How Does A Structured Settlement Work

Tailored to the needs of the individual and to the amount awarded to that individual they can be a great plan for a lifetime of financial security in the wake of a tragedy.

How does a structured settlement work. How does a structured settlement work. How does a structured settlement work. A structured settlement can also be used to fund a workers compensation medicare set aside msa account where the employer is responsible for the cost of the primary medical treatment for the claimant and medicare is the secondary payer. Keep in mind these payments are tax free because a structured settlement is a tax free lawsuit.

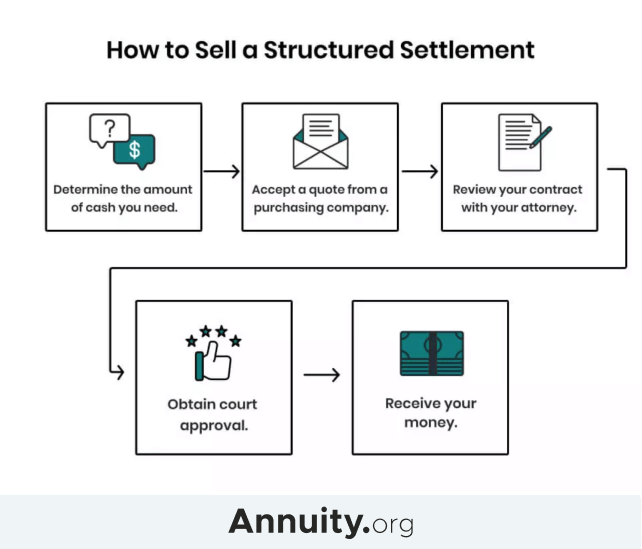

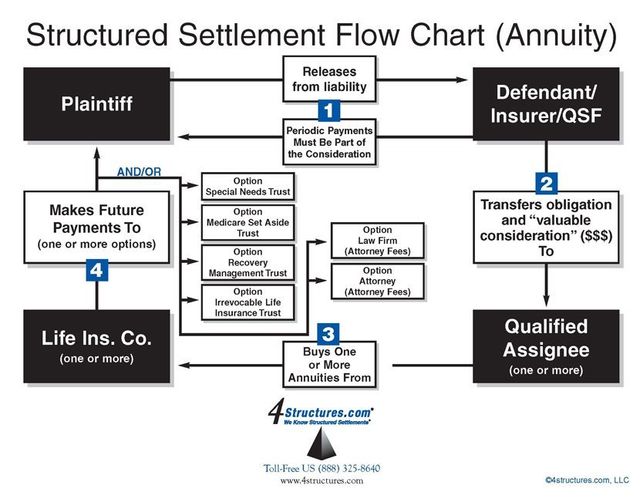

If you decide to choose a structured settlement over a lump sum the consultant will use the money from the defendant to purchase an annuity from a life insurance company chosen by you. Combination of lump sum and structured payments. The first thing that you want to understand is that structured settlements are not awarded they are negotiated. Structured settlement payments do not count as income for tax purposes even when the structured settlement earns interest over time.

A structured settlement pays you money through a serious of payments known as an annuity or a lump sum form of payment. Structured settlements have been a favorite resolution in personal injury and wrongful death cases for the last three decades. When you file a personal injury lawsuit you eagerly wait for the day when your settlement payout arrives how does a structured settlement work. How does a structured settlement work.

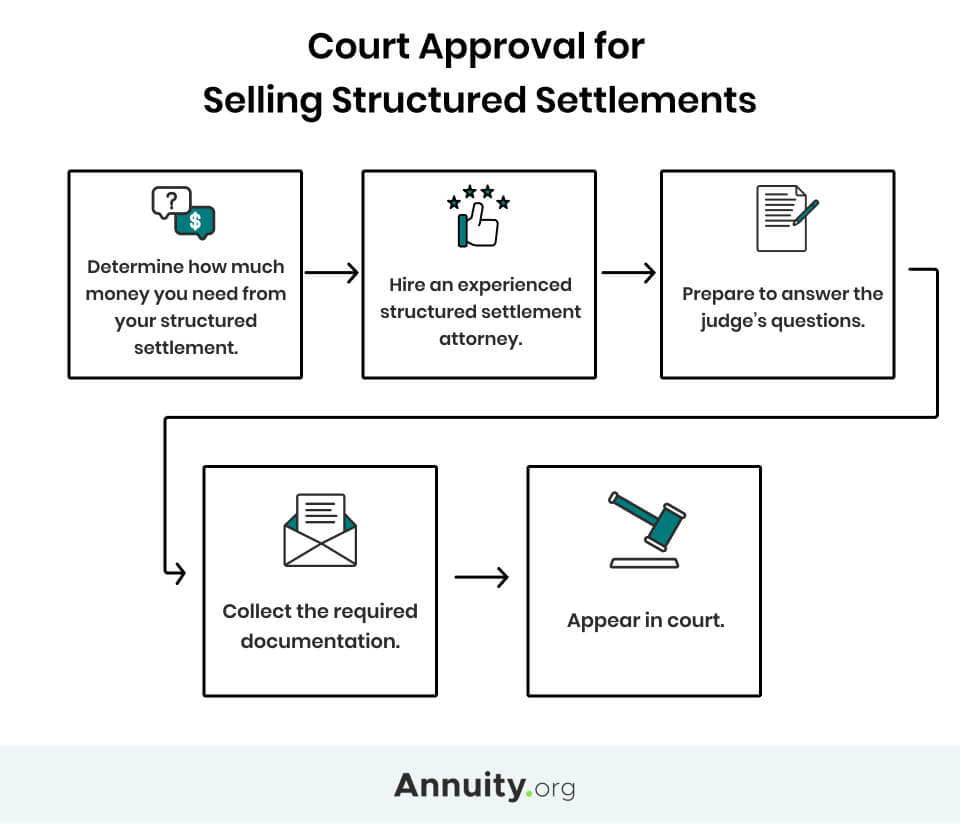

A licensed structured settlement consultant will work with all attorneys the defendant and the plaintiff during the entire settlement process. Structured settlement brokers a special type of insurance agent consult as a case approaches settlement. If you and the defendant agree on a structured settlement the defendant or the defendant s insurance company will transfer the part of the settlement that is to be structured to a different insurer often a life insurance company that specializes in handling structured settlements. Brokers are paid standardized commissions by the life insurance company that issues the.

Understanding structured settlements can be confusing at times. In addition to personal injury cases structured payouts can also happen with product liability cases. During the settlement process a licensed structured settlement consultant will work with all the parties involved including the plaintiff defendant and attorneys from both sides. Once you decide to take a structured settlement the consultant uses the money to purchase an annuity from a life insurance company of your choosing.