Do You Have To Pay Taxes On Insurance Settlements

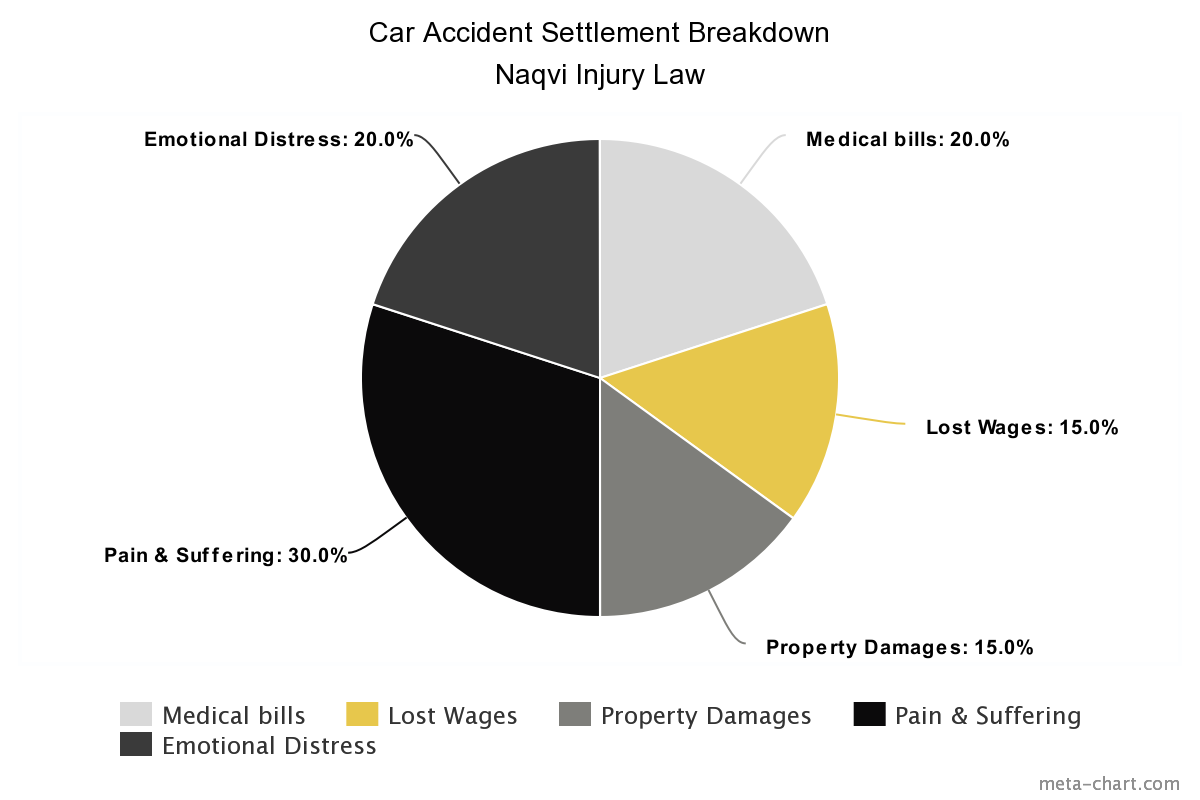

If for example you have a claim for emotional distress or employment discrimination but no actual physical injury then your settlement or verdict would be taxable unless you can prove even the slightest amount of physical injury.

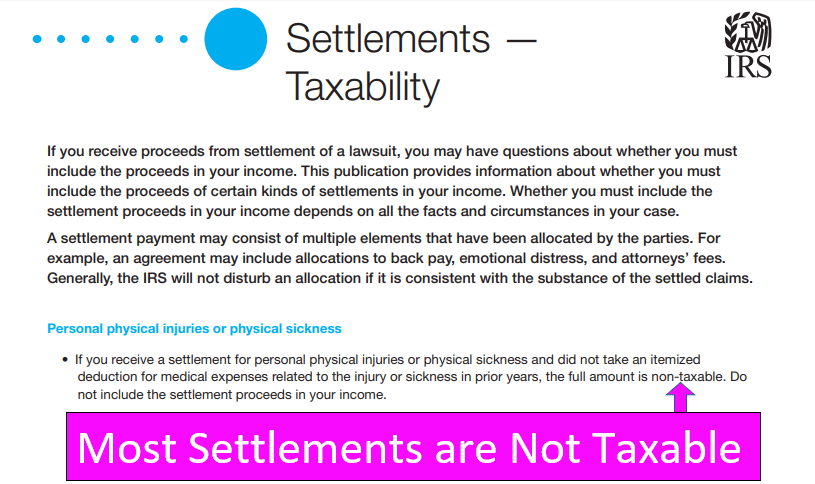

Do you have to pay taxes on insurance settlements. However many types of payout that you may receive as a result of a legal settlement are taxable whether the case is ultimately settled in or out of court. However the funds remain in the estate for federal estate tax purposes. Perhaps you have already received a lawsuit settlement and you are wondering why you haven t had to pay any taxes on it. You ll also have to pay social security and medicare taxes on that insurance settlement money.

Life insurance proceeds usually not taxed. If you have received a settlement or judgment following a vehicle accident you re probably wondering do i have to pay taxes on that money the short answer is in most cases no however that is not a hard and fast rule and the answer depends on the nature and circumstances of your settlement or judgment. Some settlement recipients may need to make estimated tax payments if they expect their tax to be 1 000 or more after subtracting credits withholding. Whether you settled directly with the insurance company or beat the at fault party in court you may be left with a tax liability for all or part of the total settlement amount.

Find out when your medical costs pain and suffering lost wages and other monetary awards are typically exempt from taxation and when you ll have to pay. Remember that the settlement or verdict is non taxable only as long as it arose from a physical injury. Well yes but like so many things in life this question isn t purely black and white. The short answer is.

Information on estimated taxes can be found in irs. But if a car insurance or home insurance settlement exceeds the original cost of your property the money could be considered income. It can get worse if you have an attorney representing you because you have to pay taxes on the entire settlement even though an attorney on contingency typically receives one third of your auto insurance settlement right off the top. Just like a normal insurance settlement compensation for medical bills and repair of property are not taxed in a lawsuit.

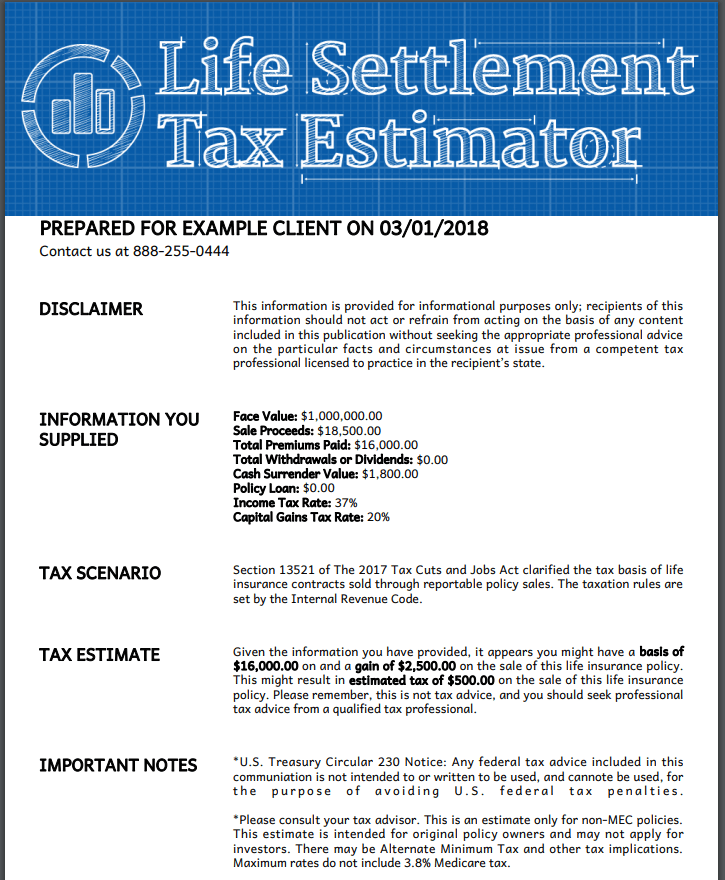

1040 schedule 1 even if the punitive damages were received in a settlement for personal physical injuries or physical sickness. You pay no tax on a life insurance settlement unless it includes some type of interest in the payment such as interest on dividends and then you only pay tax on the interest. The answer is that if you receive a settlement from the insurance corporation of british columbia icbc your settlement money is not taxable. In addition any sum you may have deducted for medical expenses that are later covered through an insurance settlement can be considered income and subject to taxation.

:max_bytes(150000):strip_icc()/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)