Factoring With Recourse Accounting

100 million is considered interest expense.

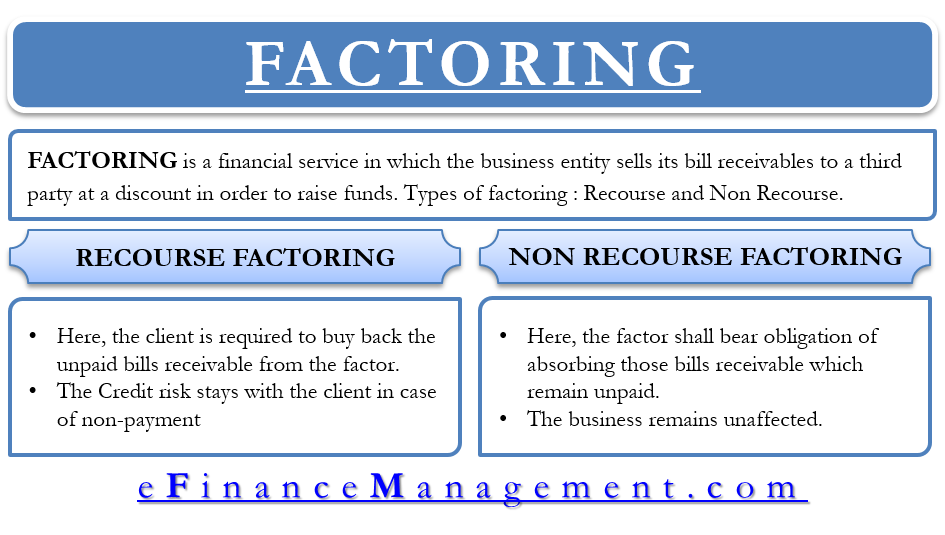

Factoring with recourse accounting. Home accounting tutorials assets in accounting recourse in factoring recourse in factoring recourse is a type of factoring which happens when an entity has to sell the invoices to the client factor with a condition that the entity will purchase back any invoices that remains uncollected this means that in recourse the factor client is not taking any risk of the uncollected invoices. Non recourse does not necessarily protect your company from all risk though. In a factoring with recourse transaction the seller guarantees the collection of accounts receivable i e if a receivable fails to pay to the factor the seller will pay. A short term quick solution that can bring cash and help the company meet its short term obligations.

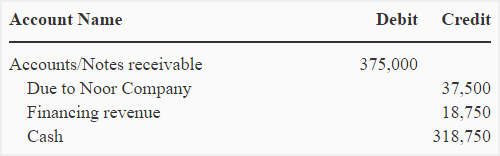

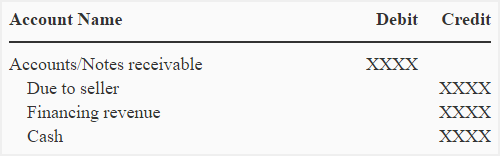

Your business sells accounts receivable with recourse to the factoring company on january 1st. Non recourse factoring means the factoring company assumes most of the risk of non payment by your customers. The journal entry would be as follows. An example of recourse factoring and non recourse factoring is shown below.

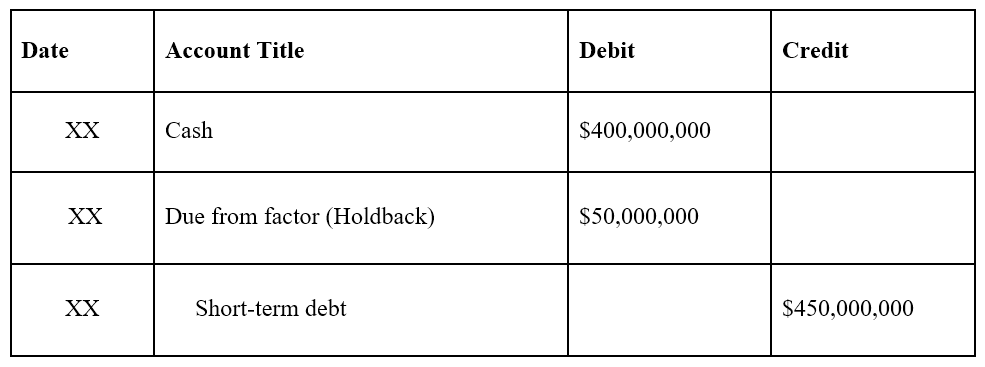

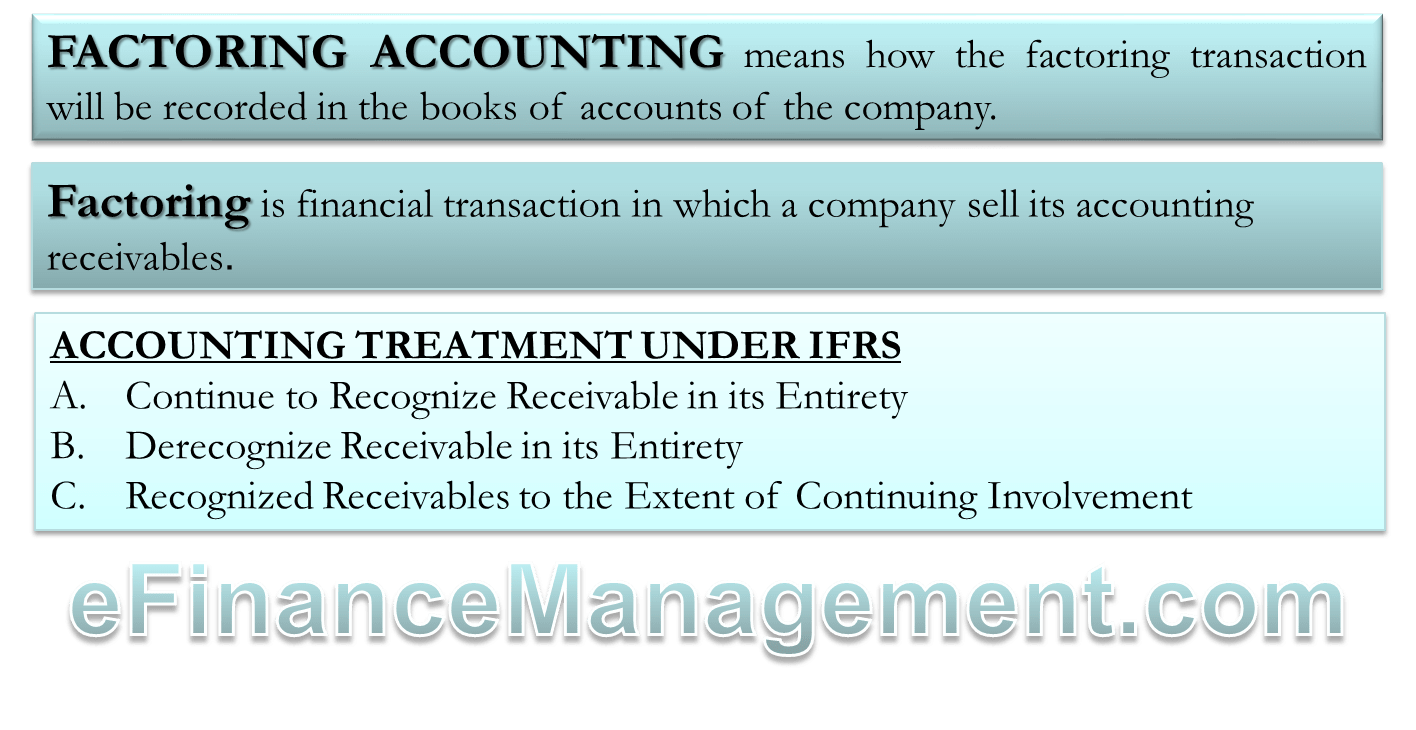

Examples of accounts receivable factoring. Accounting standards ifrs and gaap distinguish two different cases factoring with recourse and factoring without recourse. Company a transfers 500 million of receivables without recourse for proceeds of 400 million.