General Liability Business Insurance Quotes

Get free quotes for general liability business insurance.

General liability business insurance quotes. General liability insurance gl often referred to as business liability insurance is coverage that can protect you from a variety of claims including bodily injury property damage personal injury and others that can arise from your business operations. Protection in the event of physical injury or property damage to a third party. Because general liability insurance is the cornerstone of your coverage it always needs to be considered first and foremost when you are reviewing your coverage needs. General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees.

General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. Includes medical payments legal representation and defense against libel and slander accusations. General liability insurance costs vs average claim costs.

Get the best general liability insurance quotes online. Business general liability insurance. Like any small business owner independent contractors can be sued and held liable for customer injuries customer property damage or advertising injuries. 1 fortunately including general liability in your policy can help protect your small business and save you money in the long run.

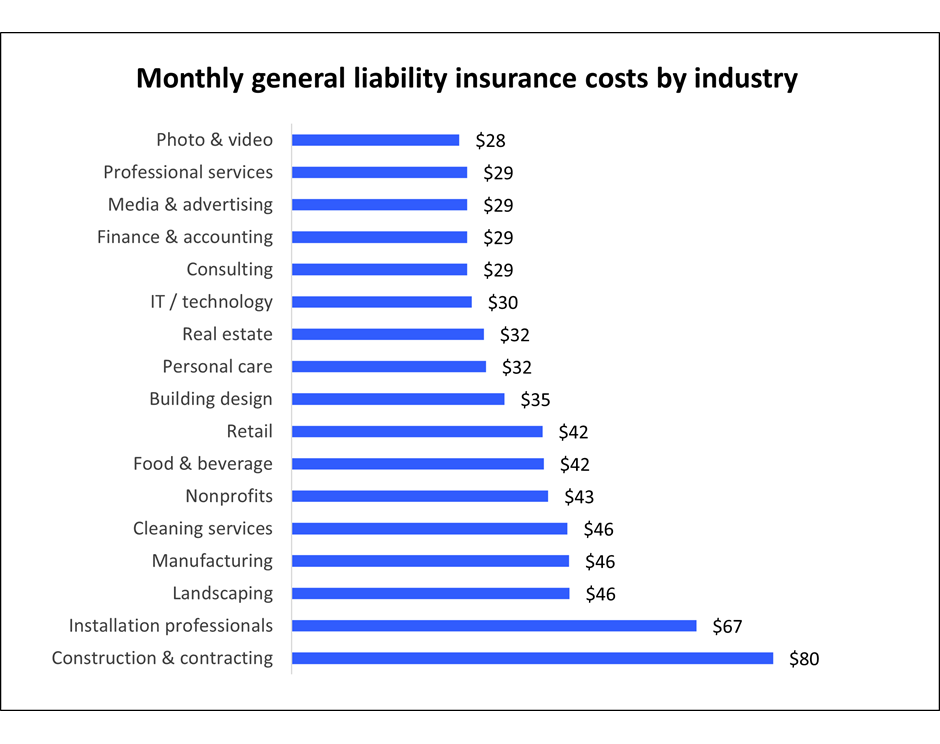

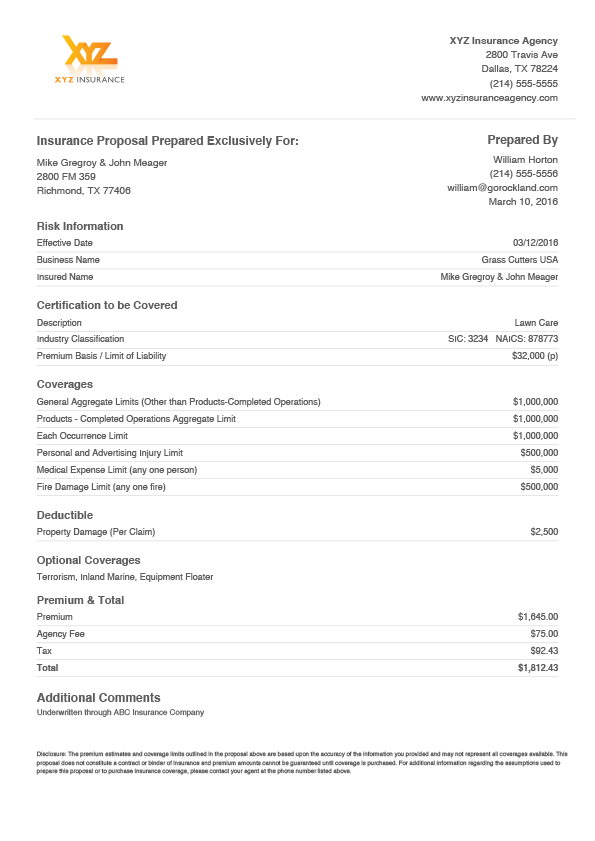

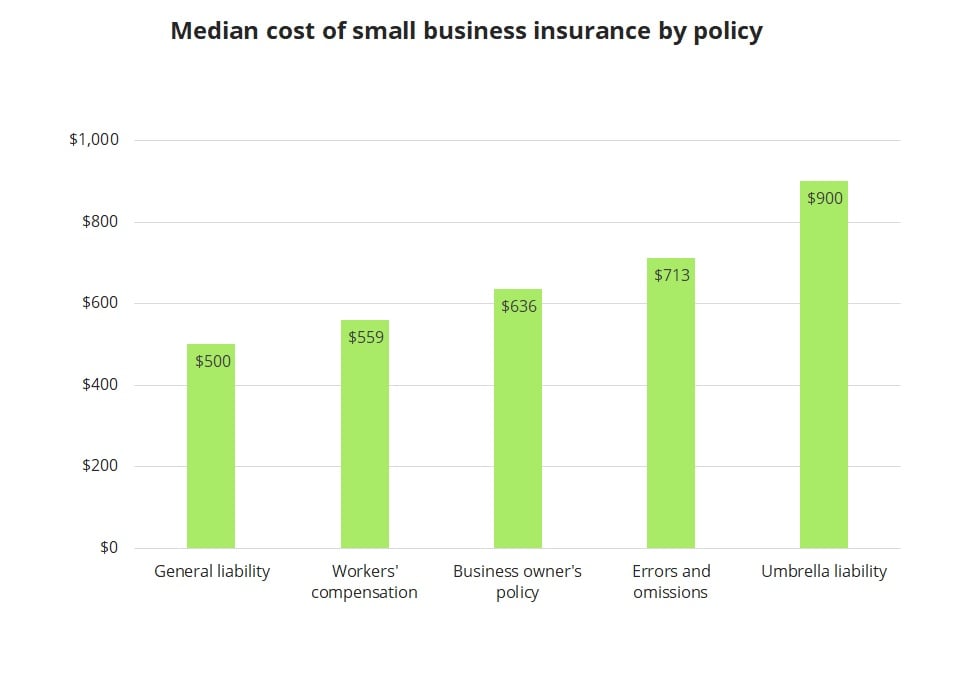

General liability insurance quotes usually include. Costs vary depending on your risk but most small businesses pay between 400 and 1 300 per year for coverage. Policies for general liability insurance are affordably priced however your quote will depend on the size and type of your business where your operation is located your previous claims history and loss experience among other factors. Factors that will be focused upon include.

The average cost of a slip and fall claim is 20 000. While contractors who don t have a physical location or expensive equipment probably don t need a business owner s policy or commercial property insurance they will still benefit from general liability insurance. Without business liability insurance your business may have to pay for all the costs related to a liability claim. General liability insurance can be purchased by itself or bundled together into a business owners policy also known as a bop.

It s a simple reality that anyone who comes into contact with you or your employees while you re conducting business can file a claim or lawsuit against you for any number of reasons from physical injuries to wrongful termination. What you will pay for general liability insurance depends on the amount of risk that your business poses for the insurer.