First Time Home Buyer Va Loan Tips

Most mortgage programs require about 3 to 20 cash down.

First time home buyer va loan tips. Many lenders charge veterans using va backed home loans a 1 flat fee sometimes called a loan origination fee. Some conventional loans aimed at first time home buyers with excellent credit allow as. Start without a coe don t let the lack of paperwork be a barrier to entry. But i know it can also feel overwhelming especially when you see homes being purchased at a median of 250 000 and available homes flying off the market in just three weeks.

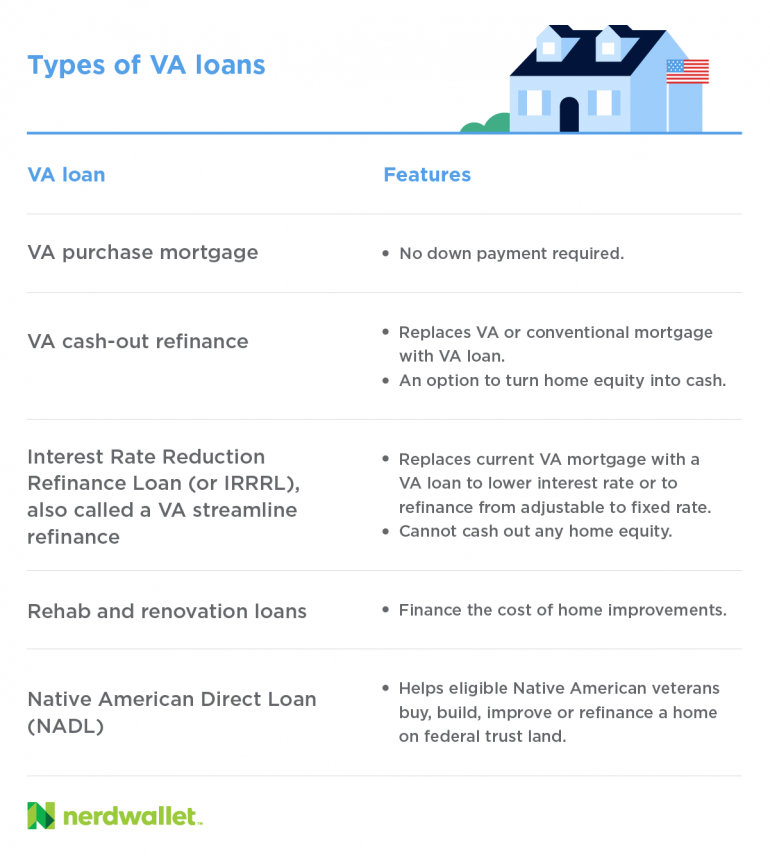

There are special loan programs for any citizen who is looking to buy real estate. If you are an active duty military or a veteran who is eligible for the va loan then this training is for you. You can use these benefits over and over again. Your down payment requirement will depend on the type of mortgage you choose and the lender.

You don t need your. Be prepared to pay lender fees. Not a one time benefit once you earn the va home loan benefit it s yours for life. Virginia first time homebuyer programs.

This reduced the upfront costs and it s available specifically for first time buyers. This isn t a one time lending option or a program exclusively for first time homebuyers. Borrowers can put as little as zero money down with va guaranteed mortgage. It s a one time payment to help purchase the home.

I created the training for people interested i. No down payment option va loans are perfect for first time homebuyers who do not have enough money for a down payment. Lenders offer different loan interest rates and fees so shop around for the loan that best meets your needs. Being a first time home buyer is exciting.

The funding fee to re use a va loan is 3 6 of the loan amount or 3 600 for each 100 000 borrowed. Lenders may also charge you additional fees. Va loans and 4 others that are best first time home buyers when it is time to buying a home the united states government wants everyone to have a piece of the american pie. It offers 30 year fixed rate loans through a statewide network of approved mortgage lenders in addition to forgivable down payment grants and federal tax breaks.

However first time home buyers get a funding charge of just 2 3.