Financing Receivables

Orix leasing singapore limited can help companies to unlock the value of this asset through receivables financing.

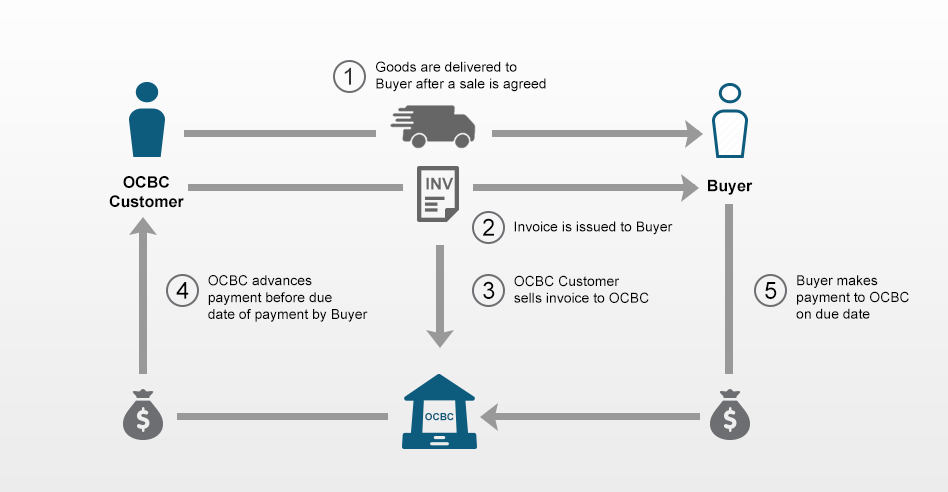

Financing receivables. When considering the different types of financing available for your business make sure to evaluate the costs and benefits of each option. Ar financing programs involve an originating company vendor and its customers buyers. Receivables finance product highlights if you are selling on open account terms and need solution on financing credit protection or collection check out our receivables finance options. Because selective receivables finance stays off the balance sheet it does not impact debt ratios or other outstanding lines of credit.

This type of arrangement is referred to as accounts receivable financing. Receivables or accounts. Receivables finance is part of a sound treasury strategy that reduces customer credit risk and provides faster access to cash. Gscf services programs based on accounts receivable ar of companies.

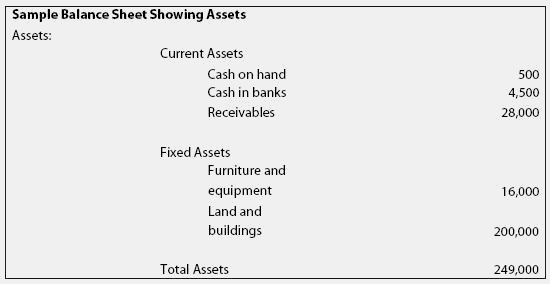

A company s accounts receivables are a key asset. Extending credit to your customers is a normal part of doing business. Understanding accounts receivable financing. Financing rates are typically lower than other alternatives and this method may not count as debt based on the program structure.

Financing receivables usually fall into two broad categories which involve either the sale of receivables or a secured loan. To measure how effectively a company extends credit and collects debt on that credit. Companies with a steady stream of accounts receivables can speed up their cash flow to take advantage of immediate opportunities. Enter your company email to download turn your receivables to cash.

However when you. It is also a good way to increase revenue and build your customer base. A lender in receivables financing decides to extend credit to a business usually based only on the receivables assets. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables.

These programs can be financed by a third party funder and might include credit insurance coverage.