Do You Get Money Back When You Refinance Your House

A bridge loan is a short term loan that can be used to help you pay off your old mortgage and make your down payment on your new home.

Do you get money back when you refinance your house. The closing costs are a. When you refinance you will take out a new mortgage in the amount of 200 000. So when the house is sold the new borrower will be the one who will be required to get new mortgage insurance if the new buyer is not able to meet the 20 percent down payment on the house. Then when you sell your old home you can.

In reality while it may feel like you re keeping money in your pocket you re actually not. Paying less towards interest and more towards the principal could save you a lot of money in the long run. For example if your home is worth 800 000 with a 575 000 mortgage balance and you want a mortgage with a loan to value maximum of 85 percent the most cash you could generate on a refinance. Financial institutions may lend you up to 80 percent of the appraised value of your home without additional fees for mortgage insurance.

In this case the amount of cash you can get is limited to 240 000 minus 200 000 to pay off your current loan minus the 10 000 in costs for a net cash out of 30 000. When you are in the process of refinancing your mortgage you may come across refinance advertisements offering the chance to skip a mortgage payment for one month. However the premiums you paid will not be refunded to you. Cash back refinance mortgages are excellent ways to access large sums of tax free cash using your home s equity.

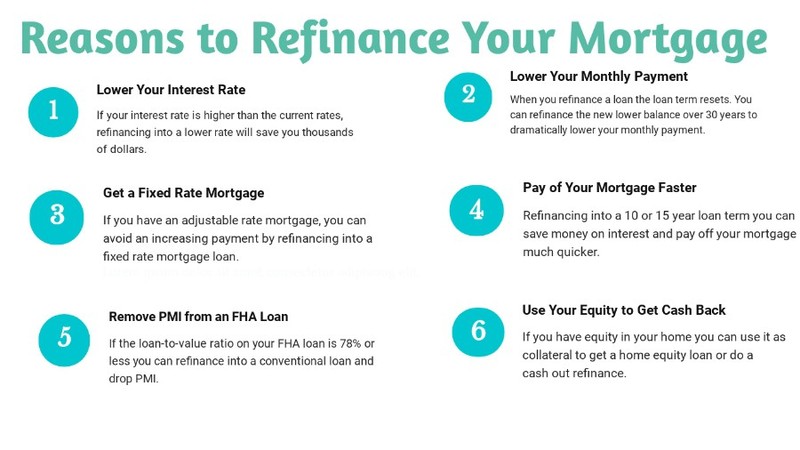

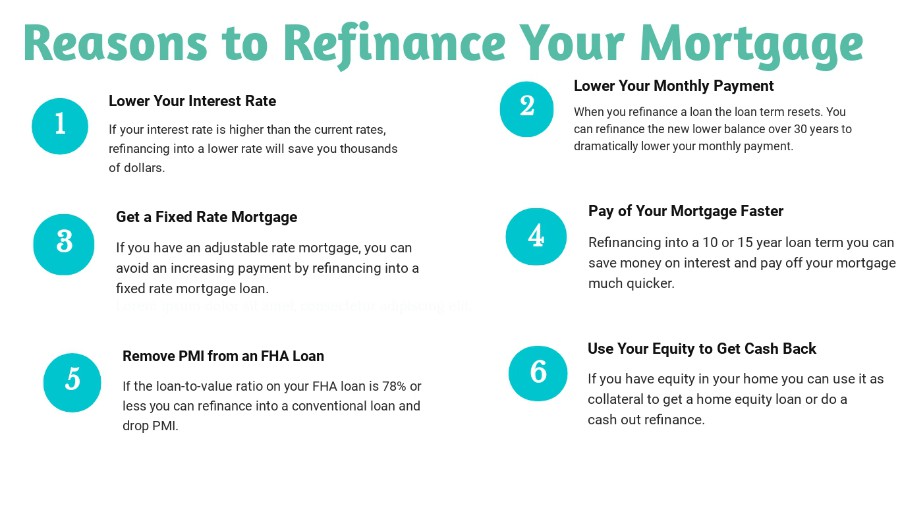

You can secure a lower interest rate. If you have the equity you can use a cash back refinance to get money for debt. If it seems too good to be true that s because it probably is. You can essentially split your remaining 100 000 between cash and home equity.

So you have 100 000 equity in your home and 100 000 remaining balance on your mortgage. Get a bridge loan. Getting a mortgage with a lower interest rate in the main reason why people choose to refinance their home. Since the cash back you receive as part of the loan is secured by your home you can deduct the interest on the cash back portion as home equity debt.

Here is how and why you get your money back when refinancing your home.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)