Credit Card Penalty Apr

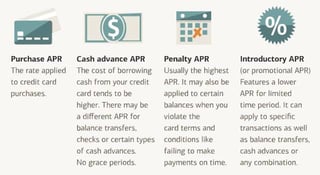

Penalty aprs are high interest rates but the specific penalty rate is determined by your credit card company.

Credit card penalty apr. As long you make at least the minimum payment on your credit card bill you ll stick with your baseline apr. Credit cards come with an apr range. Nobody likes paying interest so you should do your best to avoid them. After six months of on time payments credit card companies are required to lower your rate on your outstanding balance back to your normal interest rate thanks to the card act of 2009 but the company may keep the penalty apr on future purchases.

So as long as you make six consecutive on time payments of at least the minimum payment due your interest rate should return to its previous rate. A penalty apr is an increased annual percentage rate that issuers may charge when cardholders are late on payments. Credit card penalty rates are commonly around 29 99 but can be higher or lower with some credit cards. Federally chartered credit union cards for instance cap their aprs at 18 percent.

According to the card act of 2009 credit card issuers must reconsider a cardholder s penalty interest rates after six months. The better your credit score the lower your apr will be within that range. Cnbc select reviews what a penalty apr is how to avoid it and credit cards that have no penalty aprs. Penalty aprs can make it difficult to pay off your credit card debt.

Penalty aprs are higher interest rates that you need to pay if you start missing payments on your credit card. The card act also states that once the rate is increased on an existing balance because you were 60 days delinquent the credit card company must move you back down to your non penalty apr once you have made timely payments for 6 consecutive months. This penalty rate is often significantly higher than the rate initially offered on your credit card. Some cards don t charge a penalty apr at all.

Details are spelled out in the fine print of a credit card disclosure statement. Average credit card penalty interest rates apr the penalty rate also called the default rate is the rate you ll pay on your card when if you fail to make on time payments. A typical penalty apr is 29 99 percent but it may be lower on some credit cards. Compare that to the 10 27 finance charge you d pay on the same balance but at a much lower 15 interest rate and you ll see just how expensive the penalty rate can be.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-649660607-1--5820d0a15f9b581c0b6da79b.jpg)

:max_bytes(150000):strip_icc()/StatementAccountSummary-56a1de4b3df78cf7726f56b9.jpg)