Foreign Currency Hedge

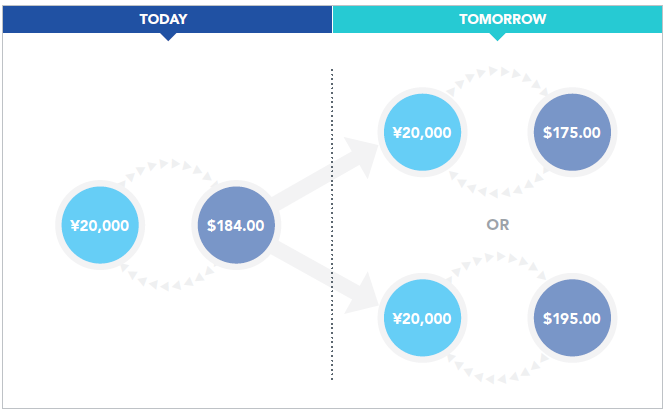

Hedging is accomplished by purchasing an offsetting currency exposure.

Foreign currency hedge. Currency hedging in the context of bond funds is the decision by a portfolio manager to reduce or eliminate a bond fund s exposure to the movement of foreign currencies this risk reduction is typically achieved by buying futures contracts or options that will move in the opposite direction of the currencies held inside of the fund. A forex hedge is a foreign currency trade that s sole purpose is to protect a current position or an upcoming currency transaction. A hedge is a way to guard against. The accounting rules for this are addressed by both the international financial reporting standards ifrs.

A cfd hedge works because you are agreeing to exchange the difference in price of an asset in this case currency from when the position is opened to when it is closed. Currency hedging is a great tool to preserve your profit margins and minimize your costs without potentially leaving money on the table. Foreign currency hedging can help you do business internationally while mitigating these risks and at the same time maximizing your business opportunities. For example if a company has a liability to deliver 1 million euros in six months it can hedge this risk by entering into a contract to purchase 1 million euros on the same date so that.

The spot rate on may 1 2017 was 1 1 0899. A contract for difference cfd is a derivative that can be used to hedge foreign exchange risk to open a cfd position the trader is not required to own the underlying currency. A foreign exchange hedge also called a forex hedge is a method used by companies to eliminate or hedge their foreign exchange risk resulting from transactions in foreign currencies see foreign exchange derivative this is done using either the cash flow hedge or the fair value method. On may 1 2017 an american company purchased inventory from a german company for 100 000 with remittance due in three months.

The journal entries illustrate the fundamental accounting for a foreign currency forward contract designated as a hedge of a foreign currency payable. Foreign currency hedging involves the purchase of hedging instruments to offset the risk posed by specific foreign exchange positions. A currency trader enters a forex hedge to protect an existing or anticipated position from an unwanted move in the foreign currency exchange rates.

.png)

/foreign-currency-804917648-053324a1c58746af86bfb9aab260f7f0.jpg)