Help With Taxes Owed To Irs

Browse common tax issues and situations at get help.

Help with taxes owed to irs. In a nutshell for the irs to accept an offer in compromise you need to prove that paying your tax debt in full will constitute an undue financial hardship or that you truly don t have the means. Taxpayers can set up irs payment plans called installment agreements. The agency will charge a late filing penalty a late payment penalty and interest on any unpaid balance you owe if you don t file your return or an extension on time and if you fail to pay on time. Payment plans differ and an experienced attorney can help you get better terms.

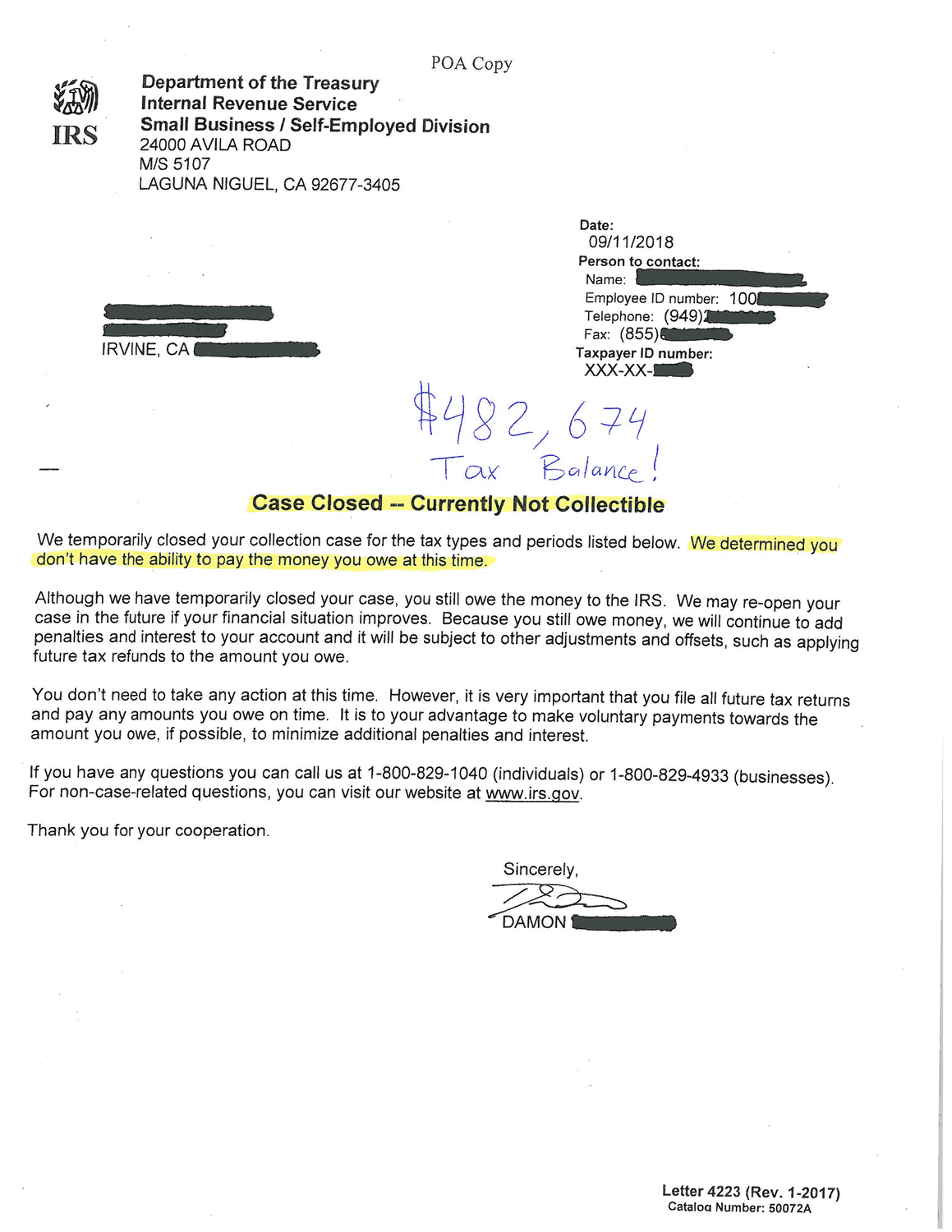

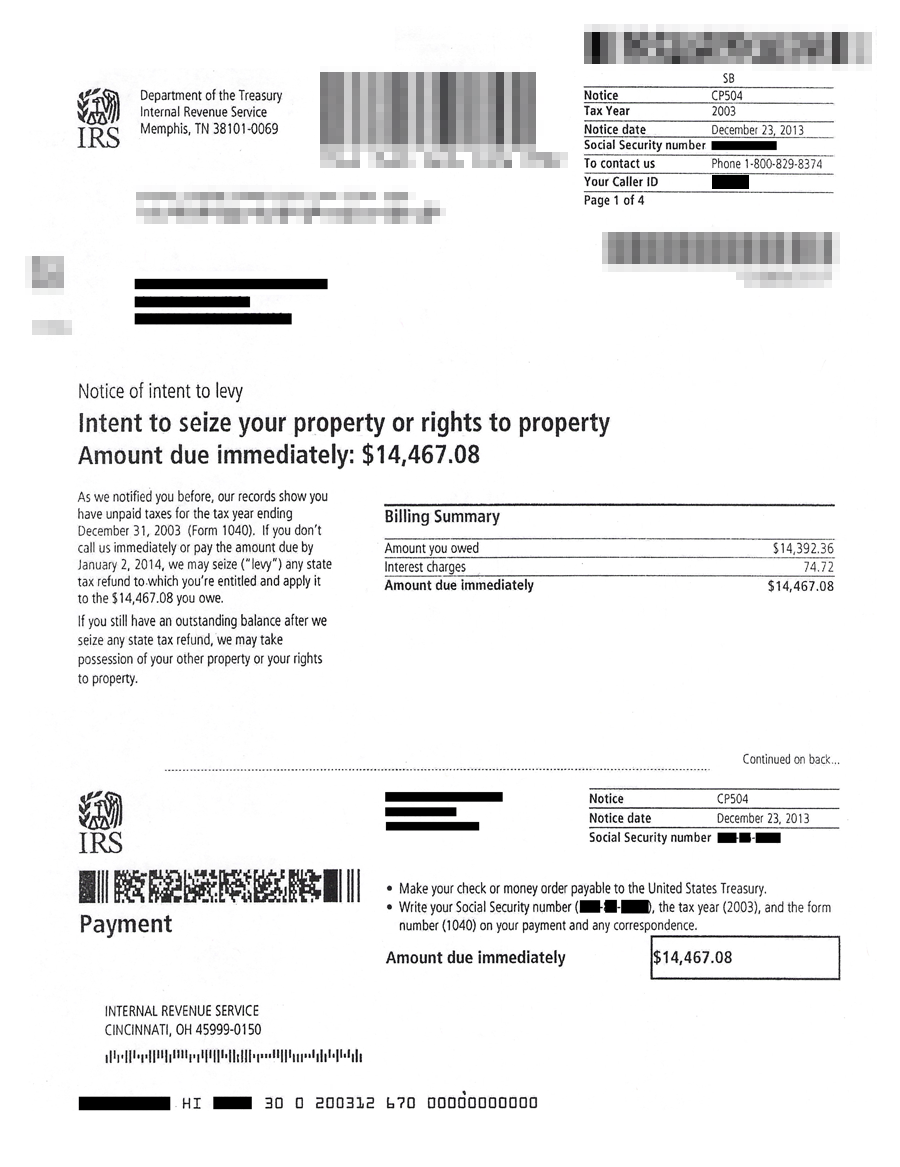

If you have an irs lien on your income or assets it will greatly diminish your chances at getting approved for a mortgage. If this impacts you please refer to the other ways to find out how much you owe section. On saturday march 21 2020 the irs confirmed this on its website stating that tax day 2020 is now july 15 2020. Other ways to find out how much you owe.

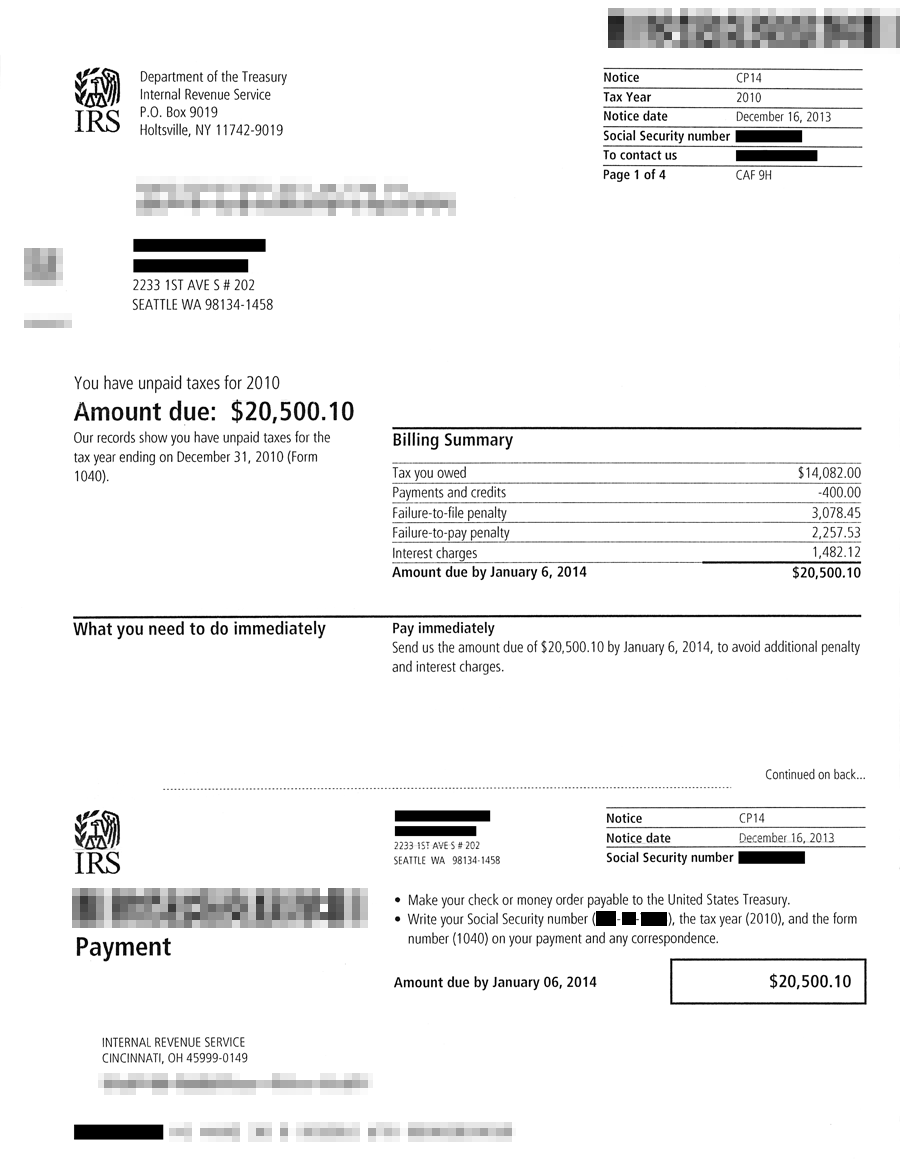

Irs tax tip 2014 57 april 17 2014 most importantly make sure you file your tax return and pay as much as you can. The type of agreement you can get depends on your situation including how much you owe and how soon you can pay the balance. Irs publication 594 the irs collection process explains the irs collection process and the different ways the irs can collect a tax debt you owe the irs also has a video on understanding collection actions. You shouldn t set up an installment agreement if you can pay the balance within 120 days see 2 below.

Owing taxes is a separate matter from having a tax lien. The federal tax deadline is midnight april 15 except for maine and. If you re a business or an individual who filed a form other than 1040 you can obtain a transcript by submitting form 4506 t request for transcript of tax return. Tax debt is simply owing money to the irs and or a state but a tax lien means that your taxes went unpaid long enough to trigger collection actions.

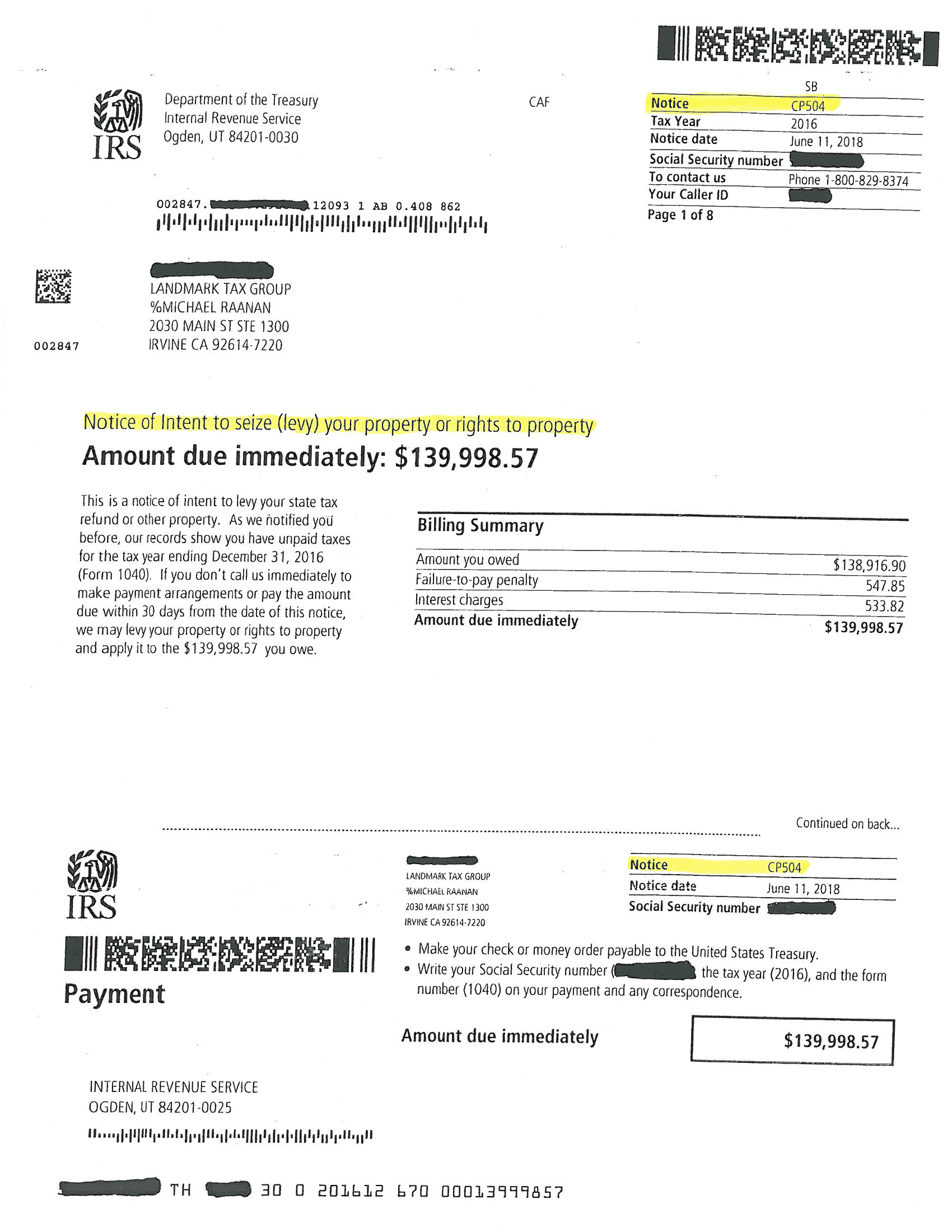

Set up an installment agreement with the irs. Adjust your income tax withholding or estimated tax payments throughout the year so you would owe less tax or no tax when you file your next tax return. If you owe more than 10 000 consider hiring a tax attorney to negotiate with the irs. If you ve received an irs notice that notice should tell you what actions to take to resolve your issue.

Here are some options to consider even if you can t pay the full amount right now.