Errors And Omission Insurance Policy

Generally any business which offers advice or provides a service needs an errors and omissions policy.

Errors and omission insurance policy. Errors and omissions insurance e o. Nna notary errors and omissions insurance will absorb the costs of claims and lawsuits resulting from the notary s unintentional errors up to the policy limit. Errors and omissions insurance also known as e o insurance and professional liability insurance helps protect you from lawsuits claiming you made a mistake in your professional services this insurance can help cover your court costs or settlements which can be very costly for your business to pay on its own. Protect your business from costly mistakes.

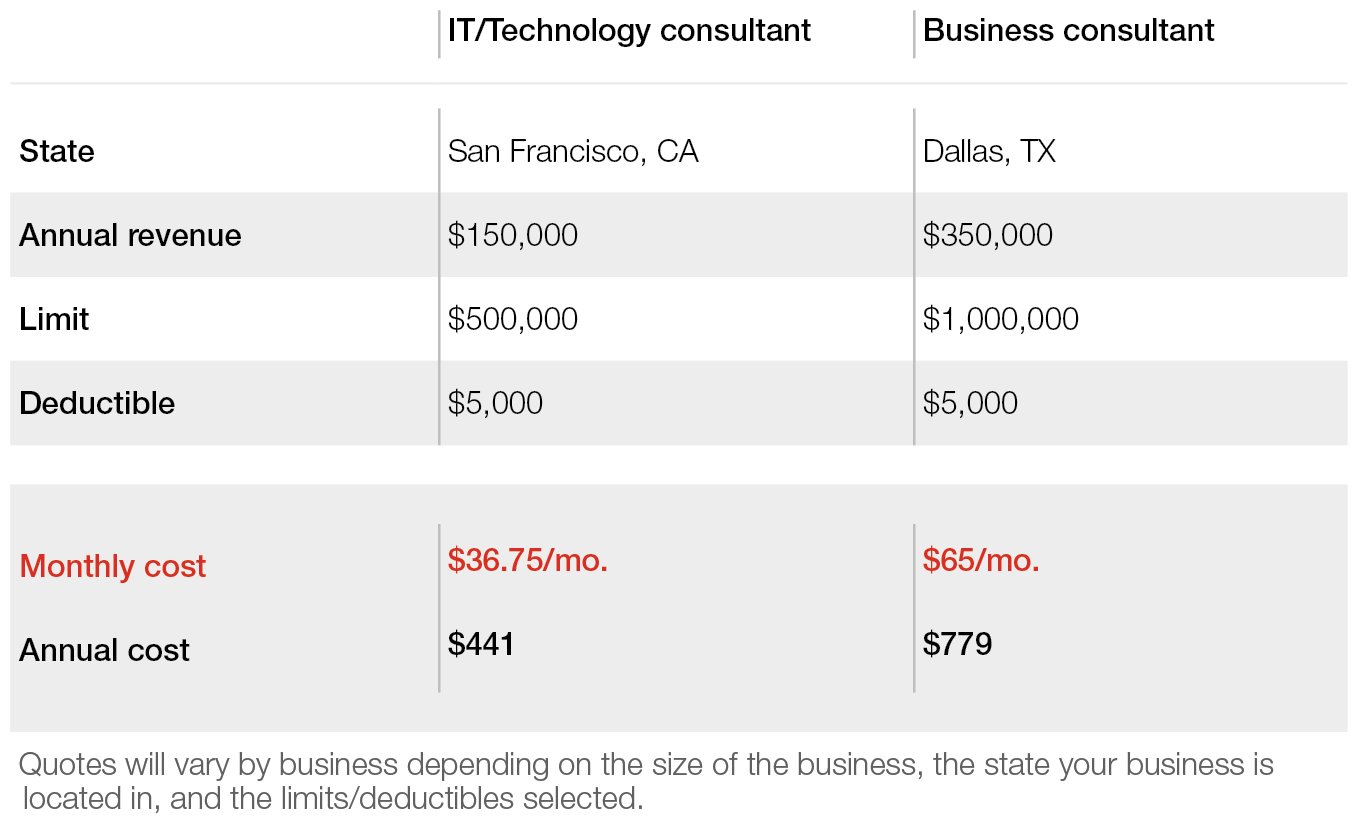

Errors and omissions insurance e o often referred to as professional liability insurance protects your business in the event you re found legally liable for faulty advice or negligence related to a professional service. Some events resulting in a loss for a client may have occurred several years in the past and the first time the mistake is apparent is when a court summons arrives in the mail. As a professional operating in today s increasingly litigious environment you could easily be subject to allegations by unhappy clients who may feel they ve been harmed by your actions or inactions. While you ll find different names for errors and omissions insurance e o this policy covers the same type of lawsuits in every industry.

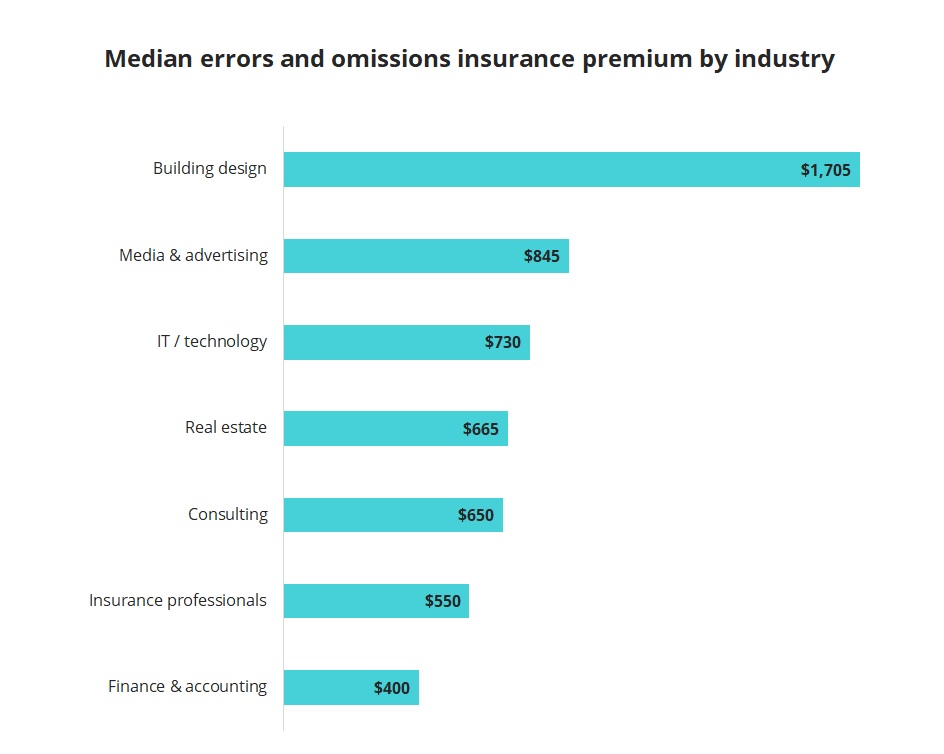

Errors and omissions e o insurance which may exclude negligent acts other than errors and omissions mistakes is most often used by consultants and brokers and agents of various sorts including notaries public real estate brokers insurance agents themselves appraisers management consultants and information technology service providers there are specific e o policies for software. Not only will e o insurance pay out damages to an injured party after a court verdict or out of court settlement but it will also absorb attorney s fees court costs and other defense costs up to the policy limit. Errors and omissions insurance e o is a type of professional liability insurance that protects companies and their workers or individuals against claims. Who needs e o insurance.

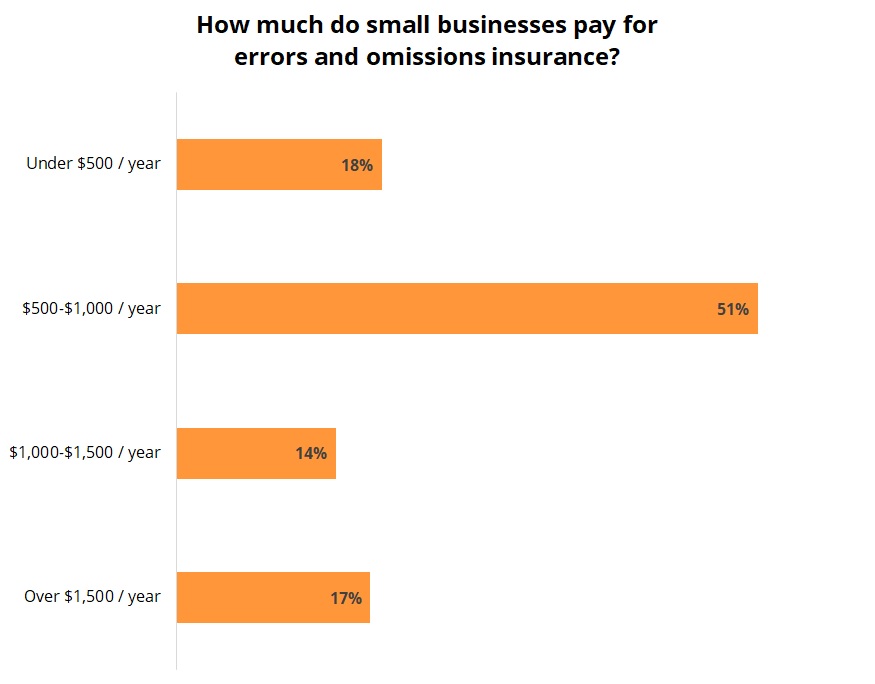

General liability covering claims of bodily injury or property damage is most likely to be used if your customers come and shop inside your store. Most errors and omissions insurance policies cover judgments attorney fees court costs and settlements up to the limits of the policy. If a customer or client sues your business over a professional mistake or oversight an errors and omissions policy can provide financial protection. Errors and omissions insurance can be customized to meet your specific needs no matter what your business or industry.

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)