Difference Between Home Equity Loan And Home Improvement Loan

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

The difference in value between your home s worth and your mortgage balance 70 000 is your home equity.

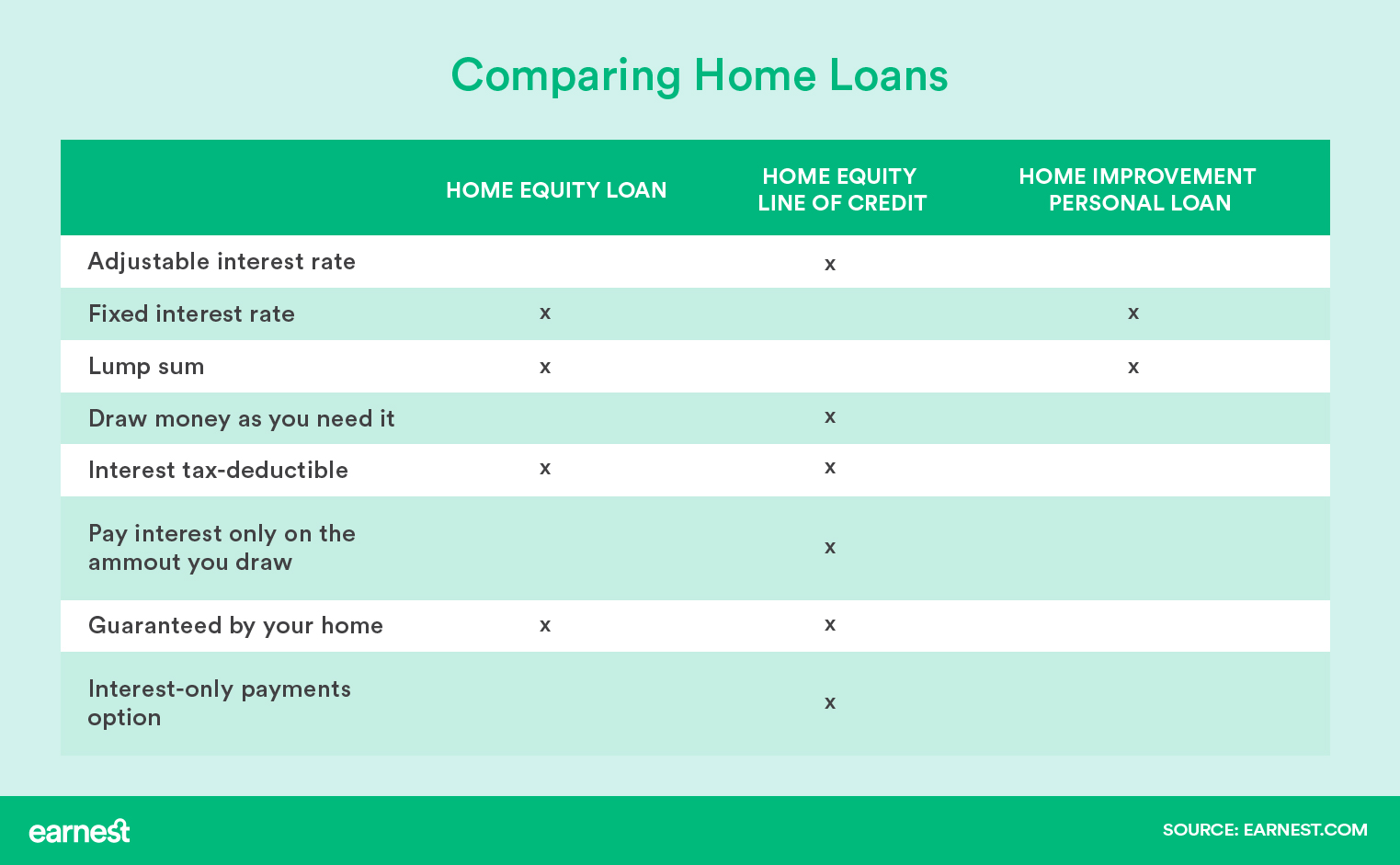

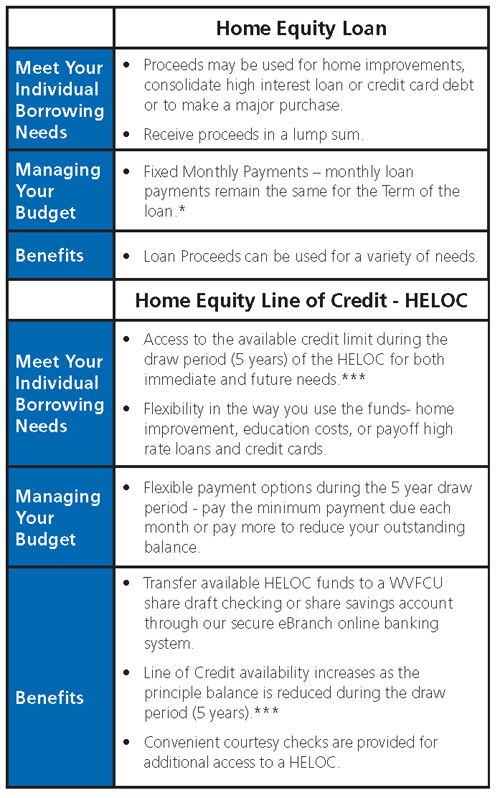

Difference between home equity loan and home improvement loan. Loans especially personal and home equity loans can be a good way to pay for a major home project or handle a financial emergency. Deciding between a home equity loan and a home improvement loan ultimately depends on your financial situation what you want to accomplish and plans for the future. Both a home equity loan and a home improvement personal loan function similarly once you re approved you ll receive the loan amount make monthly payments to the lender interest will accrue as time passes and the rate you re given when you apply stays the same as they re both fixed rate loans. Obtaining an equity loan when you apply for an equity loan the lender bases the amount you can borrow on the equity value of your home which is the difference between its appraised value and your outstanding mortgage balance.

Difference between home improvement loan home equity line of credit. A home equity loan can serve a variety of purposes in addition to making home improvements. Your home can moreover be a handy source of ready cash to cover. But before you apply for either type of loan or an alternative such as a home equity line of credit do some research and decide which option best suits your needs.

It has a fixed rate with fixed payments. If you re remodeling and concerned about getting the best loan for your home it s worth comparing home improvement loans and home equity loans to see which might be a better fit for you. You could take out a home equity loan to access part of this 70 000 in cash. The amount of the home equity loan is often capped at a lower amount than the actual home equity that you ve built in your home often 85 of the equity in your home.

Home equity lines of credit heloc and home improvement loans share some similarities but have important differences. A home equity loan can be a good way to deal with unexpected situations and opportunities and you may borrow up to 80 of your home value. As the name implies a home equity loan is secured that is guaranteed by a homeowner s equity in the property which is the difference between the property s value and the existing mortgage. Any loan that is backed by the value of your home is called a home equity loan whereas a home improvement loan is a secured or unsecured loan for fixing up your home.

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

/Remodel-Project-Financed-By-Home-Equity-1500-x-1000-56a49eb45f9b58b7d0d7df93.jpg)

/business-with-customer-after-contract-signature-of-buying-house-957745706-85fbb1739bcc4a27b1e5d1e80dd9c1c9.jpg)