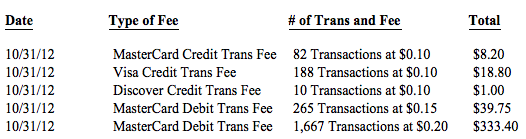

Credit Card Transaction Charges

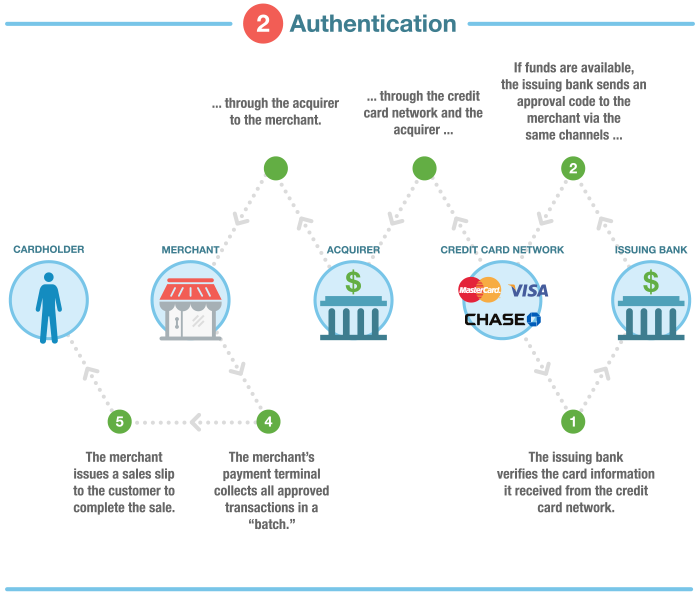

Average credit card processing fees range from 1 5 to 2 9 for swiped credit cards.

Credit card transaction charges. Most interchange fees are assessed in two parts. Read on to learn what business owners should know about credit card processing fees including some smart tips to reduce. A foreign transaction fee is a surcharge that is charged on your credit card bill if you use your card to make a purchase in a currency that is not your domestic currency or a transaction that passes through a foreign bank. This fee is partly charged by your payment.

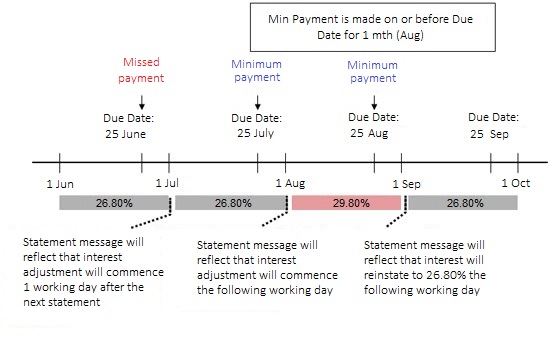

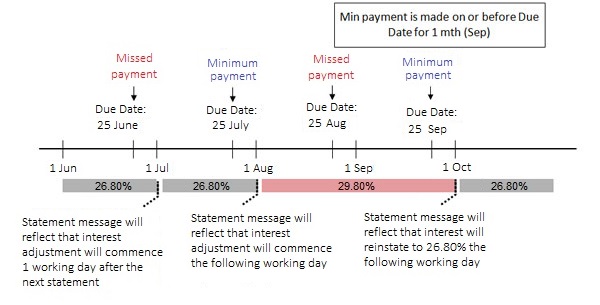

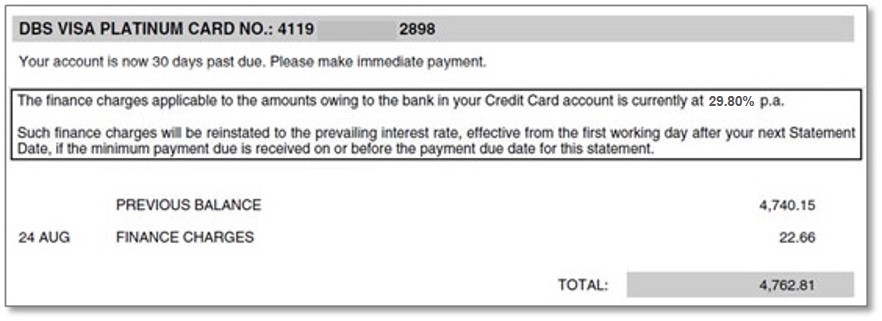

Keyed in transactions have a higher average processing fee of 3 5 to account for the higher risk. Subject to compounding if the charges are not repaid in full on the transaction amount chargeable on a daily basis from the date of transaction until receipt of full payment minimum charge. Credit card companies charge between approximately 1 3 and 3 4 of each credit card transaction in processing fees. 3 1 0 30 per domestic transaction.

A percentage to the issuing bank and a fixed transaction fee to the credit card network. Additional 1 5 for cross border transactions. Finance charges for card transactions. Packaged holidays thomas cook has a 2 credit card fee.

Flights flybe charges 3 on credit card and paypal transactions. American express card usage fees. Interchange fees vary and are categorized through a process called interchange qualification which determines the rate based on several criteria. Paid for tv sky charges a 30p mth fee on recurring credit card payments.

Shoppers are likely to make the biggest savings on expensive purchases. For paypal payments pro or virtual terminal pricing questions call 1 855 787. 2 9 0 30 per transaction. Authorization fees return fees avs fees and gateway fees are just a few examples of the various transaction fees that processors charge.

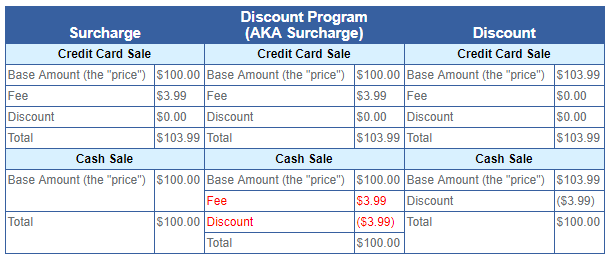

For instance the per swipe fee might be 2 35 plus 0 15. The exact amount depends on the payment network e g visa mastercard. For example if you use a credit card to buy a car or pay a wedding venue. The term transaction fee generally refers to any flat fee charged when a business s credit card machine or software gives or gets information to or from a processor.

These are currently prohibited in 10 states colorado connecticut florida kansas maine massachusetts new york oklahoma and texas. Generally a foreign transaction fee on credit cards is around 3 but it differs from bank to bank. 4 4 fixed fee per transaction. The practice of always charging customers a fee for credit card payments no matter how the transaction takes place is called a surcharge.