Fha Reverse Mortgage Underwriting Guidelines

Neither the lack of traditional credit history nor the lifestyle of the borrower may be used as a basis for rejection.

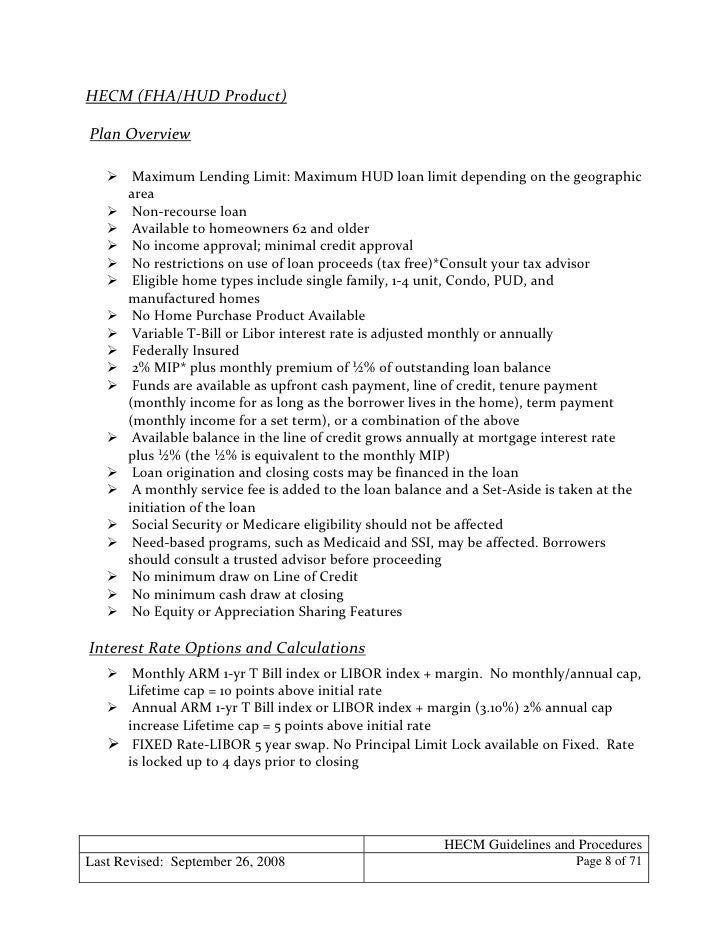

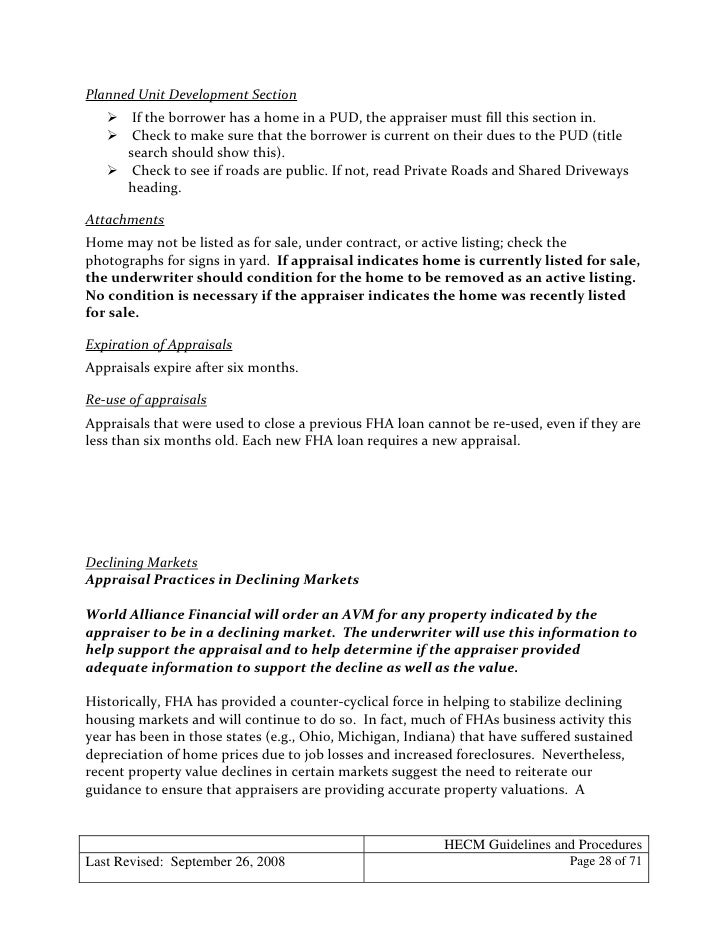

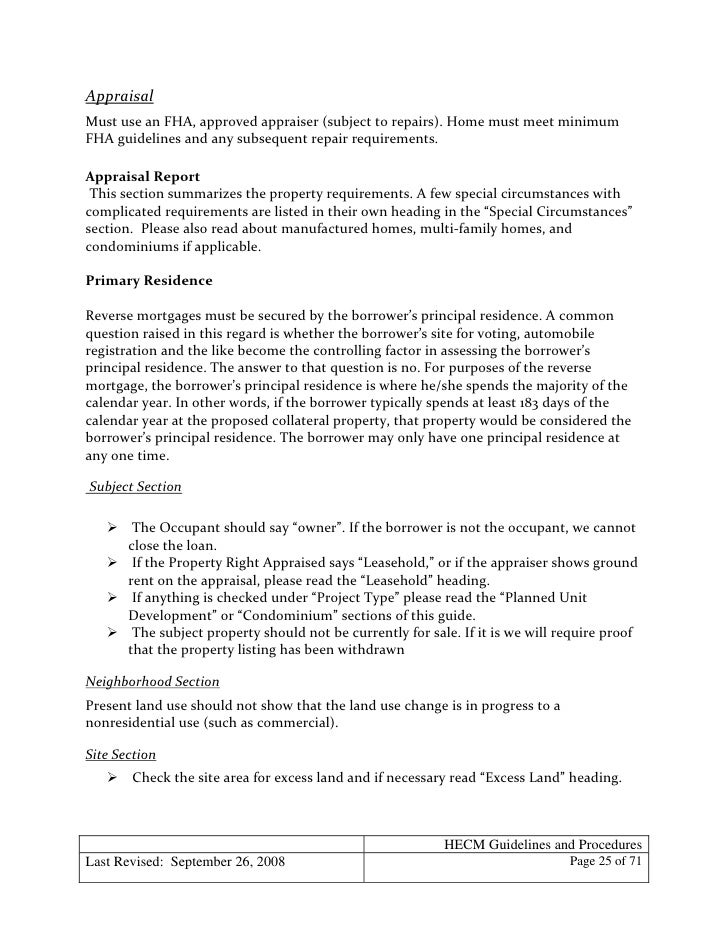

Fha reverse mortgage underwriting guidelines. The amount that will be available for withdrawal varies by borrower and depends on. Hud creates underwriting guidelines for fha. Every reverse mortgage transaction requires an fha appraisal report to determine the value of the subject property which in turn helps to establish the lending limit. Created by the government to insure home loans for borrowers of modest means fha is an agency within the department of housing and urban development.

The financial assessment for a reverse mortgage is a lot like the process for getting a traditional or forward mortgage. The fha reverse mortgage has a variety ways the borrower can receive the money including monthly payments a line of credit or combinations of payments and credit. Should not be in the lender appraiser exclusionary list effective case numbers assigned on or after 10 01 2018 through 09 30 2019 fha will perform collateral risk assessment of the appraisal submitted for use in the hecm origination. The borrower does not pay on these loans until the house is sold.

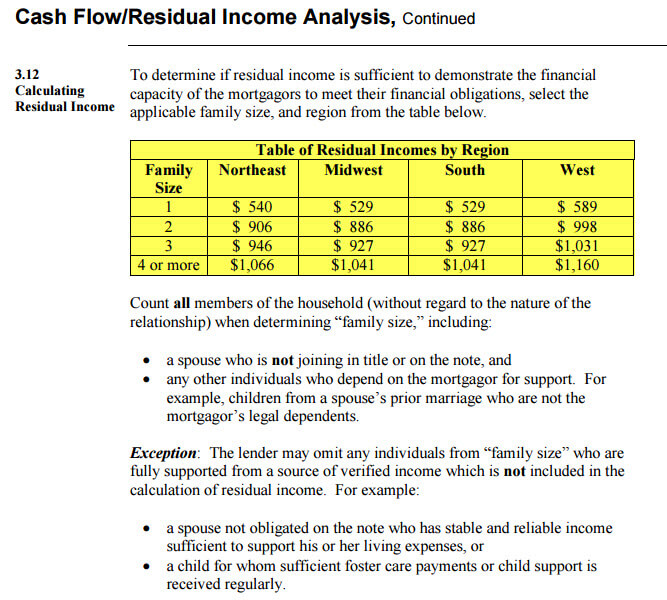

Age of the youngest borrower or eligible non borrowing spouse. Custom reporting for private investors and mortgage backed bonds can be easily. Mortgage guidelines underwriting fha reverse below you will find a guide to the standard fha loan guidelines used in the underwriting process of an fha mortgage. The fha or federal housing administration provides mortgage insurance on loans made by fha approved lenders.

Since the property is being pledged as collateral for an fha loan it must comply with certain criteria for eligibility. If you re applying for a reverse mortgage for the first time you will be subject to meeting new minimum income requirements as part of the financial assessment underwriting guidelines. Fha reverse mortgages or hecm loans require the home to conform to fha property standards and flood requirements. Another important aspect of underwriting is collateral review.

Designed from the ground up for reverse mortgages the rm navigator system meets all of the requirements of fha fnma and private investors as well as provides senior customers with a user friendly monthly accounting statement of their reverse mortgage. Guidelines should be fha approved at the time of assignment and completion of the appraisal. Fha loan requirements important fha guidelines for borrowers.