General Liability And Property Insurance

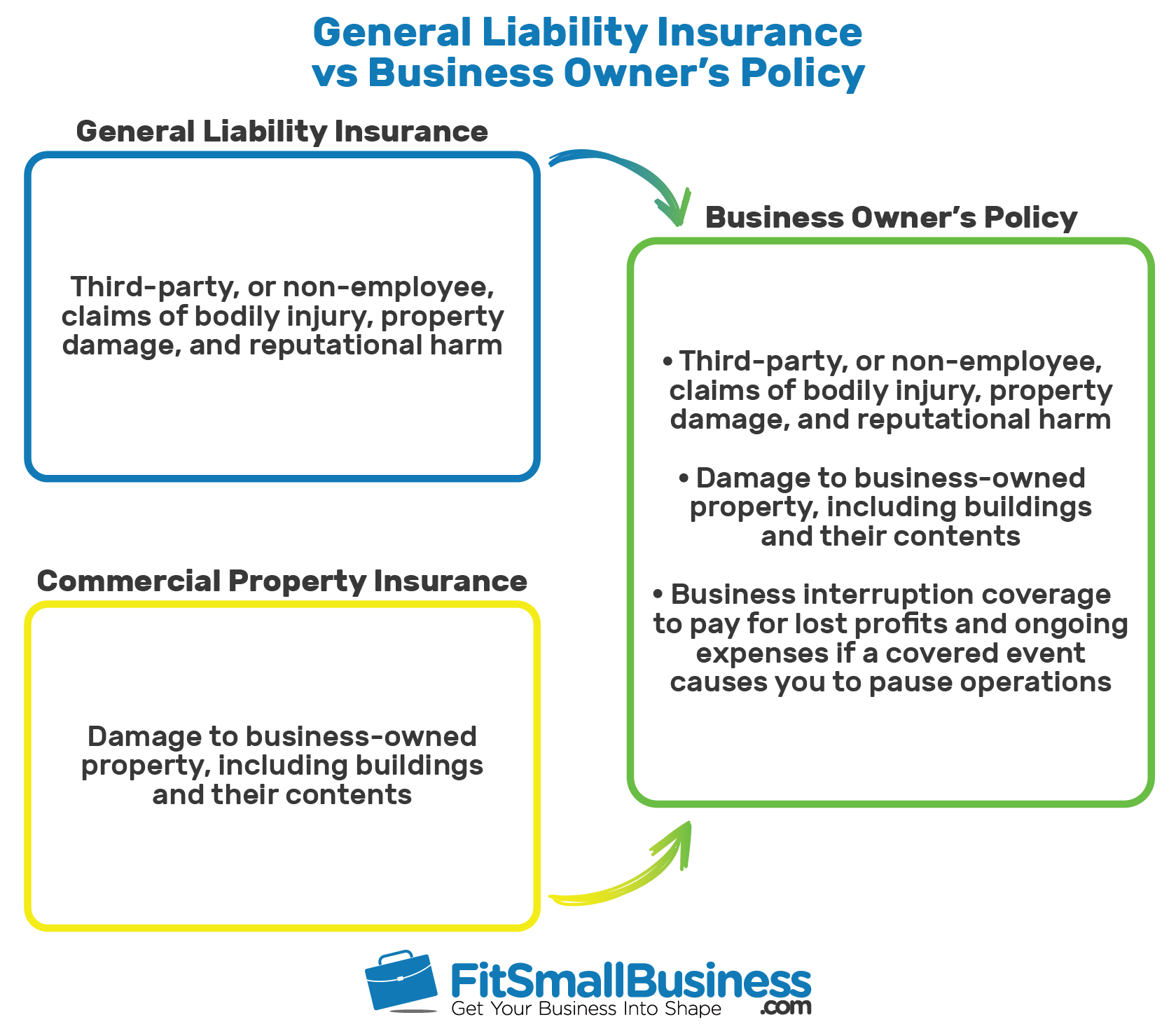

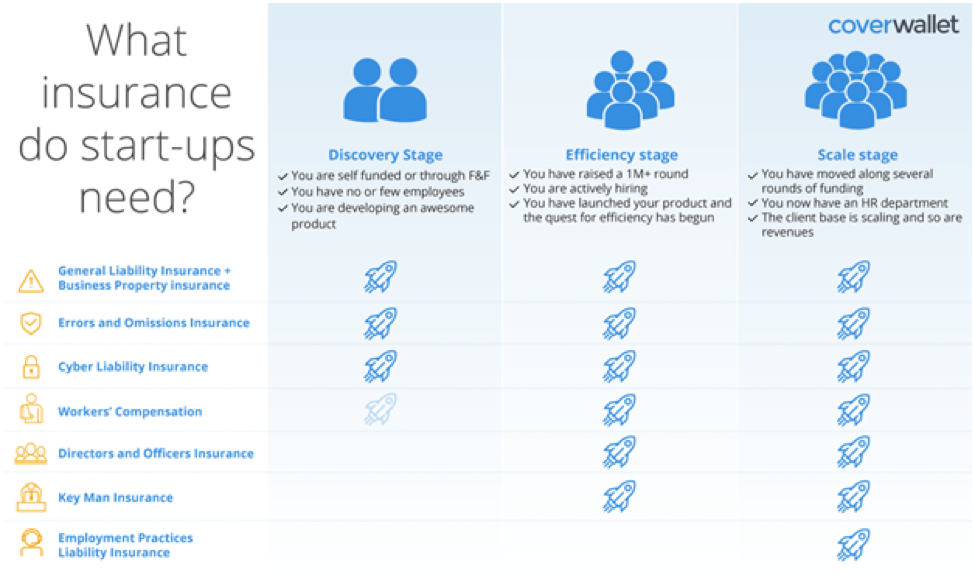

General liability insurance gli also known as commercial general liability cgl insurance can help protect your business if someone sues you for causing property damage or bodily injury you can get this insurance as a standalone policy or bundle it with other coverages in a business owner s policy bop.

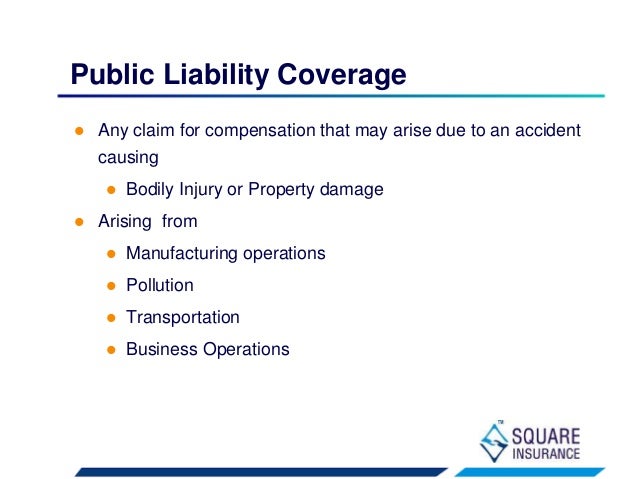

General liability and property insurance. Dedicated to the insurance needs of business owners. For more information please call us or complete the online quote request. Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. Most commonly a claim occurs if there is a slip and fall on the small business premises and the injured person sues.

General liability insurance can help cover medical expenses and attorney fees resulting from bodily injuries and. A general contractor backs his pickup truck into a client s fence. Business owner s package a business owner s package includes both general liability and property insurance coverage. General liability insurance can cover expenses to repair or replace customer property accidentally damaged by a business.

A commercial general liability insurance policy is generally triggered when a small business or its owner is sued because another person is injured or somebody else s property has been damaged. Someone could sue your small business for a variety of reasons including personal injury property damage professional mistakes and oversights and unfair hiring practices. Depending on policy limits general liability coverage can pay for some or all expenses associated with replacing the damaged fence. From startup companies to those with years of experience and for risks small and large we make it easy for you to obtain the right insurance coverages.

Property general liability insurance. Liability insurance and property insurance provide different types of coverage and both policies are necessary to protect a small business. Also known as business liability insurance general liability insurance protects you and your business from general claims involving bodily injuries and property damage almost every business has a need for general liability insurance. Commercial general liability cgl is a type of insurance policy that provides coverage to a business for bodily injury personal injury and property damage caused by the business s operations.