How Does A Levy On A Bank Account Work

Each levy is a one time deal.

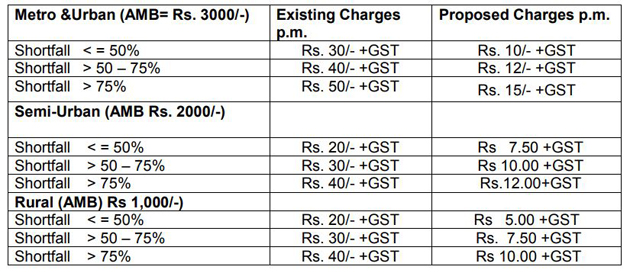

How does a levy on a bank account work. With the exception of jeopardy levies taxpayers usually have plenty of notice before the irs freezes a bank account. Then 21 days later they deduct them from your account. This link explains how a bank account levy works and what to expect. Your money remains in your account but you can t access it.

In massachusetts your bank is obligated to freeze your account for the money you owe for 21 days after it receives a levy notice. Primarily this means if your social security number is attached the account then the irs bank levy will attach to that account too. The right option depends on your situation. If they do not satisfy the debt in full the first time they levy they may keep coming back as more money appears in the account.

In some situations it s possible to prevent a levy especially when the only money in your account is from federal benefits. With a bank levy the irs will contact your bank and demand that they put a hold on your funds. How to stop or release a bank account levy. This all begs the question how does an irs bank account levy work.

You can stop a bank account levy but you need to act quickly before the irs seizes the funds. A creditor can t levy your bank account without first winning a lawsuit judgment against you and then obtaining a court order to levy your bank account. Any money that is deposited into your bank account after the levy has been processed will not be captured in the irs bank levy unless they issue another bank levy. The irs will ask to be furnished with pertinent documents to assess the veracity of claims relating to wrongly levied bank accounts.

In cases of levied bank accounts wherein the tax debtor is no more than a signatory the actual account holder should contact the irs using the telephone number specified on form 668 a c do. There is normally a long series of letters each one slightly more ominous than the last. Bank levies give creditors a powerful collection tool when you re behind on payments that doesn t mean you re powerless. An irs bank levy attaches to any account at that financial institution that you have an interest in.

The creditor can apply for additional bank levies if needed. After 21 days your bank forwards the money to the department of revenue. Or in the case of a tax levy the irs will have sent a bill for payment allowed you to neglect or refuse to pay then sent a final notice of intent to levy. Lastly the sheriff will take the money out of the bank account and give it to the creditor.

If you do not respond to the notice or otherwise take any action to resolve the issue the irs may decide to issue a bank levy. This is done in order to seize the funds in your bank account to pay off back taxes that you owe.

/bank-levy-basics-315527_FINAL-5788135a0c274ffc81b9d8d53e44a1bb.gif)

/bank-levy-basics-315527_FINAL-5788135a0c274ffc81b9d8d53e44a1bb.gif)

/light-from-open-vault-door-758285733-5be8c7c7c9e77c0051e35e44.jpg)

/GettyImages-471332401-57a51ac33df78cf459780309.jpg)

:max_bytes(150000):strip_icc()/GettyImages-92099750-f40617345741420c9436bff43332fb75.jpg)