Home Equity Loan Or Heloc

That said approval is not guaranteed.

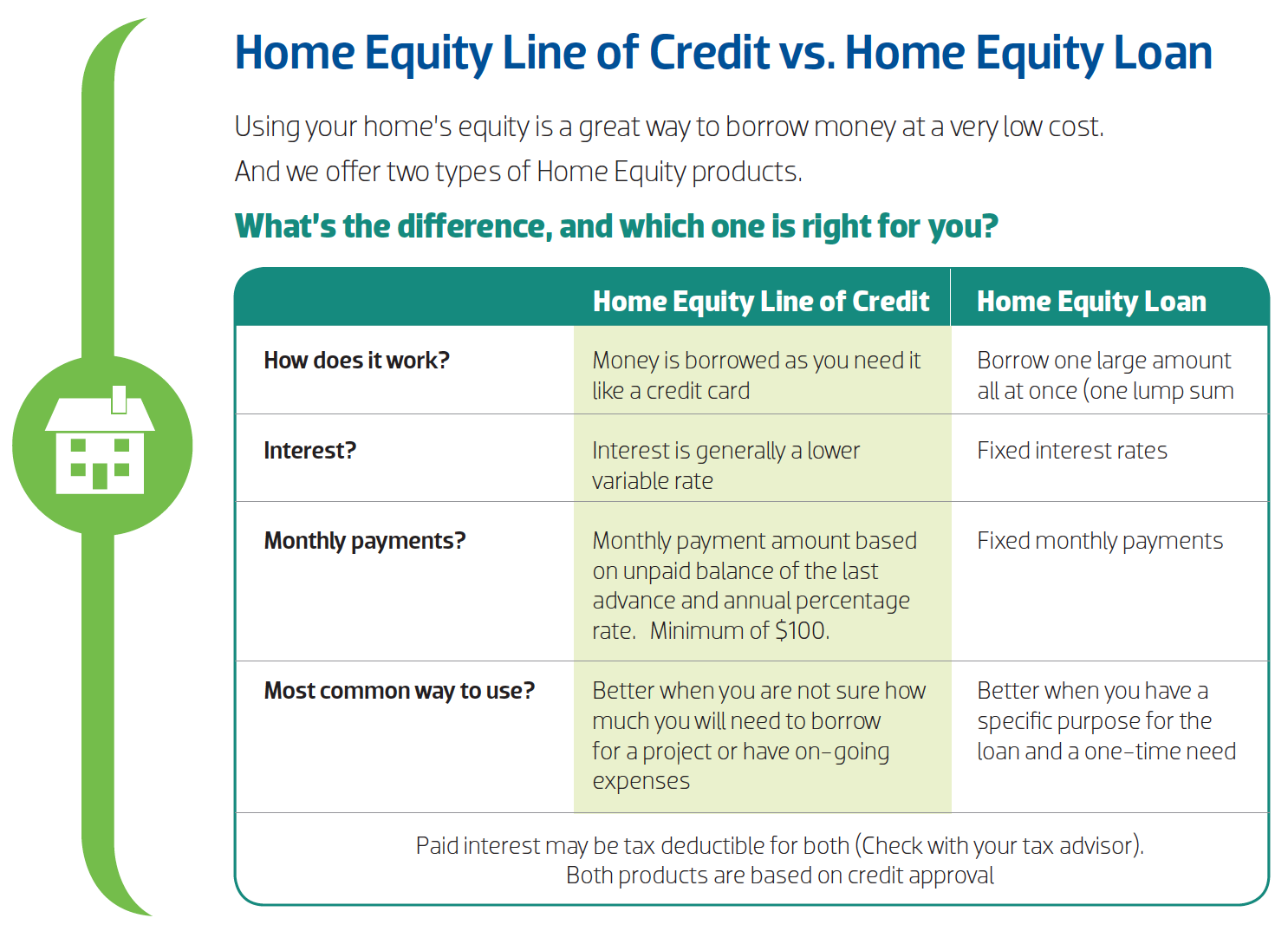

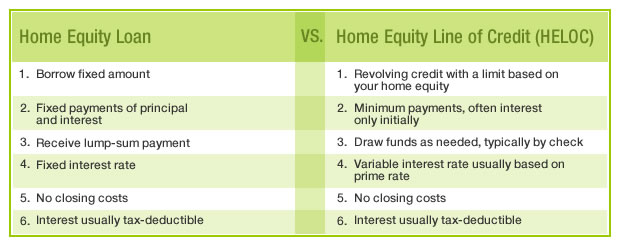

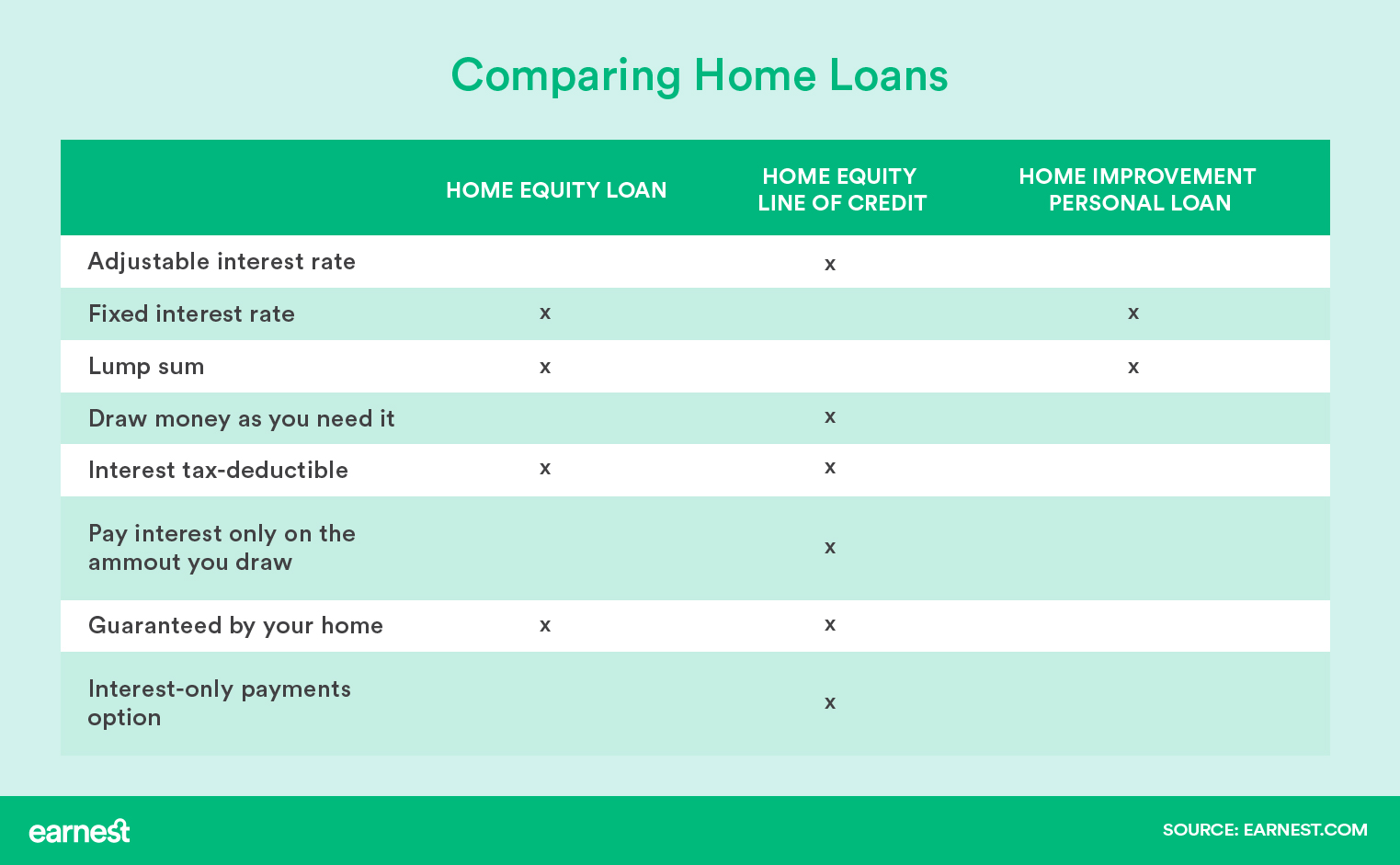

Home equity loan or heloc. Home equity loans and home equity lines of credit let you borrow against the value of your home but they work differently. The following discounts are available on a new home equity line of credit heloc. Discover s home equity loans allow you to borrow up to 200 000 against your home equity with rates starting at just 3 99 percent. Home equity line of credit heloc.

Home equity access checks are not available in texas on homestead properties. You may not use these checks to pay a balance on any home equity line of credit account you have with wells fargo. A home equity line or loan is available for single family residential properties including co ops in new york illinois district of columbia new jersey and maryland. Home equity access checks may not be accepted by all merchants or other third parties and cannot be processed electronically.

1 an auto pay discount of 0 25 for setting up automatic payment at or prior to heloc account opening and maintaining such automatic payments from an eligible bank of america deposit account. A home equity line of credit heloc is a line of credit extended to a homeowner that uses the borrower s home as collateral. Home equity line of credit. Find out about both options here.

The apr will vary with prime rate the index as published in the wall street journal. A home equity line of credit or heloc is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time rather than an upfront lump sum. 2 an initial draw discount of 0 05 for every 10 000 initially withdrawn at account opening up to 0. A home equity loan and a home equity line of credit heloc knowing about these ways of.

Home equity loans can be easier to qualify for if you have bad credit because lenders have a way to manage their risk when your home is securing the loan. Home equity loan vs. Borrowers are pre approved for a. The apr is variable and is based upon an index plus a margin.

There are two basic ways to use your residence as collateral. Home equity lines are also available for 2 4 family homes that are primary residences excluding texas.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)