Home Equit

Home equity lines and loans are not available for mobile homes in any state.

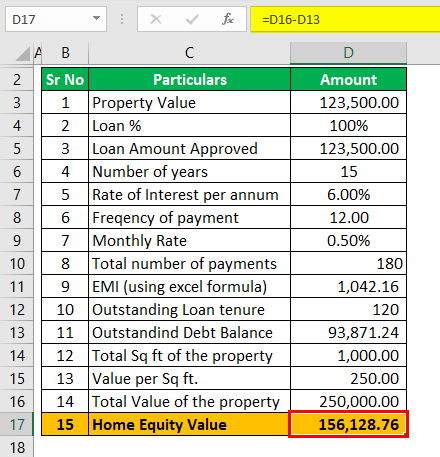

Home equit. The property s equity increases as the debtor makes payments against the mortgage balance or as the property value appreciates in economics home equity is sometimes called real. Home equity is the difference between the value of your home and the unpaid balance of your current mortgage. With a home equity loan you get all of the money at once and repay in flat monthly installments throughout the life of the loan. This timeline could be as short as five years or as long as 15 years or more.

These kinds of loans often referred to as second mortgages come with fixed interest. A home equity loan is a type of second mortgage. Home equity loans allow you to borrow against your home s value minus the amount of any outstanding mortgages on the property. In texas home equity lines and loans are only available on collateral properties that are single family primary residences.

Home equity is the market value of a homeowner s unencumbered interest in their real property that is the difference between the home s fair market value and the outstanding balance of all liens on the property. Home equity lines and loans are not available for mobile homes in any state. A home equity loan is a fixed term loan granted by a lender to a borrower based on the equity in their home. Home equity is the value of a homeowner s interest in their home.

A home equity loan is a second mortgage that allows you to borrow against the value of your home. For example if your home is worth 250 000 and you owe 150 000 dollars on your mortgage you d have 100 000 in home equity. A home equity loan is a second mortgage that borrows against the equity in your home and uses your house as collateral to secure the loan. In texas home equity lines and loans are only available on collateral properties that are single family primary residences.

In other words it is the real property s current market value less any liens that are attached to that property. Home equity loans are also available for 2 family homes that are primary residences excluding texas. Your home equity is calculated by subtracting how much you still owe on your mortgage from the. Tapping home equity accesses the portion of the home you ve paid for to get one lump sum payment without having to sell your home or refinance your first mortgage.

Home equity loans are also available for 2 family homes that are primary residences excluding texas.

:max_bytes(150000):strip_icc()/what-is-home-equity-315663-FINAL-5bbe03efc9e77c0026be1d5a.png)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)