Fraud Alert On Credit Cards

Initial fraud alerts will be placed on those files too transunion s springer says.

Fraud alert on credit cards. As a result a potential lender should take additional steps in verifying your identity before extending you a line of credit or loan. That puts the alert out and it gives you time to look at your credit reports and determine if you really are a victim of fraud and need to file a police report sweet says. A fraud alert on your credit report notifies lenders including credit card issuers that you have been a victim of identity theft or fraud. The type of fraud alert most often discussed as an alternative to a credit freeze is an extended fraud alert or fraud victim statement.

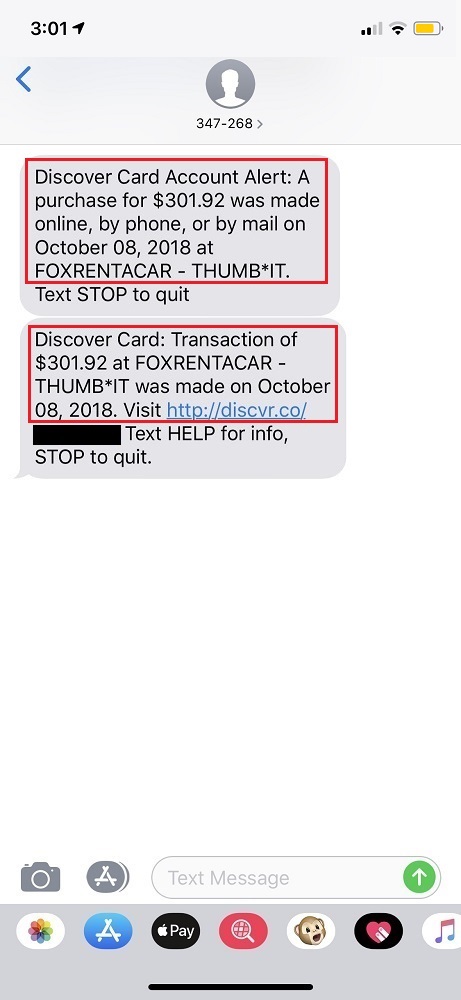

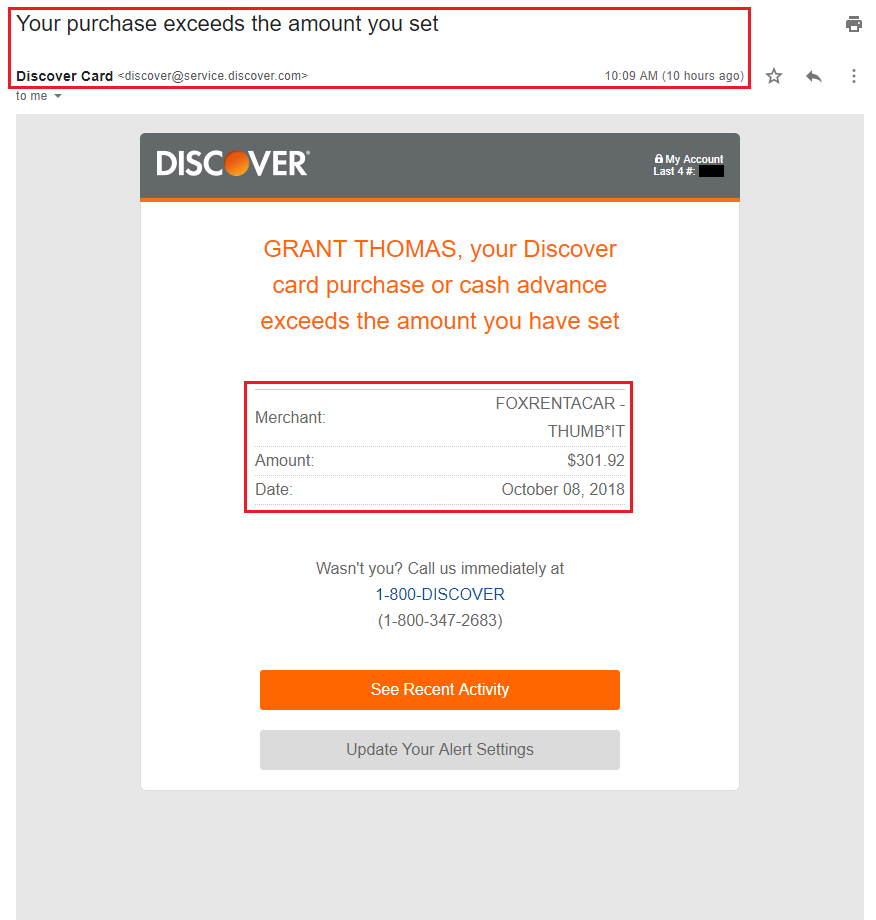

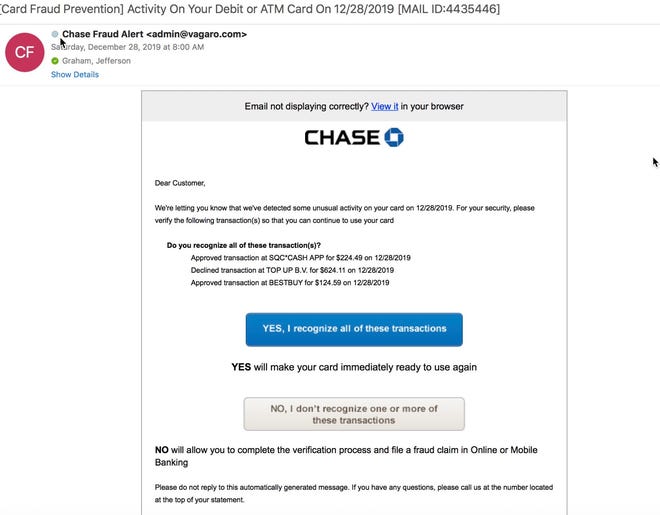

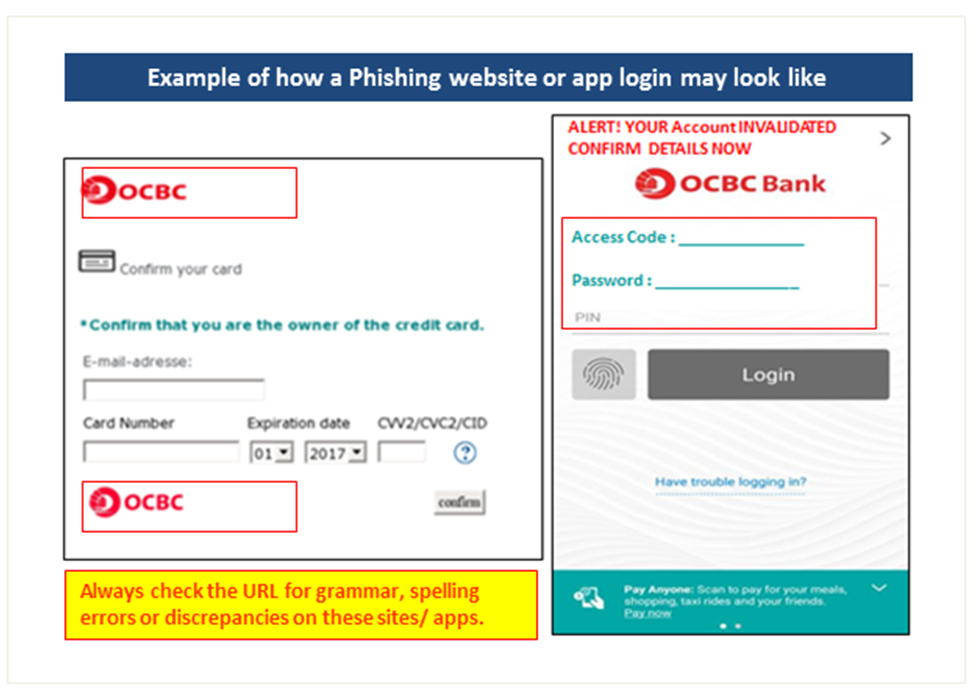

This email attack attempts to scare the recipient by sending them a fake fraud alert which asks them to verify a transaction. You can place a fraud alert by asking one of the three nationwide credit bureaus. A fraud alert is a security alert placed on a credit card account or credit bureau listing by either the customer or the issuer when a fraudulent account activity is either experienced or suspected. The most basic fraud alert known as a temporary fraud alert or an initial fraud alert expires after one year as does an active duty fraud alert.

The alert entitles you to one free credit report from each bureau. If the target is tricked the phishing email attempts to steal the users payment information from a spoof web page. Intended for victims of credit fraud or identity theft an extended fraud alert will stay on your credit report for seven years unless you have it removed sooner. It has to put the alert on your credit report and tell the other two credit bureaus to do so.

The alert lasts one year. Fraud alerts are free and you can renew them as many times as you like. Consider placing a security freeze or a fraud alert on your credit report. An extended fraud victim alert remains on your credit report for seven years unless you remove it before then.

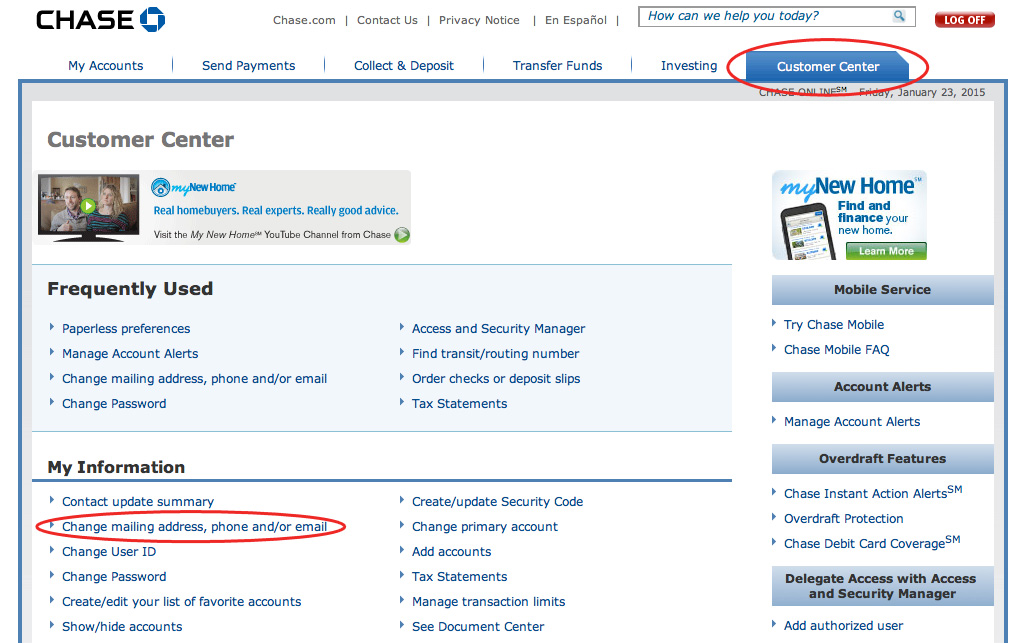

If you receive a fraud alert from your credit card issuer log in to your online account or call the number on the bank of your credit card to contact a customer service representative to confirm or deny the charges. The federal trade commission ftc says freezes and alerts make it more difficult for identity thieves to open accounts in your name. A fraud alert is a notification on a consumer credit report alerting a lender who is checking credit that the consumer may be a potential victim of identity theft says robert siciliano a security awareness expert and ceo of safr me a security education resource. If you ve been the victim of fraud and are concerned about the security of your accounts the fair credit reporting act fcra gives you a few options to help protect yourself.