Home Equity Line Of Credit Maximum Amount

The minimum heloc amount that can be converted at account opening into a fixed rate loan option is 5 000 and the maximum amount that can be converted is limited to 90 of the maximum line amount.

Home equity line of credit maximum amount. Today most companies will limit the loan to value for home equity loans combined at around 90 percent. Even though the two sound the same a heloc is not the same thing as a home equity loan. The maximum home equity loan amount you can get depends on what your home is worth. The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65 of your home s purchase price or market value.

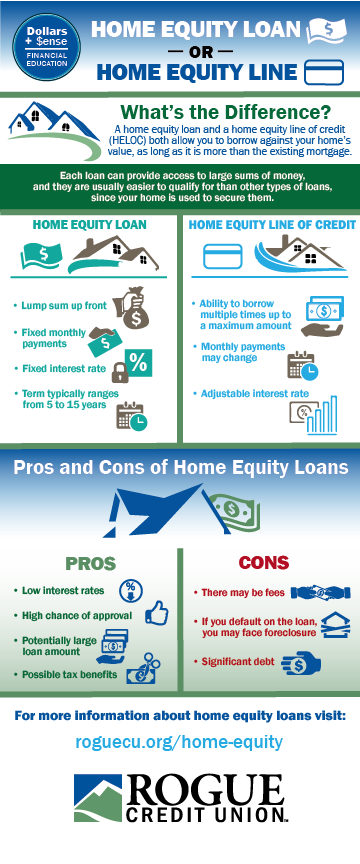

A home equity line of credit or heloc is a combination of a home equity loan and a credit card. You ll get a percentage of that worth for your first and possibly second mortgage. A home equity loan is more like a traditional mortgage in that you borrow a specific amount and make fixed monthly payments over time. When considering a home equity loan or credit line shop around and compare loan plans offered by banks savings and loans credit unions and mortgage companies.

With a home equity loan the lender advances you the total loan amount upfront while a home equity credit line provides a source of funds that you can draw on as needed. A home equity line of credit or heloc is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time rather than an upfront lump sum. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage. A home equity line of credit or heloc pronounced he lock is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the collateral is the borrower s equity in their house akin to a second mortgage because a home often is a consumer s most valuable asset many homeowners use home equity credit lines only for major items such as education.

Like a credit card it gives you a borrowing limit which you can access as needed or go without. The minimum loan term is 1 year and the maximum term will not exceed the account maturity date. Home equity line of credit vs home equity loan. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100.

The maximum amount of your home equity line of credit will vary based on the value of your home what percentage of that value the lender will allow you to borrow against and how much you still.

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)