General Liability Insurance Limits

An insurance policy may have several different types of limits.

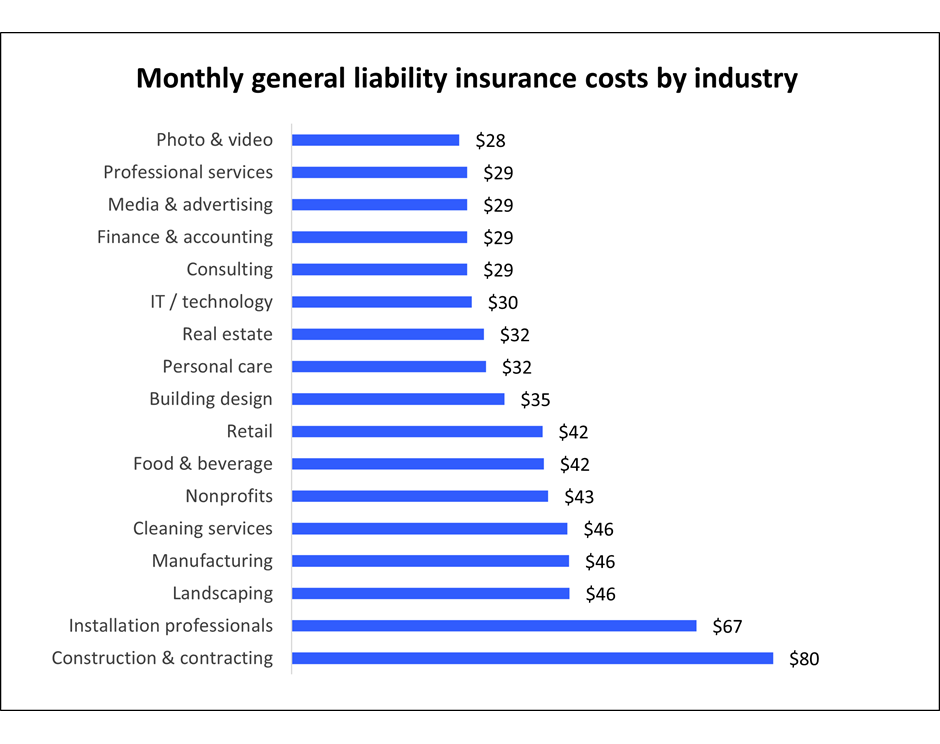

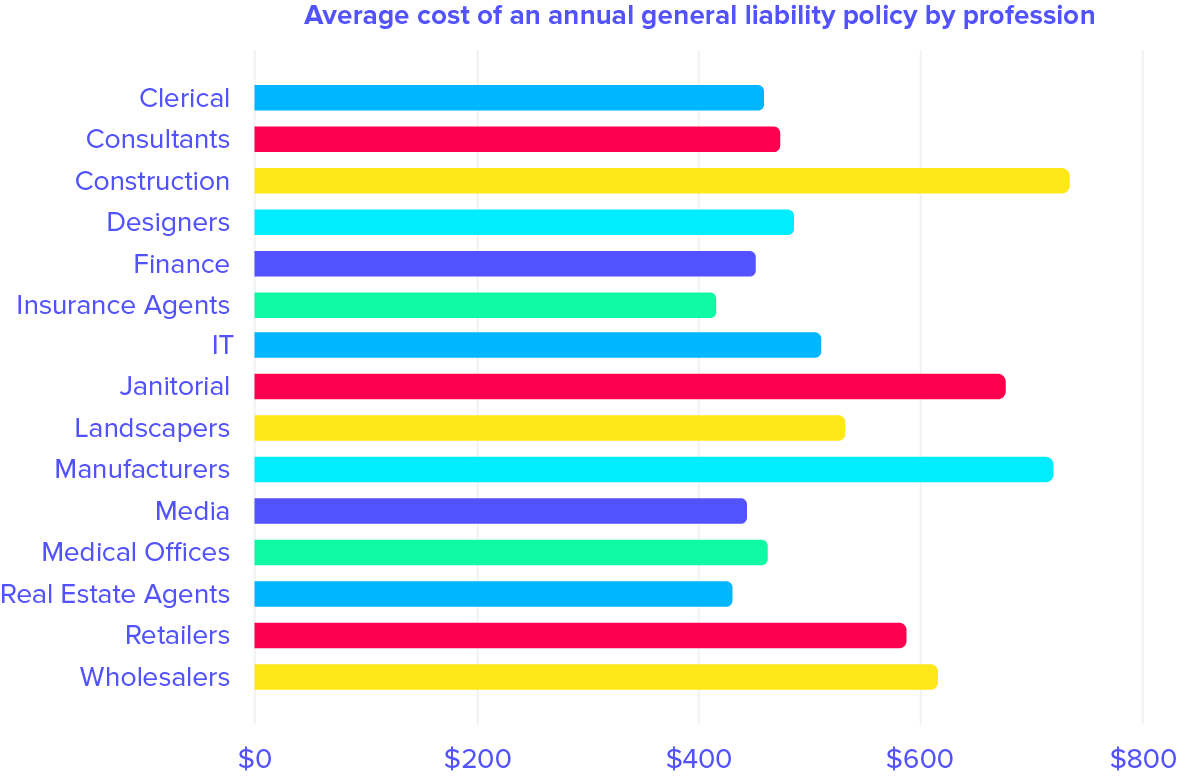

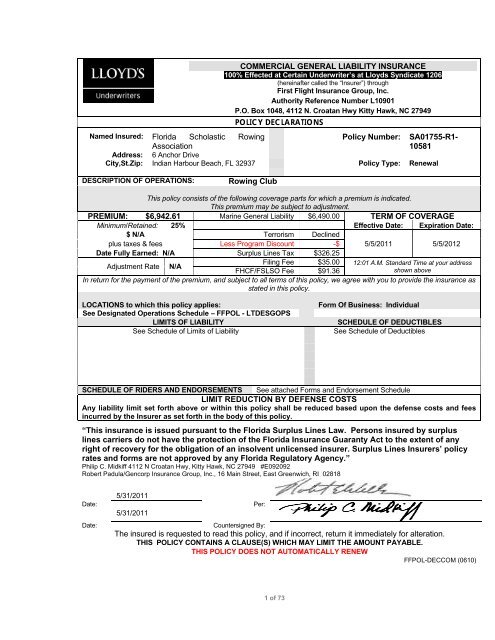

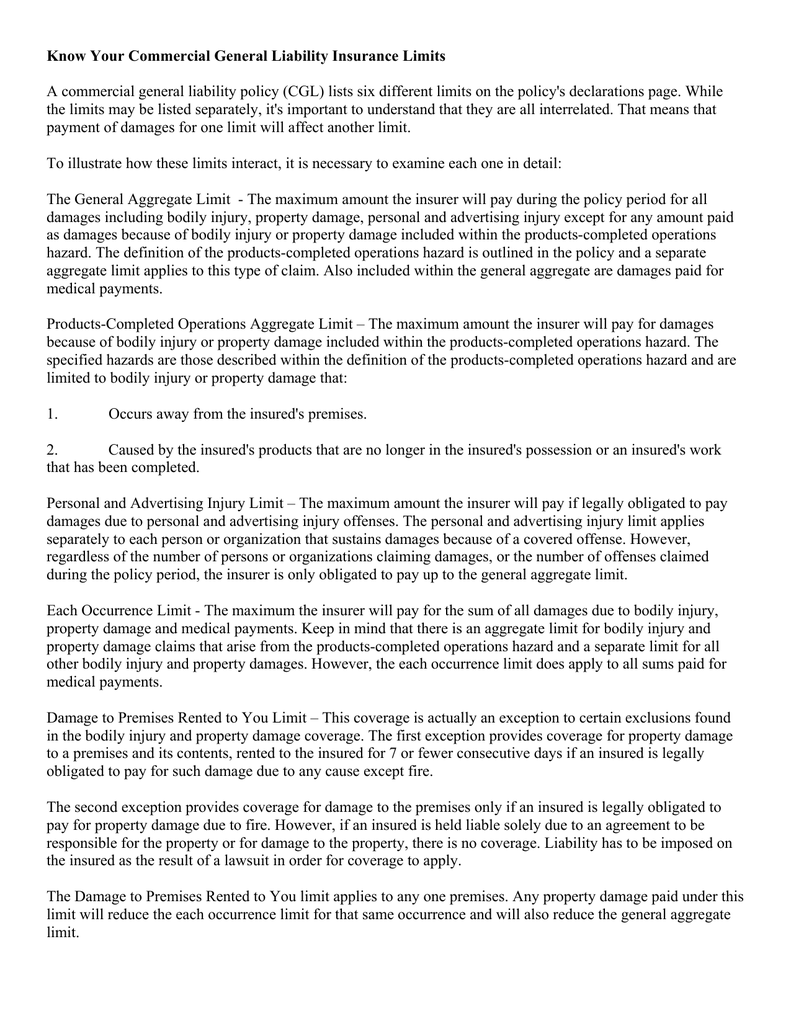

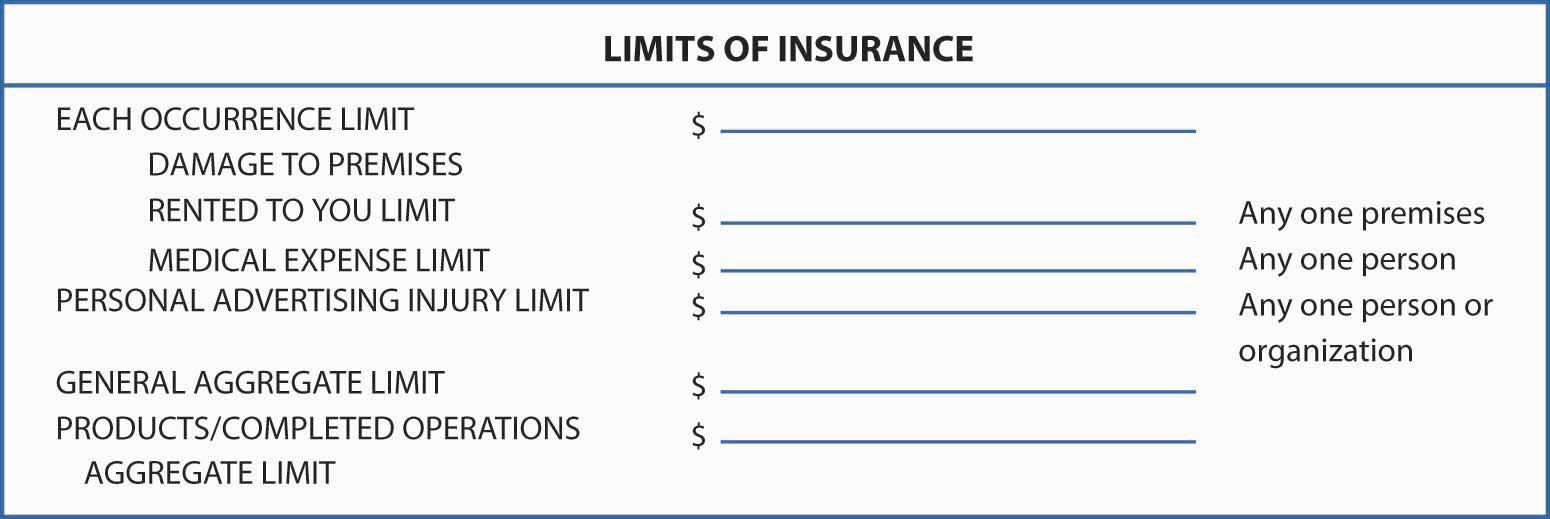

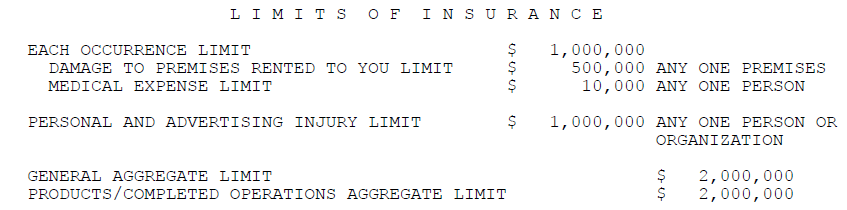

General liability insurance limits. When one looks at the declarations page of a commercial general liability policy cgl one normally sees six different limits of insurance listed. So to prevent further confusion we decided we would break down a few of those limits for you. 6 key general liability limits explained1 6 key general liability insurance elements explained people often speak about general liability as if it is one coverage or one thing. Section iii limits of liability of the april 2013 edition of the insurance services office inc.

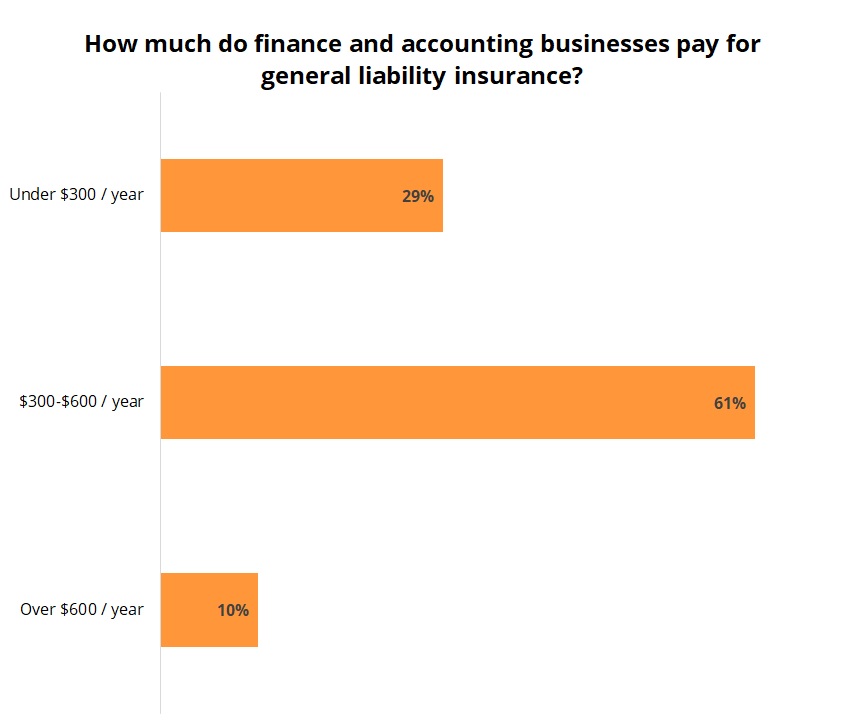

Any amount beyond 1 million will need to be covered by your business or a supplemental liability policy. In general valuable items like these are insured up to around 2 500 and on some premium policies 5 000. The typical general liability policy is written 1m 2m limits with some companies writing the 2m 4m limit as the primary layer of insurance. I have limits of 1m 2m and i need limits of 2m 4m.

Commercial general liability cgl is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business s operations or products or on its premises. Your insurance policy can be flexible just like your business is. In both homeowners and renters insurance there s something called special limits of liability. This refers to limits on specific types of valuable items you may own like your jewelry watch bike money electronics etc.

Iso commercial general liability coverage form begins by making it clear that the limits shown in the declarations fix the most the insurer will pay regardless of the number of insureds claims made suits brought or persons or organizations making a claim or bringing suit. These coverages and how they work are often misunderstood. It s common for a general liability policy to have several limits within it. Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy.

The general liability coverage will cover the next 990 000 until the 1 million limit is met. We have packaged the most common general liability coverages for businesses together in our diamond endorsements in three different tiers. Aggregate limits and per occurrence limits define different maximums. Separate limits are provided for medical expenses and damage to a premise you rent.

A general aggregate limit of liability applies to all types of liability claims that the policy covers such as property damage.