Home Insurance Water Leak

Simply put it covers the cost to repair damage done by a water leak you can t see within the walls floors ceilings cabinets beneath the floors or behind or under a home appliance.

Home insurance water leak. The level of insurance excess you will have to pay. Does home insurance cover water leaks. The scale of the water leak and the damage it has caused to your home. If the damage caused by your water leak is very small then it may not be prudent to make an insurance claim.

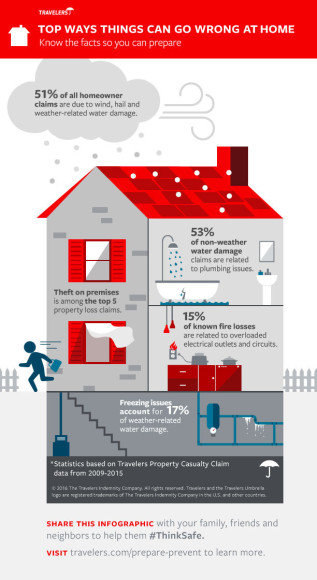

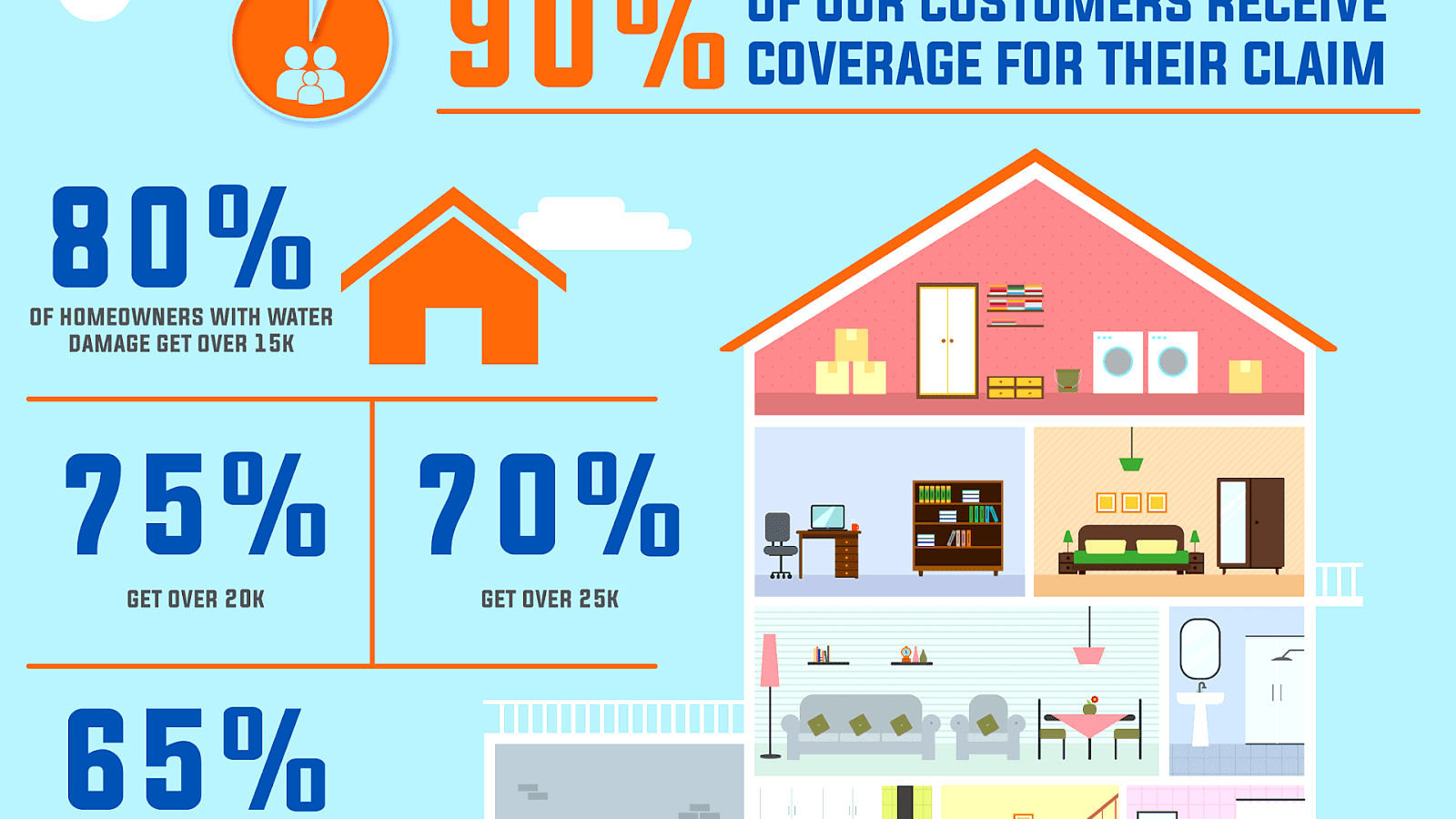

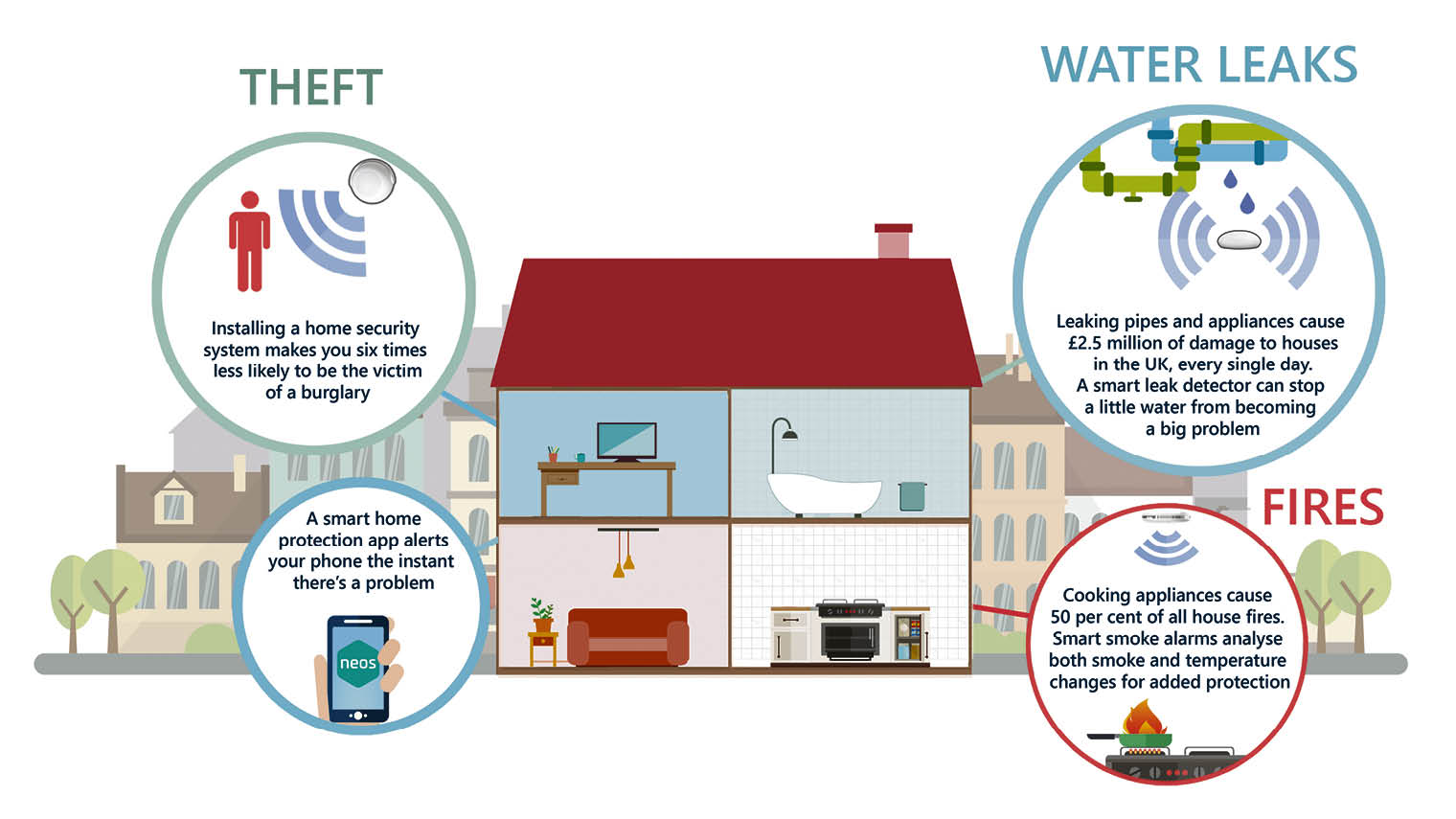

Claims due to water damage impacts 1 in 50 homeowners each year. Some home insurance policies will cover water leaks and some won t. Whether your homeowners insurance covers water damage depends on the source of the water that caused the damage. Here are some things to keep in mind about slab leaks and a few scenarios in which homeowners insurance may and may not help provide coverage.

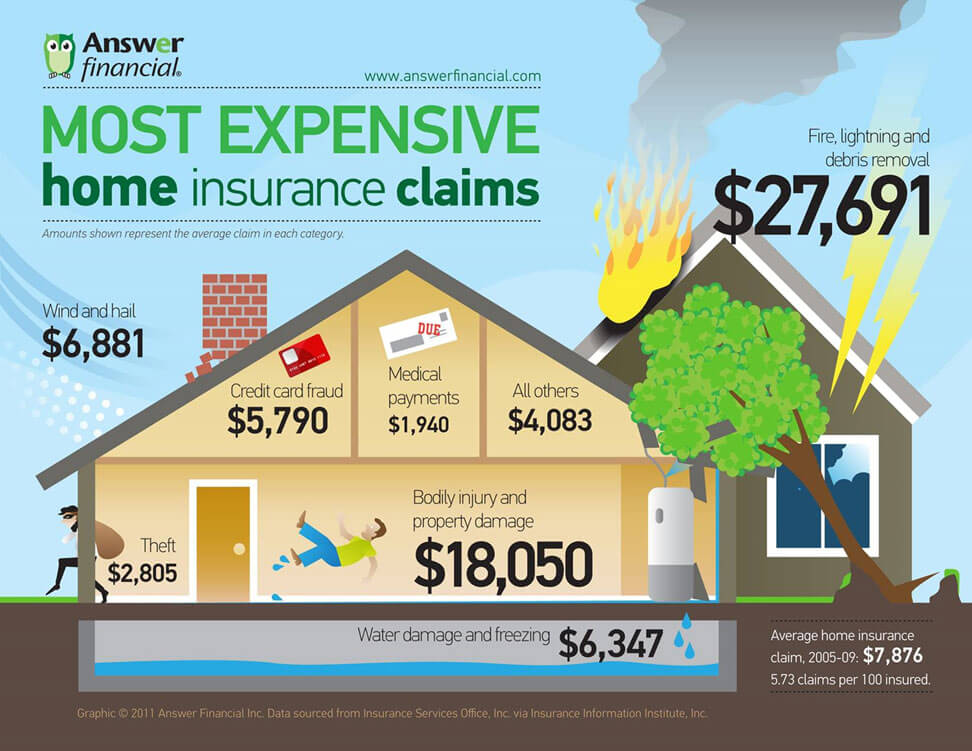

According to the insurance information institute homeowners insurance may help pay for repairs if for instance your drywall is drenched after your water heater ruptures or an upstairs pipe bursts and water saturates the ceiling below. Water damage is one of the most common causes of home insurance claims according to the insurance services office iso water damage claims are the second largest frequent insurance claim following wind and hail damage. However most home insurance policies exclude damage to your home that occurred gradually such as a slow constant leak as well as damage due to regional flooding. The answer rests on the cause of the water leak.

Yes if you have the right cover. Here are three instances in which your homeowners policy will not provide coverage. Plus you may also have to claim for damaged furniture curtains or carpets on your contents insurance. For example your homeowners insurance will likely not cover water damage that is the result of.

The short answer is that homeowners insurance might cover some leaks and not others. Most homeowners insurance policies help cover water damage if the cause is sudden and accidental. A water leak in your home is disruptive and downright irritating. And you could find yourself with a hefty bill after the leak is dealt with if you don t have adequate cover in your buildings insurance.

The effect on your no claims bonus. The hidden water leak can result from wear and tear deterioration corrosion or rust from your home s internal systems. Maintenance problems that have not been attended to. Your homeowners insurance policy should cover any sudden and unexpected water damage due to a plumbing malfunction or broken pipe.

Your policy should fully cover you should you suffer from wind or rain damage associated with a storm.

:max_bytes(150000):strip_icc():format(webp)/how-to-handle-water-damage-claims-3860314-FINAL-5ba50164c9e77c0082224c9c.png)