Continuous Insurance

There s nowhere to hide.

Continuous insurance. Progressive auto insurance vs. Throughout its history the company has led the industry through a number of milestones including being the first company to allow customers to buy a policy online. 1 commercial auto insurer from snl financial s 2019 national written premium data. If a vehicle is uninsured the penalties are severe.

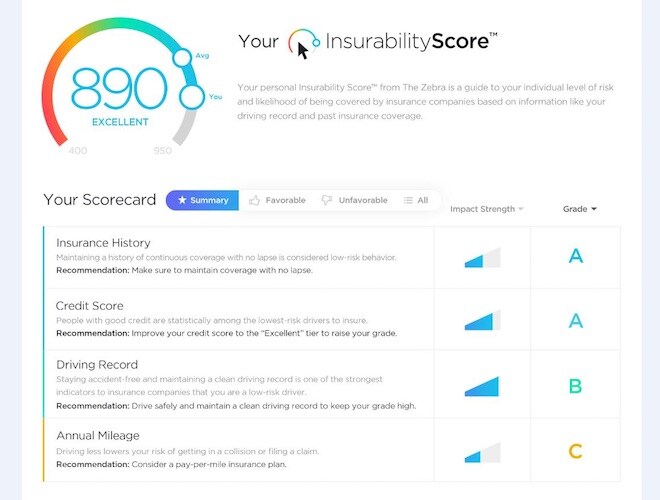

You don t have to be driving to be caught. That 30 goes to fund payments to victims of uninsured drivers made by the motor insurance bureau mib. Insurer and employs more than 41 000 people. The progressive group of insurance companies has always lived up to its name by being one step ahead of the insurance industry finding new and affordable insurance solutions.

Continuous insurance enforcement came into force in 2011. From the moment you start a car insurance quote to the purchase of your policy we re all about finding you auto insurance discounts and saving you more. The continuous insurance enforcement scheme will provide a new fixed penalty for people who ignore official reminders that their insurance has expired. This will apply to vehicles that are not declared as being off the road through sorn statutory off road notification and not insured.

If a vehicle is between registered keepers or registered as in trade with the driver and vehicle licensing agency dvla it is excluded from continuous insurance enforcement. Today progressive is the third largest u s. Drivers who save with progressive save over 750 on average. Progressive insurance company began selling automobile insurance in 1937.

Progressive was founded in 1937 on the basis of providing basic insurance that people could actually afford. Geico auto insurance in terms of average representative rates geico has a big advantage over progressive. National annual average insurance savings by new customers surveyed who saved with progressive in 2019. Geico also beats progressive s average representative rates for single females and males for the 25 year old driver profiles as well as the married adult driver profiles for women and men aged 35 and 60.

Progressive began in 1937 with the first drive in claims office became the first to introduce reduced rates for low risk drivers and then changed the insurance shopping experience by offering comparison rates on the web. Share this page on facebook share this page on twitter share this page by email share this page by email. Figure based on 2019 consumer data collected by hagerty on single car quotes with premiums 5000 and under from several daily driver auto insurance carriers.