How Is General Liability Insurance Calculated

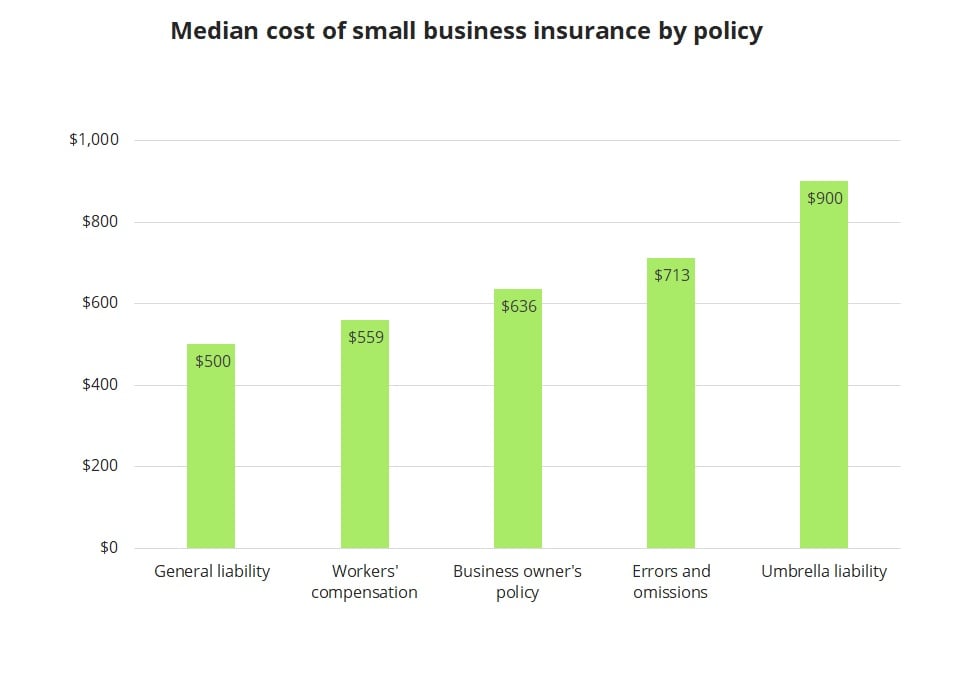

Based on their results the typical general liability insurance cost was approximately 30 per month.

How is general liability insurance calculated. Calculate quotes by multiplying your insurance rates by the size or revenue whichever applies of your company. This policy provides protection for your business in the event of a 3rd party claim for property damage bodily injury and lawsuits costs for covered losses. You can keep your general liability limits reasonable and draw on extra coverage when you need it by purchasing an umbrella liability insurance policy as for your deductible the amount you pay before your insurance benefits kick in remember that higher out of pocket spending will lower your monthly premium. Annual revenue annual payroll and number of students.

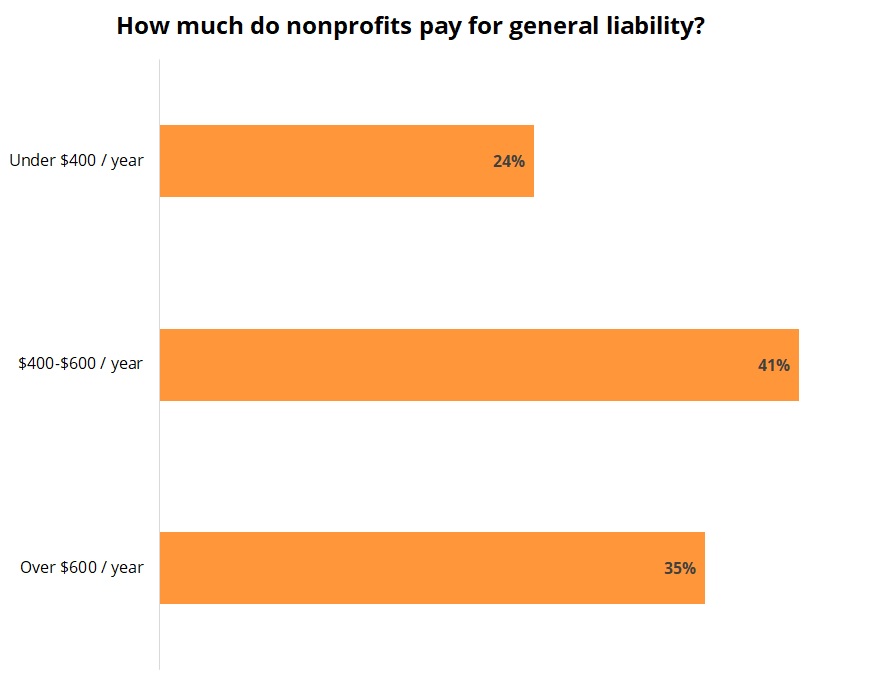

General liability premiums are usually calculated on one of three things for a charter school. If you re looking for additional coverage for. Only 1 have a general liability insurance cost of over 100 per month. Start general liability quote.

The original insurance cost calculated by the contractor is based on estimated payroll and contract value and some cip sponsors like to perform a true up or closeout calculation using the actual or final payroll and contract value. However for businesses such as consulting firms liability insurance is based on the square footage of occupancy. For these classifications the premium is typically calculated by multiplying the rate times gross sales divided by 1 000. Specifically more than 80 of small businesses pay 30 per month or less for general liability coverage while 95 pay 50 per month or less.

If the rate is 2 00 your premium will be 4 000 2 000 000 1 000 x 2. General liability insurance cost averages 500 600 and is determined by your risk exposure. However it is an option in other states. In many states professionals are required to purchase professional liability insurance in order to practice.

This can protect you from damage due to data breaches. Management liability and employment practices liability insurance. Without liability insurance if you lose a lawsuit you will have to pay the judgment yourself. Insurers are typically most concerned about the following.

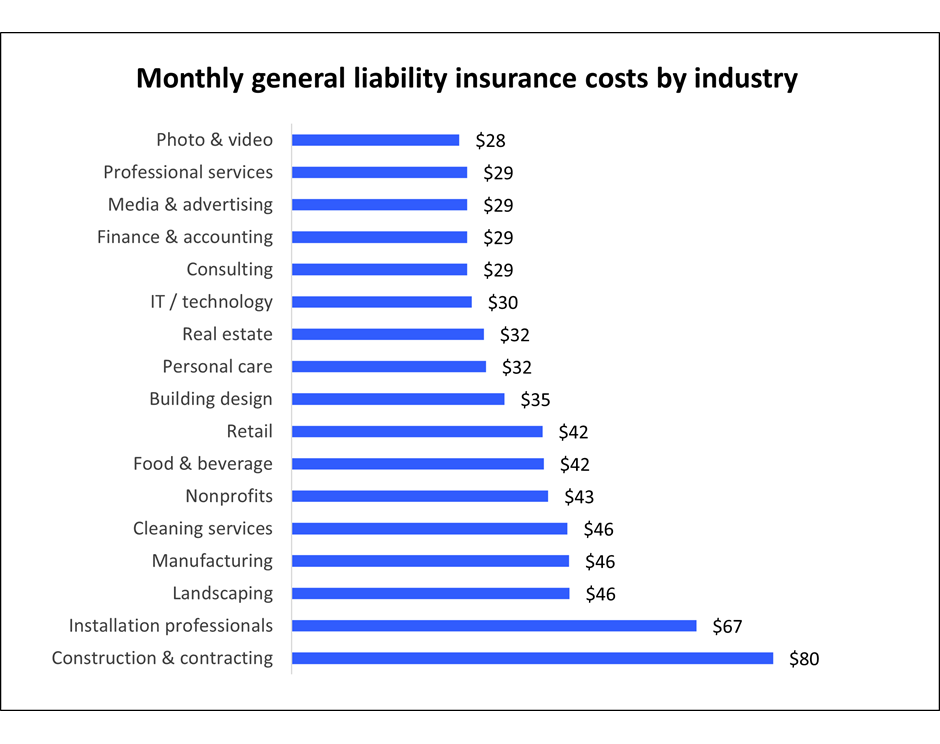

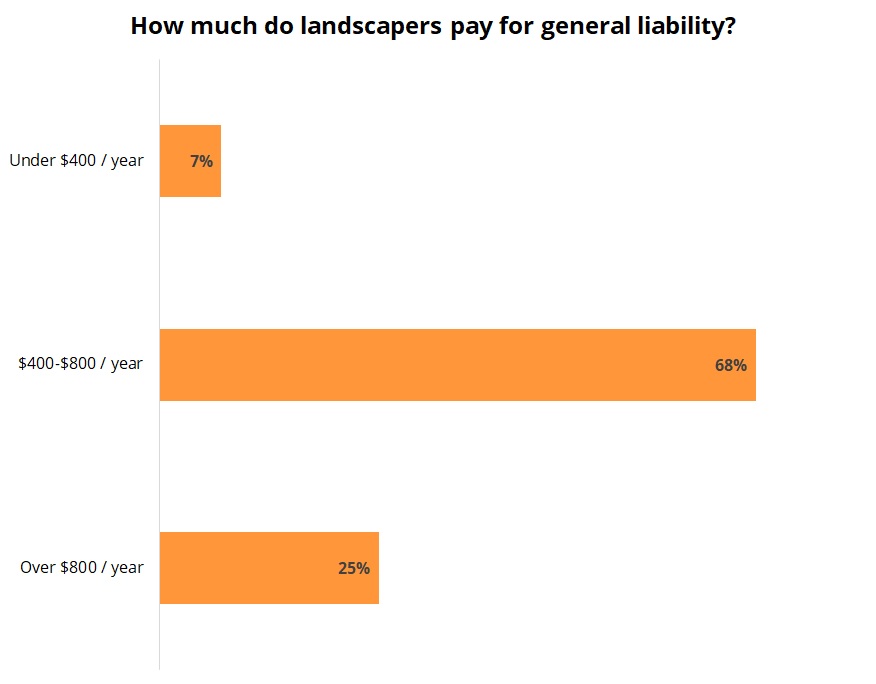

For example if the quote is for 10 percent multiply your gross revenues by 0 10 to calculate your cost. General liability insurance cost also varies by industry. This can financially devastate your business and. How to calculate business liability insurance.

For example suppose you expect your grocery store to generate 2 million in sales over the next year. No matter where you work your businesses should have liability insurance.