Cost Of Adding Teenager To Car Insurance

The cost of adding your kiddo to your car insurance policy can be jaw dropping.

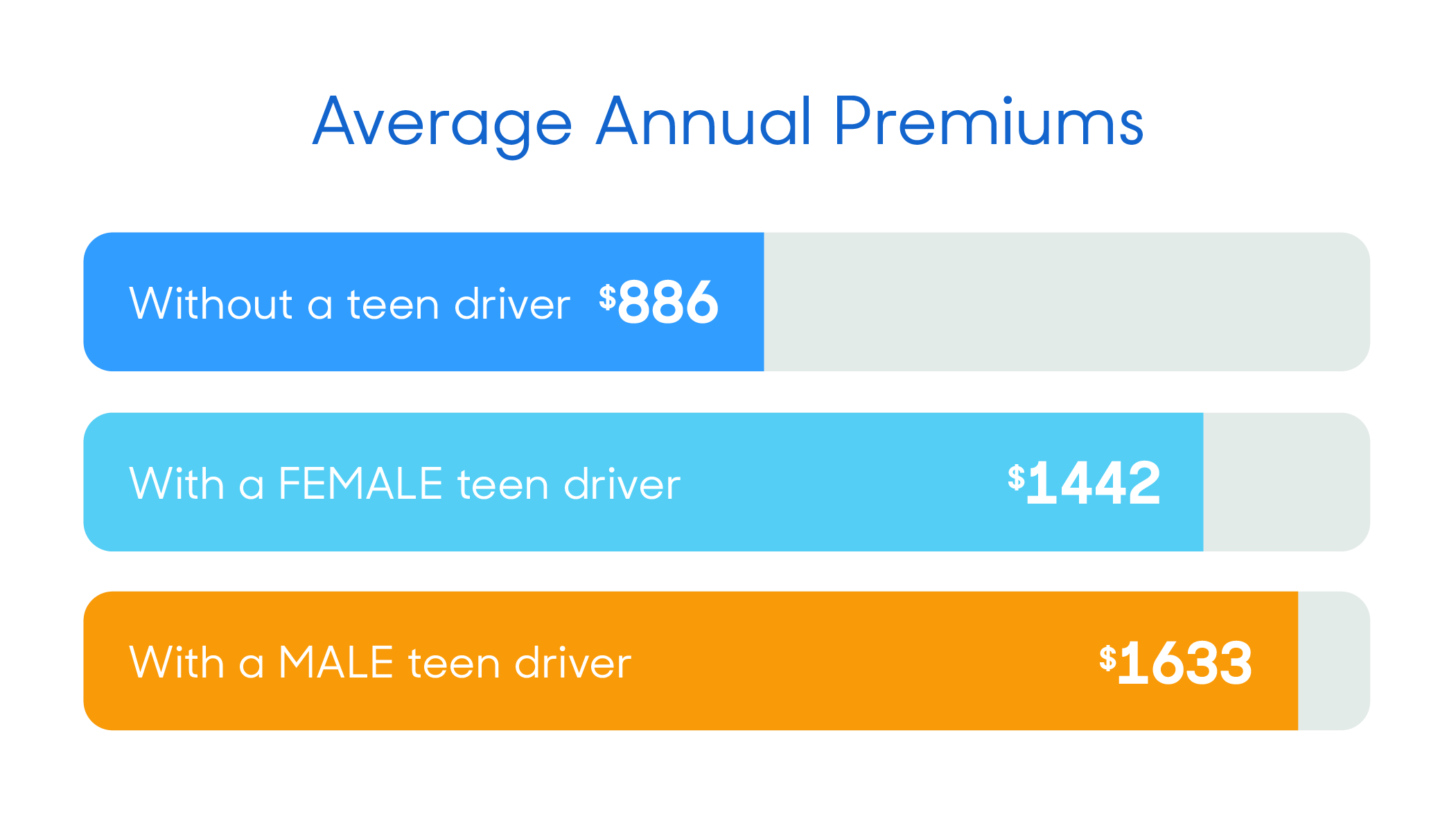

Cost of adding teenager to car insurance. The really big question is. Adding a teenager to your car insurance policy. Adding a teenage driver to your car insurance policy can hike your annual premium by as much as 3 500. If there s an adolescent driver in your future brace yourself.

A 2017 study showed motor vehicle injuries among teenagers cost 13 1 billion. The most cost effective option for teenagers is to add them onto an existing policy. Teen drivers are immature and inexperienced. For instance forbes states that adding a 16 year old son increases rates by 92 on average.

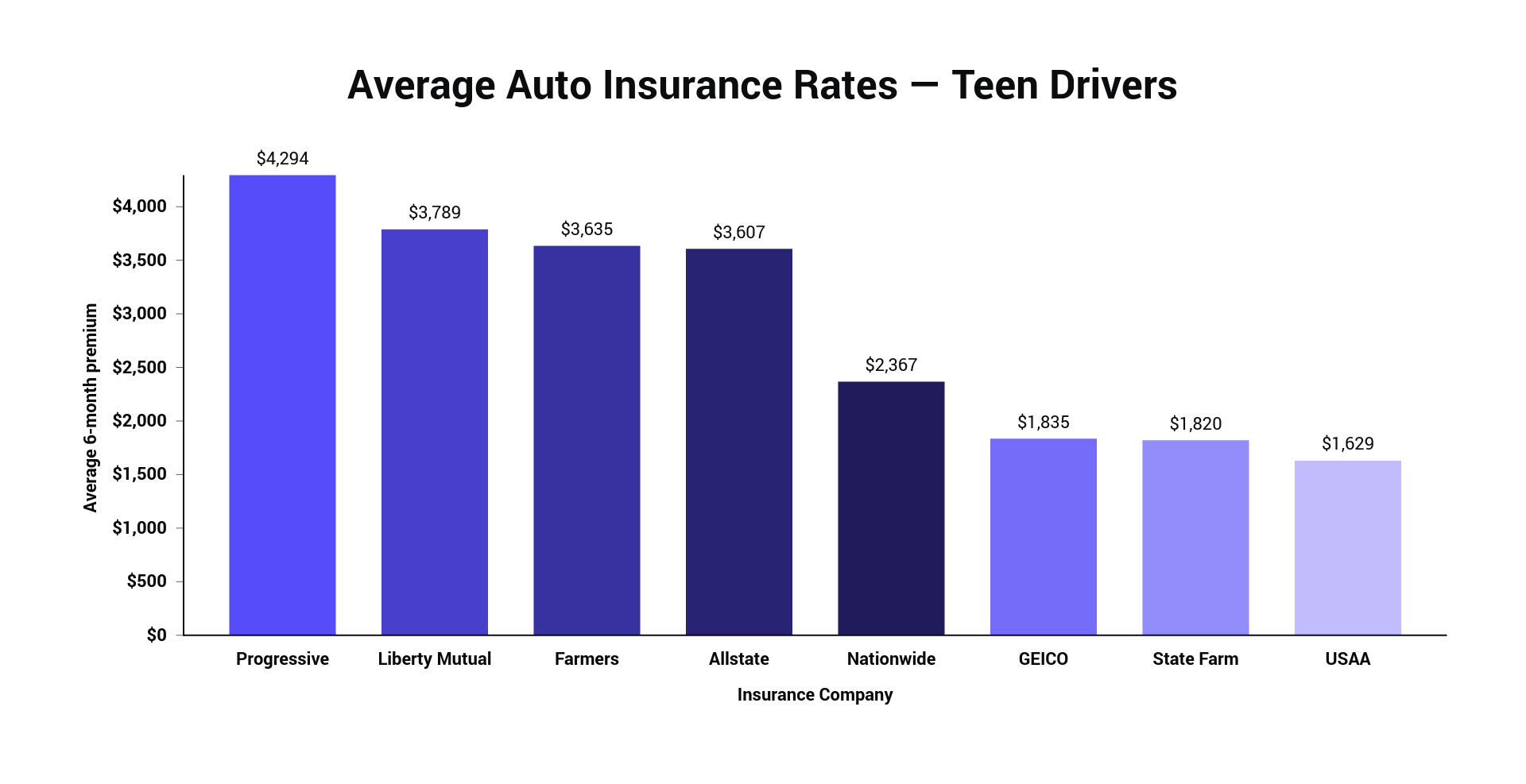

It still comes with a hefty cost but you can certainly save if you choose the best car insurance companies for teens. Lowering car insurance premiums for teenage drivers. The cost of adding a teenager to your car insurance posted april 13 2017 april 13 2017 guest post this week s loose change comes from eileen adamson a financial coach who blogs at your money sorted about making good financial decisions and having more money to spend on the things you love. Keep reading to learn why.

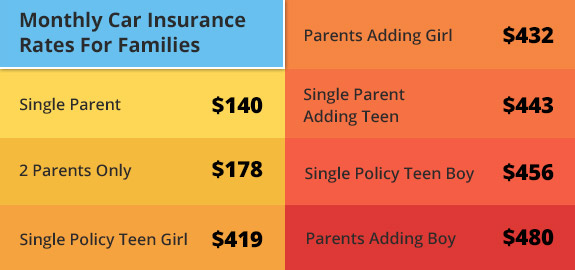

This average includes all liability coverage levels. The above table illustrate rates in new york for a driver added onto an existing insurance policy with married parents high coverage 2 existing vehicles and no accidents the prices do not include adding a 3rd vehicle. How much does it cost to add a teenager to my car insurance. It s a fact that young teen drivers are involved in far more accidents than even those in.

If you re thinking about adding your teenager to your car insurance you know it s a quick way to increase your rates what s more is the gender of your child matters. That s a horrible combination for premiums since insurance companies gauge premiums based risk. There are ways to reduce auto insurance rates for a teen driver but buying a car for the teen and putting him on his own policy isn t one of them the average annual rate quoted for a teen driver is 2 267. While a 16 year old daughter can increase it by 67.

Insurance companies dwell on statistics and rightfully conclude that drivers in their late teens are highly accident prone. Young drivers are at the top of the risk list.

/african-american-teen-learning-to-drive-with-mom-123133825-580f95893df78c2c73b8c4ac.jpg)