Homeowner Insurance Alabama

When it comes to buying homeowners insurance in alabama there are only two places you should search.

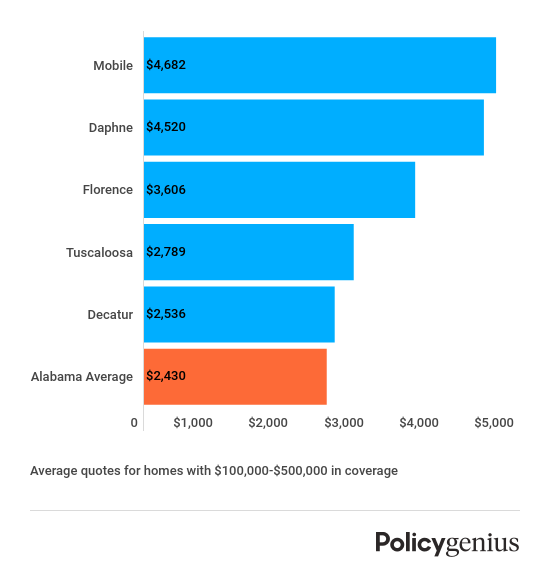

Homeowner insurance alabama. Alabama is the 12th most expensive state for home insurance in the us. Homeowners insurance rates in alabama can vary based on the insurer you choose. The average cost of homeowners coverage in birmingham is higher than the national average. Best gets 4 out of 5 stars from j d.

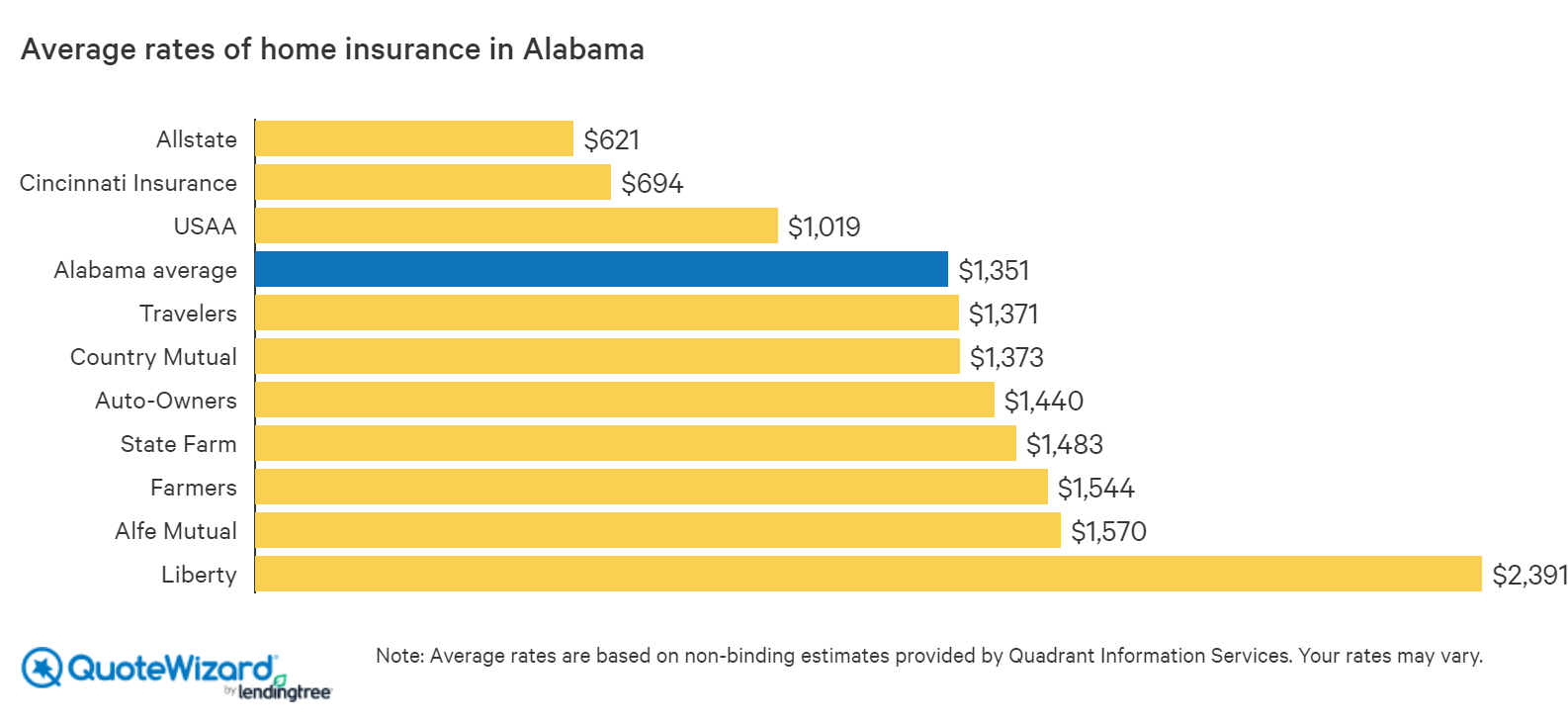

If you re looking for dependable home insurance in alabama start your homeowners insurance quote today with nationwide. Cheapest options for homeowners insurance in alabama. To determine how much you ll pay in annual premiums consider the. Farmers offers the cheapest homeowners insurance in alabama at only 604 per year.

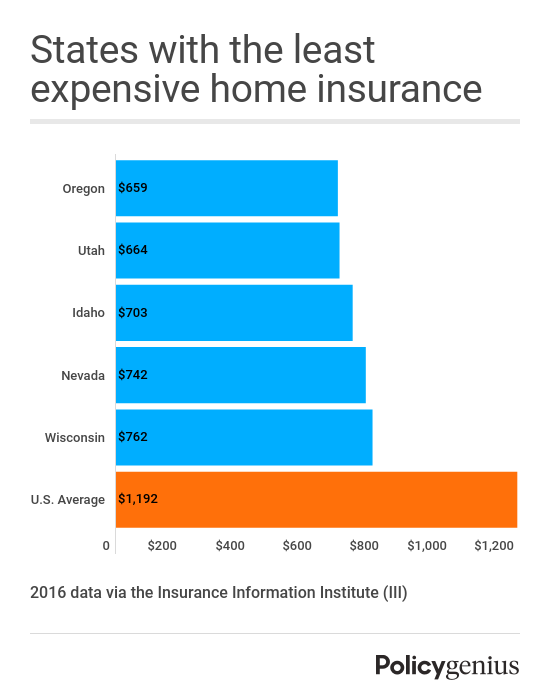

On average the price of homeowners insurance in alabama is about 1 850 per year. Homeowners insurance prices in alabama by insurance company. Liability guard liability insurance is a major part of alabama homeowners insurance policy which protects you in case anyone gets injured in your home or property and sues you. The average cost of homeowner insurance in the u s.

Is 1 211 but in alabama the average is somewhat higher at 1 754. This is more expensive than the united states average cost of coverage which we found to be 1 083 annually. Buying online through a site like ours is going to be one of the best places to find homeowners insurance quotes in alabama. This compares favorably to the state average cost of 1 705 offering a 1 101 price cut on average statewide home insurance costs.

But that doesn t mean you should pay more than you have to. When you shop online you are able to get the fastest quotes and easy alabama homeowners insurance comparisons. Usaa is backed by an a financial rating from a m. Best homeowners insurance rates in alabama for a 200k dwelling.

Average cost of homeowners insurance in alabama. Rates can be significantly affected by the weather patterns which in alabama includes strong thunderstorms some of the most deadly tornadoes in american history and related weather patterns. The table below shows average rates for the five largest home insurance companies in alabama by market share. Medical protection for guests if a guest meets with an injury or accident on your insured property your alabama homeowners insurance policy will help you to cover for his her medical expenses.

Nationwide offers alabama homeowners insurance that provides reliable protection at rates you can afford. Power and boasts a strong history of military values so you know you can trust the service you will receive. We also offer homeowners insurance discounts to reward our members even more.