Contributing To A Rollover Ira

/ira-5bfc47b5c9e77c00587d681d.jpg)

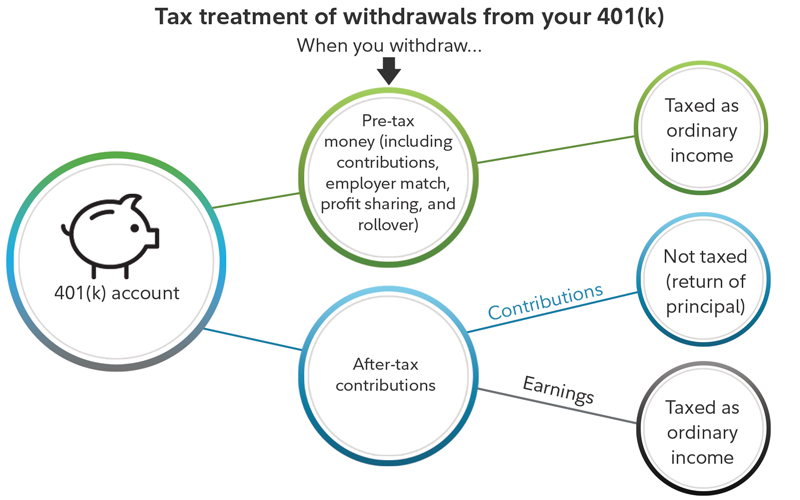

However for participants who have large amounts of appreciated company stock it may be more beneficial to take a lump sum distribution of company stock instead because it allows them to pay taxes.

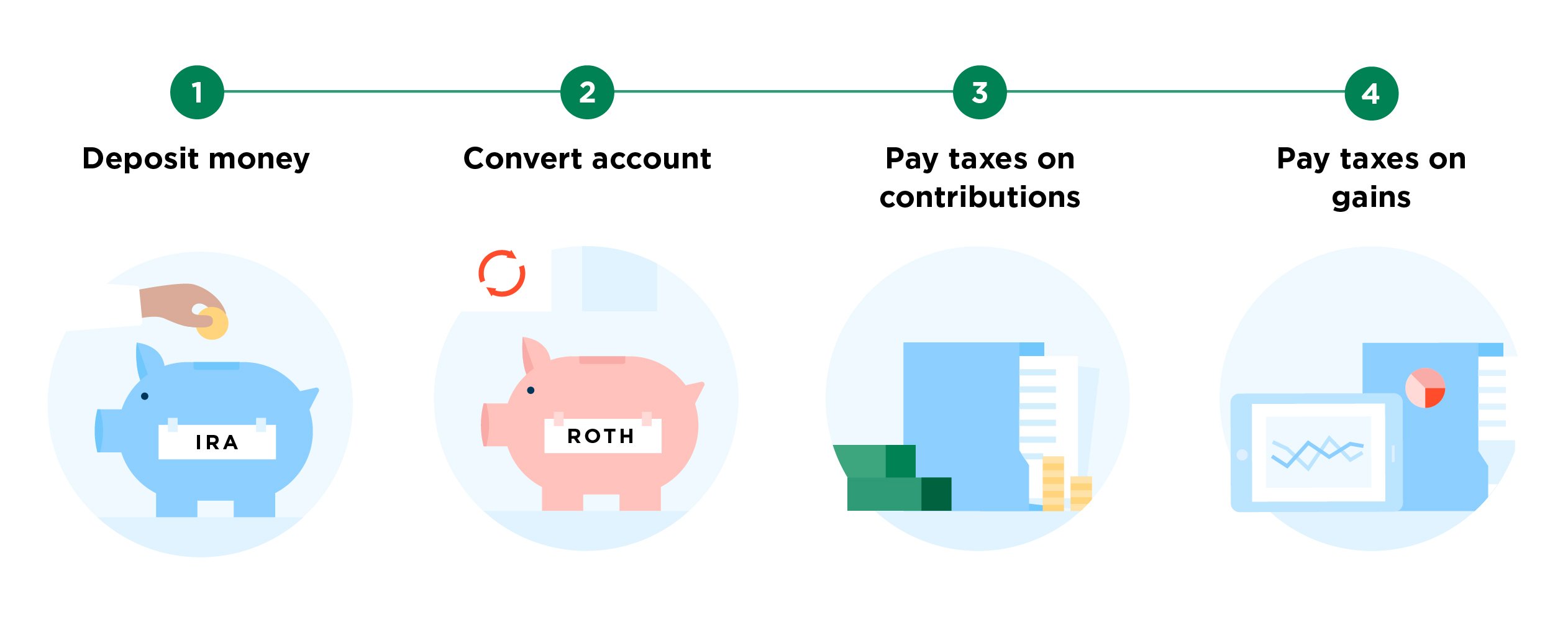

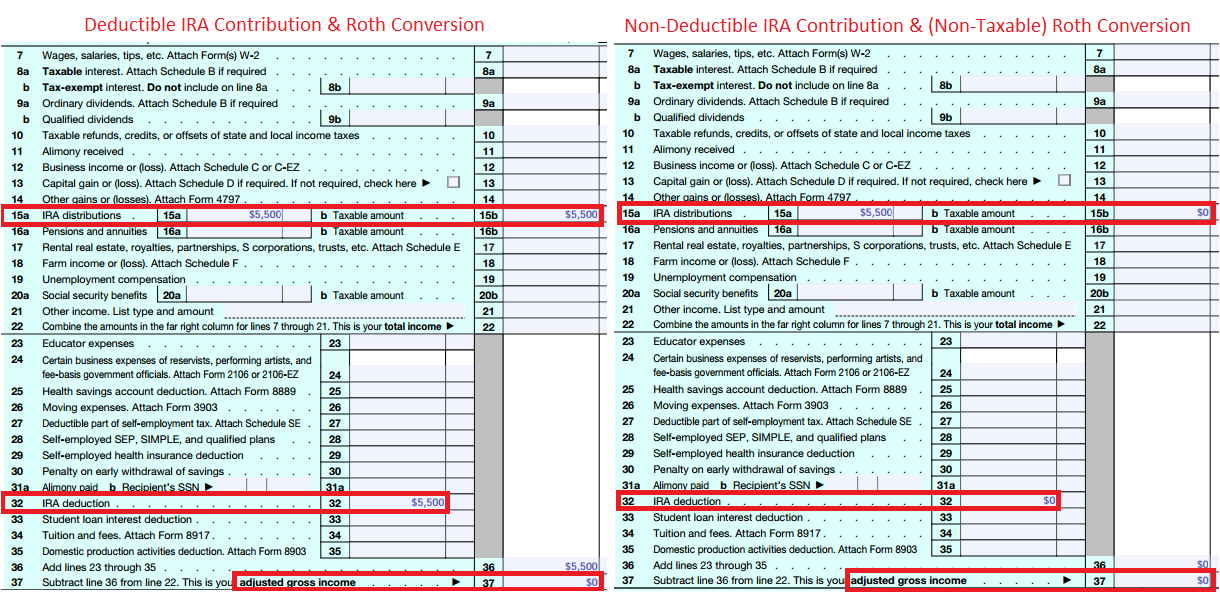

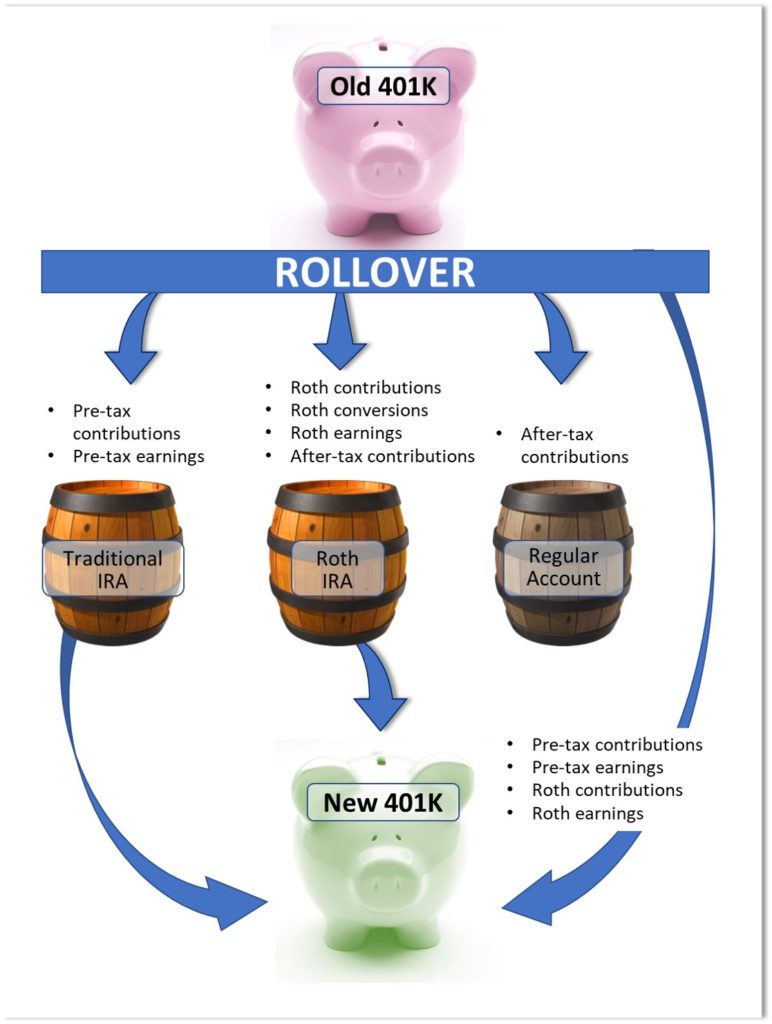

Contributing to a rollover ira. If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place. How to contribute to a rollover ira. Therefore you may want to consider making your annual ira contribution to a separate ira. Why there used to be a big problem with contributing to a rollover ira.

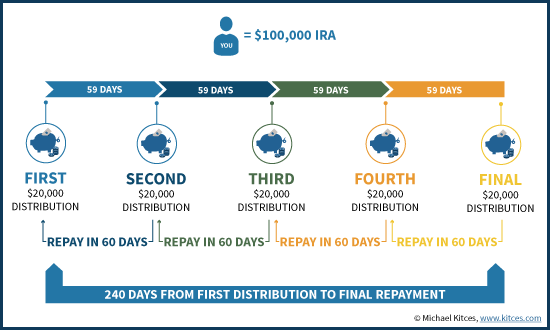

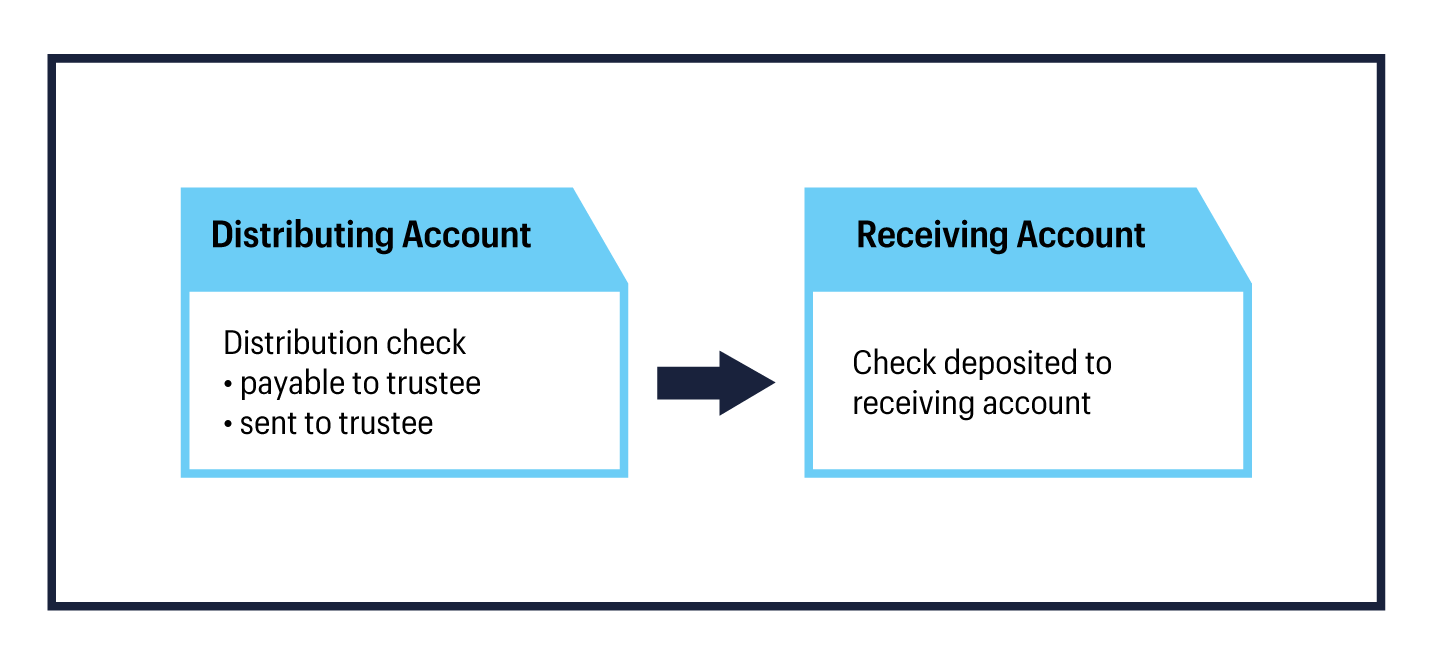

Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan. Once i roll over my retirement plan assets into a vanguard ira can i make additional contributions to my account. Note that you cannot make a 60 day direct rollover contribution online. Verifying rollover contributions how plan administrators can check the validity of incoming rollover contributions announcement 2014 15 application of one per year limit on ira rollovers notice 2018 74 safe harbor explanations eligible rollover distributions.

Yes you can make contributions to your ira subject to the irs annual contribution limits 6 000 for the 2019 tax year and 6 000 for the 2020 tax year. If you continue working you can contribute to your rollover ira within ira contribution limits. If you are trying to do so please contact a fidelity representative at 800 544 6666. Also your modified adjusted gross income magi cannot exceed the general annual income limits that affect whether you can contribute to a roth ira at all less than 206 000 for married.

Contribution limits don t apply to rollover contributions. If you roll over another retirement plan such as a 401 k from a previous employer into your ira the rollover doesn t count. In the past financial advisors routinely told people never to combine a rollover ira with ira money from regular contributions. Making contributions to a rollover ira is the same as contributing to any other ira and the same annual dollar contribution limits apply.

Just because you have rolled your ira or qualified plan into another ira doesn t mean that you can t contribute to it anymore. Consult your tax advisor.

/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)