How Do I Get My 1095 A Form

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

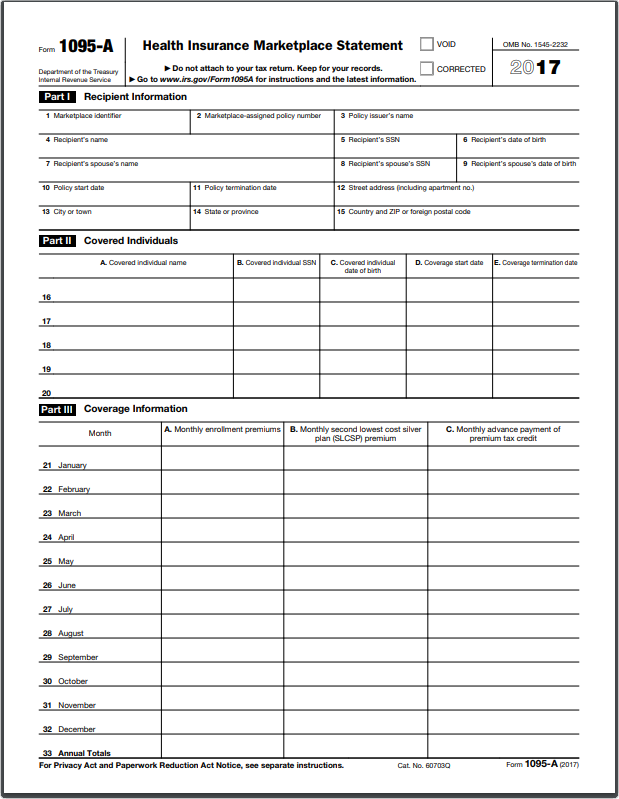

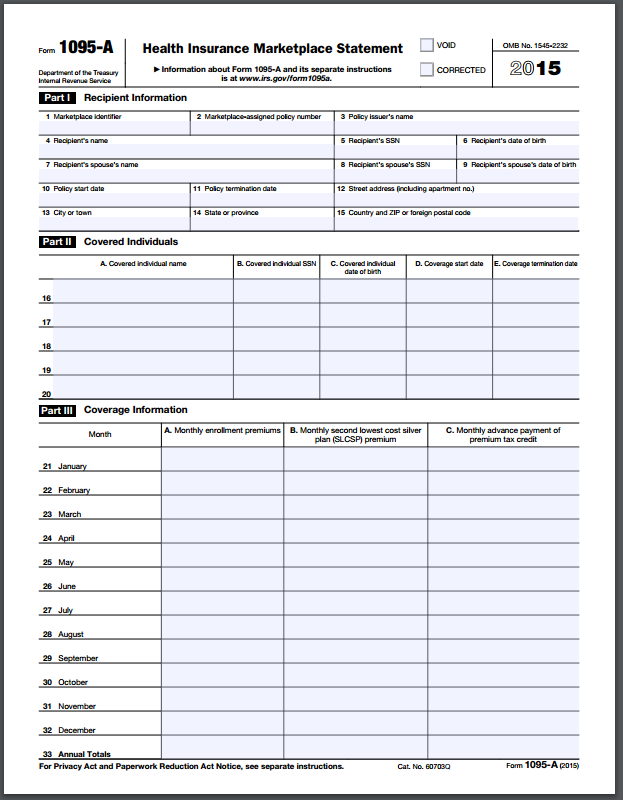

Form 1095 a is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your tax return.

How do i get my 1095 a form. The 1095 b form is generated by medical insurance carriers and used to report enrollee coverage status to the irs. To get a copy of your form 1095 a you will need to contact your marketplace insurance carrier. Form 1095 a is your proof that you had health insurance coverage during the year and it s also used to reconcile your premium subsidy on your tax return using form 8962 details below. If you have not yet received your 1095 a you can obtain the form the marketplace online or by phone.

Log in to your healthcare gov account. You can do that by calling them or through your marketplace account as leonard smith describes above. However using the information on your form 1095 a you must complete and file form 8962 premium tax credit. Information about form 1095 a health insurance marketplace statement including recent updates related forms and instructions on how to file.

People who receive health insurance subsidies generally get form 1095 a. If you bought coverage through healthcare gov follow the steps in the next section below. How do i get my 1095 a form here are directions for obtaining a copy of your 1095 a online or by phone. Why did i get a letter from the irs asking for more information and a copy of my 1095 a.

Get screen by screen directions with pictures pdf or follow the steps below. In this case the monthly enrollment premium on your form 1095 a may be higher than you expect because it includes a portion of the dental plan premiums for pediatric benefits. Click your name in the top right and select my applications coverage from the dropdown. Carriers send 1095 b forms directly to enrollees so brokers do not have access to these forms if you did not receive your 1095 b form in the mail you can get your.

Click the green start a new application or update an existing one button. You were enrolled in a stand alone dental plan and a dependent under 18 was enrolled in it. In this case your form 1095 a will show only the premium for the parts of the month coverage was provided. Say thanks by clicking the thumb icon in a post.

Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace. If you expect a 1095 b or a 1095 c you can typically mail your taxes without the form as long as you know whether or not you were insured. If you didn t get form 1095 a in the mail or you received your form but lost it first check to see whether you can find your form in your online marketplace account. If you expect a 1095 a you will need the form before you finish your taxes.

Your 1095 b form will indicate the months that you met the minimum essential coverage for the previous tax year.

:max_bytes(150000):strip_icc()/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)