Google Tax Avoidance

Multinationals such as google amazon and starbucks have been criticised by the public accounts committee over tax avoidance stung starbucks plans to change its arrangements and pay uk.

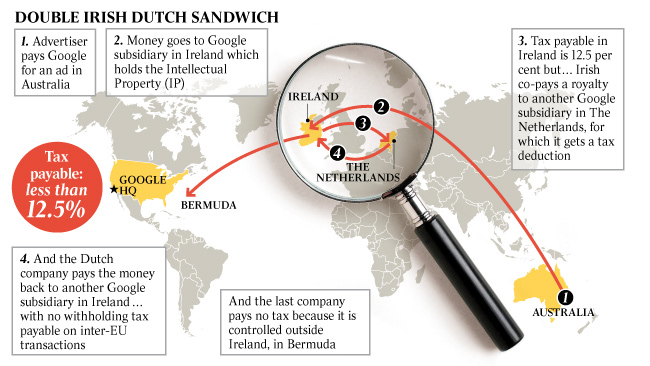

Google tax avoidance. Its submission to the parliamentary inquiry into corporate tax avoidance says google doesn t owe this country a zac. Google moved 19 9bn 22 7bn through a dutch shell company to bermuda in 2017 as part of an arrangement that allows it to reduce its foreign tax bill according to documents filed at the. Mps on parliament s public accounts committee are investigating the company s tax deal. In fact we should be thankful.

European president tells mps he doesn t know how much he s paid. A google tax also known as a diverted profits tax refers to anti avoidance tax provisions that have been introduced in several jurisdictions to deal with the practice of profits or royalties. Labour pledged to take on the scourge of tax avoidance and close down loopholes in its manifesto for the 2017 election. Google has agreed a deal with british tax authorities to pay 130m in back taxes and bear a greater tax burden in future.

Google tax is a popular term used to refer to anti avoidance provisions that have been passed in several jurisdictions dealing with profits or royalties that have been diverted to other jurisdictions with lower or nil rates. The federal government s tougher anti avoidance laws aimed at recouping more tax from multinationals saw both google and facebook previously restructure their tax affairs to pay more tax locally. The unmistakable google offices in london image.

:format(jpeg)/cdn.vox-cdn.com/assets/1290919/google__1_of_1_.jpg)