Documents Required For Mortgage Pre Qualification

Before going house hunting you can request that your lender preapprove your loan and not just prequalify it.

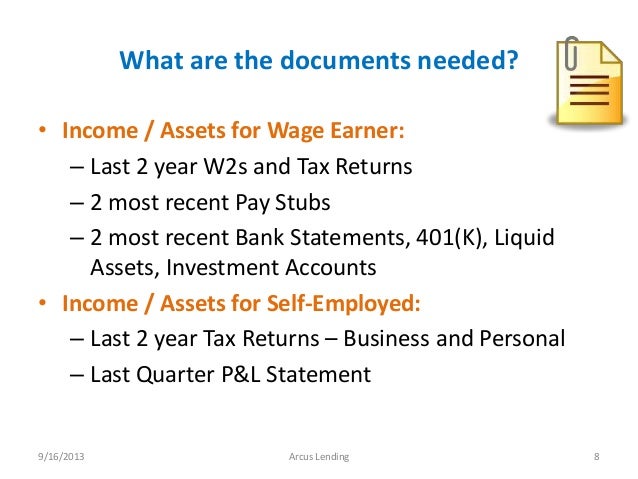

Documents required for mortgage pre qualification. Past two years w 2 forms for all borrowers. A mortgage lender might want to see a list of employers for the past two years maybe longer in addition to the name of your employer a lender will want to see a mailing address and phone number. Unlike prequalification preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your w2 recent pay stubs bank statements and tax returns. Usda mortgage loans require a minimum credit score of 640 for automatic approval provided employment and income requirements are also met.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow. Thirty days of pay stubs. Suggested documents to submit to your loan originator for review during the pre qualification process. Documents needed for a mortgage preapproval letter income and employment documents such as tax returns w 2s and 1099s.

A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. Mortgage document requirements even though many lenders are still quoting quick 10 minute pre qualifications over the phone or online a true mortgage approval that holds any weight is one that has been issued by an underwriter who has had an opportunity to review all of the necessary documents. When getting pre approved there are some documents that you might be asked for. Photo id 2 forms of id drivers license and one additional most recent two months bank statements all pages for any accounts you plan to utilize for your down payment and closing costs.

Asset statements on bank retirement and brokerage accounts. Documents needed for a mortgage pre approval. Two years of federal tax returns. However homebuyers with lower credit scores may still be approved if a temporary hardship such as an illness or job loss impacted their scores or the new housing payment is less than what the borrower is currently paying.

The document requirements for mortgage preapproval vary by lender and your individual circumstances but typically you ll need to provide documents which show your income your assets and any regular commitments against your income. These will include but may not be limited to. Common documents required for a mortgage pre approval even though many lenders are still quoting quick 10 minute pre qualifications over the phone or online a true mortgage approval that holds any weight is one that has been issued by an underwriter who has had an opportunity to review all of the necessary documents. Loan preapproval requires more up front.

Know the maximum amount of a mortgage you could qualify for.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)