Homeowner Insurance Premium

An insurance company first looks at the home s perceived risk the home s location and the homeowner.

Homeowner insurance premium. Things more specific to your home s location like how close you are to a fire hydrant and whether your area is served by a professional or volunteer fire department can affect your premium the insurance information institute iii says. One of the factors used to price policies are the types of claims that have happened in your neighborhood. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price. Once an insurer compiles that information it is able to create a home insurance rate.

An insurer then reviews filed claims and adds surcharges to the rate. Increasing their homeowners insurance deductible from 500 to 1 000 will decrease homeowners insurance premiums by 13 and increasing it from 500 to 5000 will decrease premiums by a third. Your homeowners insurance premium is the amount of money you pay every year to keep your insurance policy active. In addition geographical location such as.

The premiums of this necessary insurance coverage like the property taxes charged by your local community are expenses that will continue as long as you own the structure. There are a number of factors that impact your premium namely your level of coverage deductible amount home characteristics and credit score. The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing. While there are not many actions you can take to reduce your tax obligation there are ways to lower the premium you pay for homeowners insurance.

The value of your home where you live and the coverage level you choose can all impact the. The result is your home insurance premium. Your homeowners insurance premium is the amount you pay to keep your home insurance policy active. Insurance premiums will vary depending on the type of coverage you are seeking.

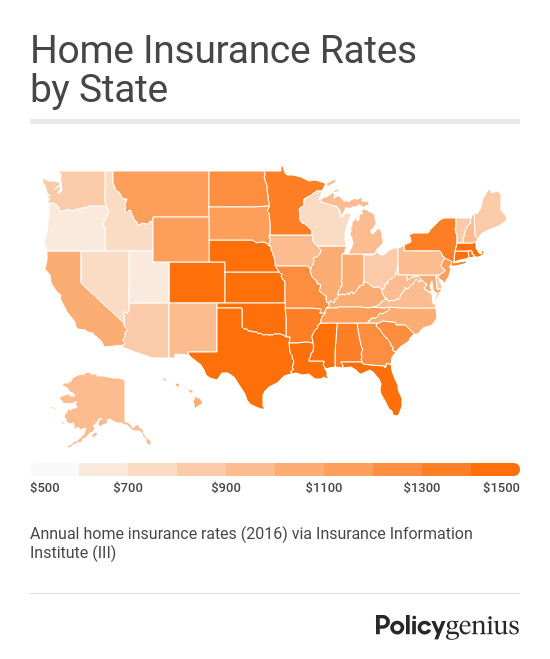

The average homeowners insurance premium in the united states is 1 211 a year according to the naic. They lastly subtract applicable discounts. An item located on a property that is appealing but potentially hazardous especially to children. Your location location is one of the biggest homeowners insurance premium cost factors.