How Long To Keep Business Insurance Policies

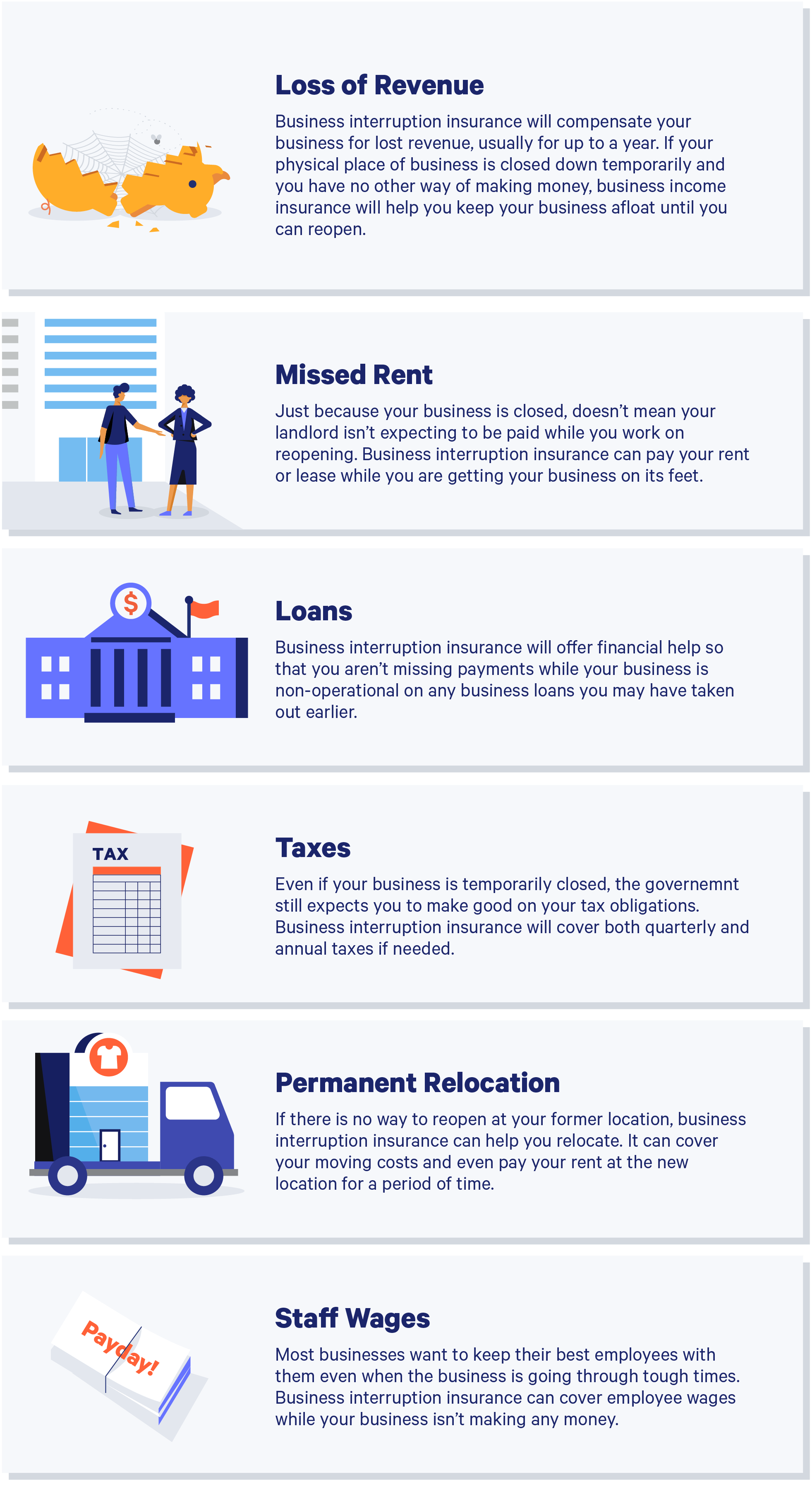

Many companies have implemented records retention policies to ensure that they remain protected under essential business insurance policies.

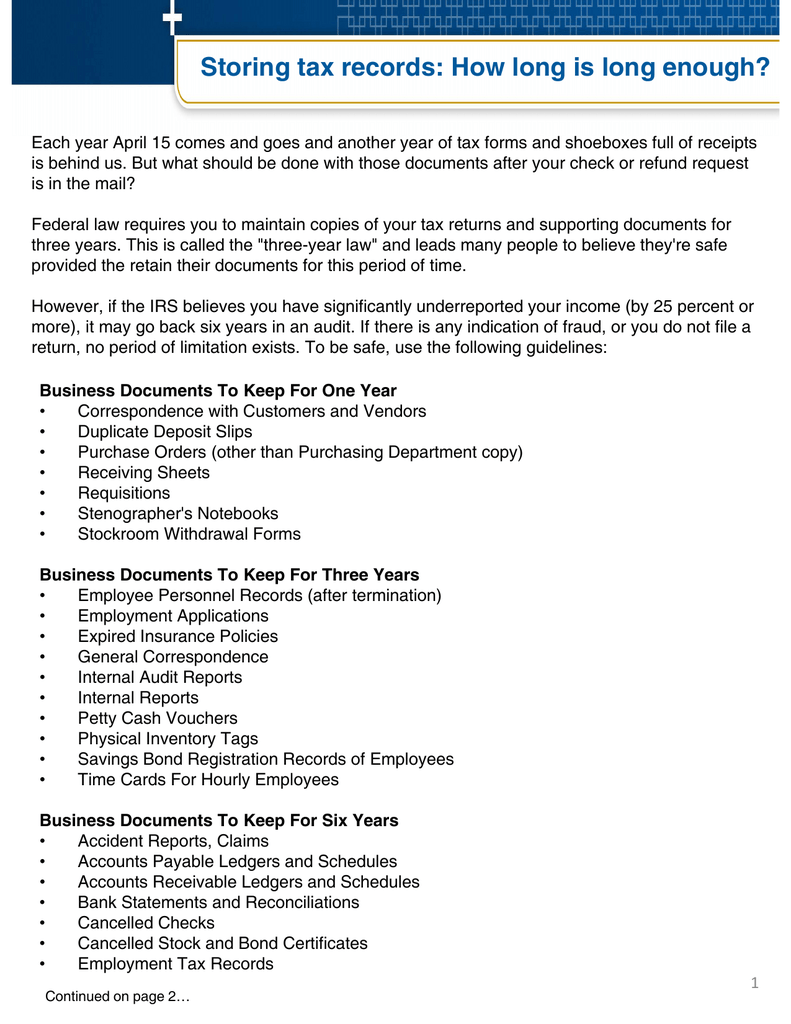

How long to keep business insurance policies. Claims made policies experts generally agree if you have renewed a claims made insurance policy you can get rid of the ones. State laws vary but generally require insurance agents to keep copies of their customer s policies for 6 7 years. But how long should the company s files be kept. Businesses often base how long they keep files on the length of the statute of limitations.

When to retain insurance policies. How long you should keep them depends on how they are written. Jack hungelmann insurance adviser with bankrate recommends for health life long term care and disability insurance policies to keep all documentation as long as the. The answer varies depending on company policies and the type of files.

Real estate property abstracts deeds mortgage documents closing documents insurance policies and receipts for home improvements. Records retention program the simplest way for a company to manage all the records it acquires is to institute a records retention program that defines how long documents are to be kept. Permanent life insurance policies such as whole life or universal life contracts should be retained as long as the policy is in force or until the claim is settled after your death. Insurance paperwork is particularly problematic many businesses are unsure of what they should keep and what they can safely send to the shredder.

Vehicles titles purchase or lease documents and auto insurance policies. Keep documents while you own the asset. Occurrence based liability insurance policies such as business auto and commercial general liability may be triggered far after the policy has expired. In this situation be sure and retain the current policy and declaration for auto and home insurance policies.

How long do you keep auto insurance statements. Business policies should be kept for tax purposes. Household receipts warranty certificates and operating instructions for household items. The average person is free to toss their old auto insurance documents when the policy period is over unless you have an ongoing claim involving the vehicle.

For occurrence based policies like commercial liability auto insurance homeowners and excess or umbrella you should keep them forever. Generally the files should be kept as long as they serve a useful purpose or until all legal and regulatory requirements are met.

/GettyImages-1141164585-5486d44770c94a2784185a75be37a6fa.jpg)

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)