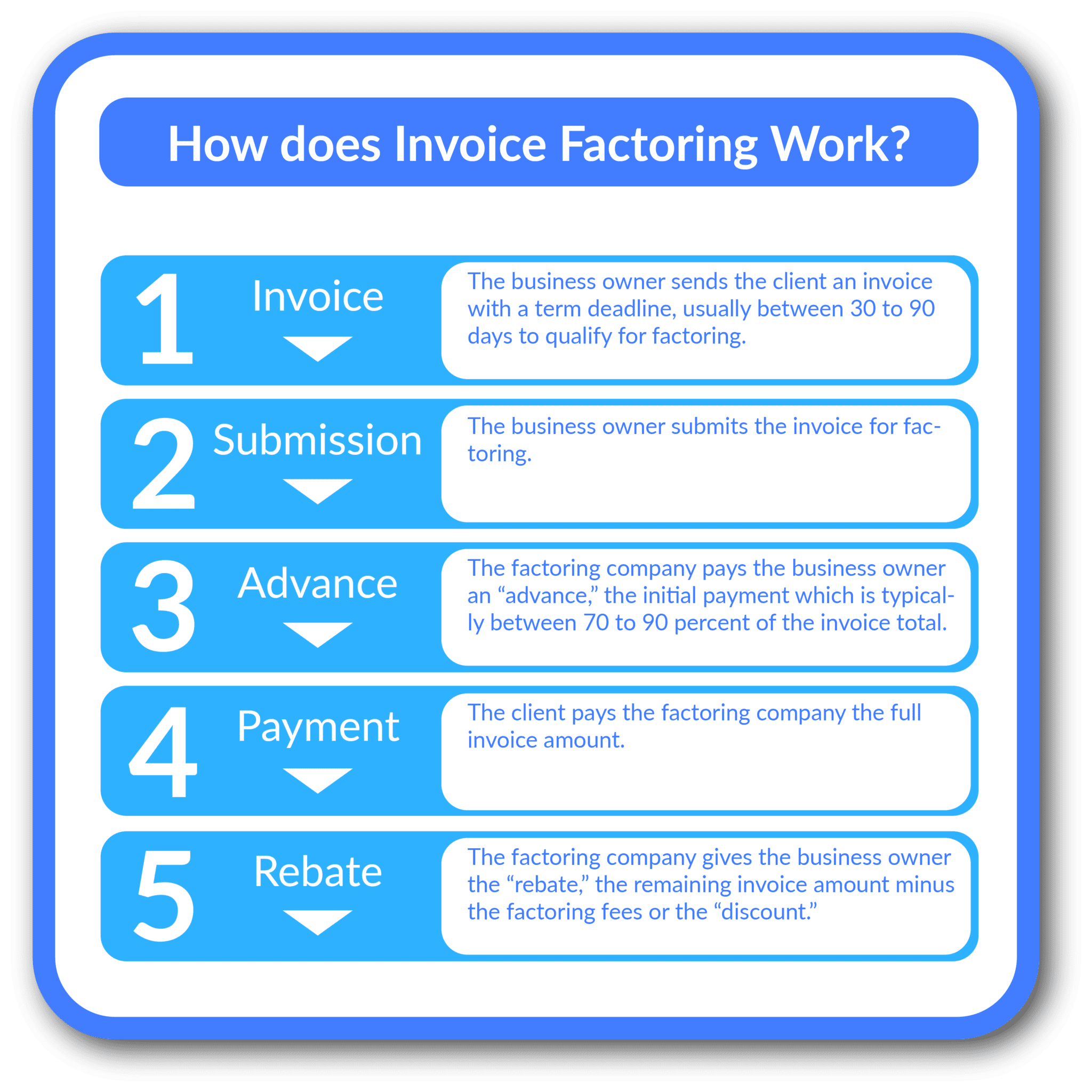

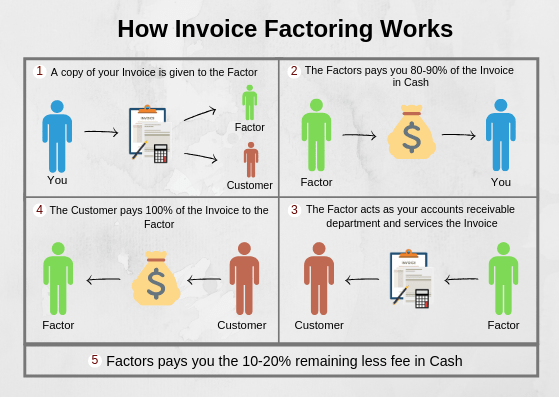

The process of factoring invoices includes the following steps. Rather you sell your invoices at a discount to a factoring company in exchange for a lump sum of cash. Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital. Sell goods to customers on credit terms and generate invoices.

Many might ask how much does factoring receivables cost and how much does a factoring company charge like any form of financing there are invoice factoring fees. You should consider factoring if your business. The factoring company then owns the invoices. People using this service know about the financial and economic benefits.