Credit Card Application Household Income Or Individual

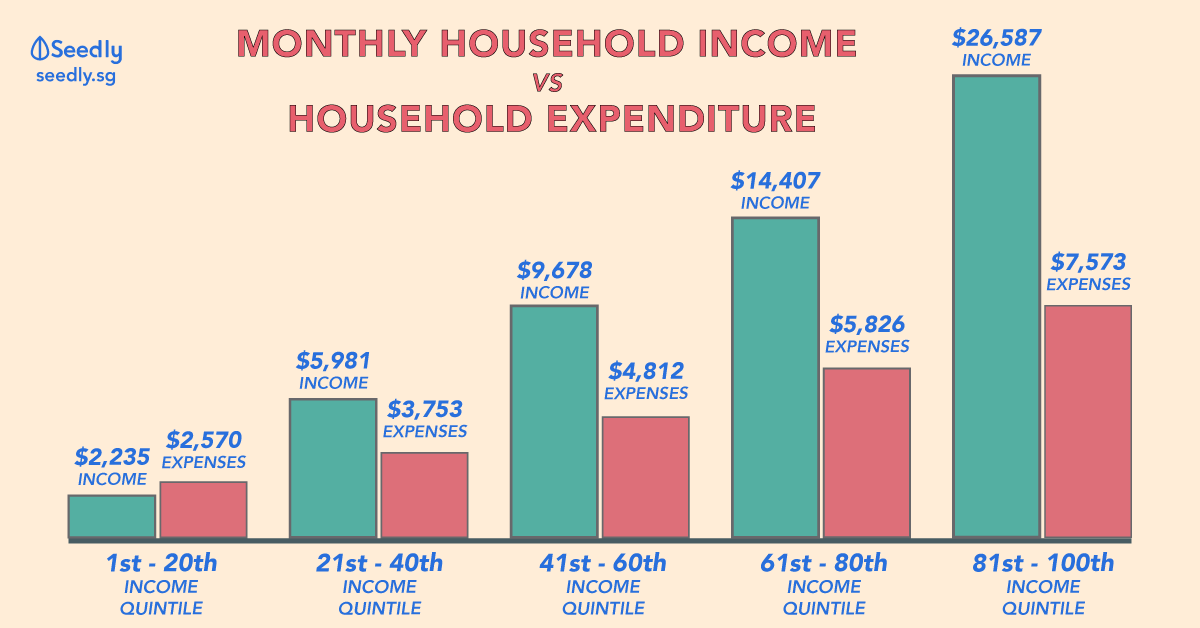

Since you are sharing access to bank accounts with your partner you can report the combined total of your incomes as income on your credit card application.

Credit card application household income or individual. However you can add an authorized user or a guarantor later. The income you report on your credit card application is one way creditors decide how much credit they should extend to you if any. Personal income income from a spouse gifts or allowances trust fund or retirement distributions scholarships and grants and social security income. When you apply for a credit card the card is either for you or your wife so the answer would be no.

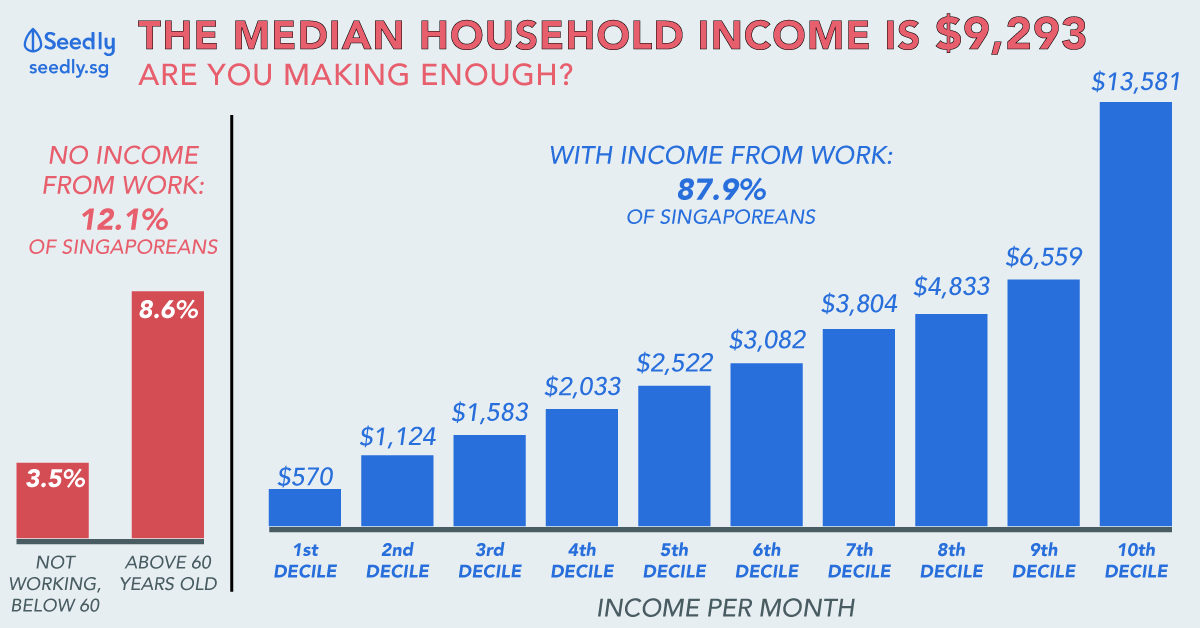

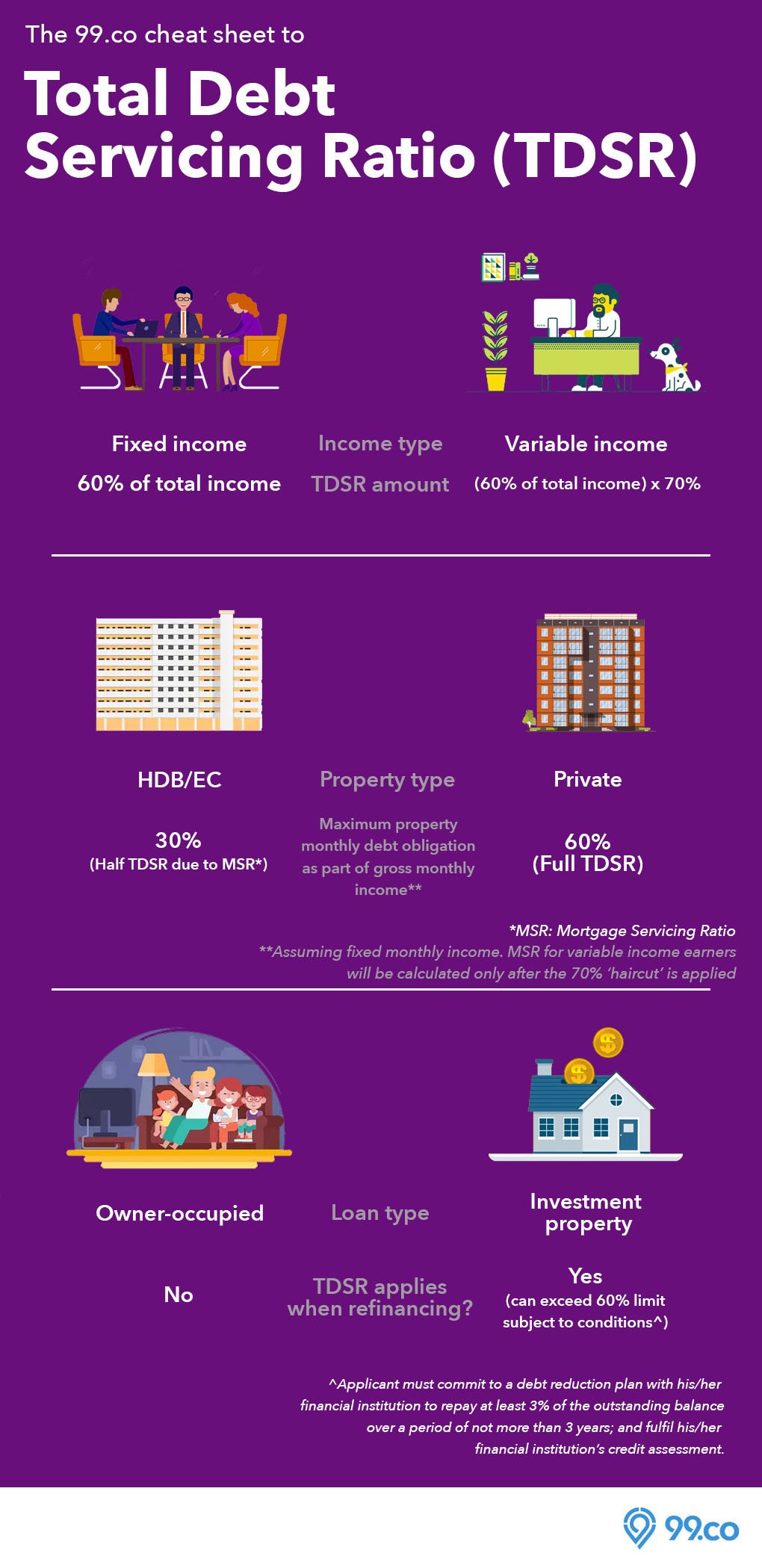

The cfpb says people with a dti of more than 43 can t qualify for a mortgage for example although this doesn t apply to credit cards there is no specific dti value for credit card approval. It can also include nonwage income such as savings trust fund distributions unemployment compensation and others. For those age 21 and older according to an amendment to the card. In addition to your income credit card issuers may ask for the balances of your checking and savings accounts the amount of your monthly housing payment and the name and phone number of your employer.

According to the cfpb the objective was to allow stay at home applicants to include their household income when applying for a credit card. This can include income from a spouse partner or other member of your household. Household income under this amendment can include. Photo courtesy of shutterstock.

By taking the time to add up all of these potential sources of income and including the total on your credit card applications you can avoid this common mistake and increase the chances of being approved for your next card.