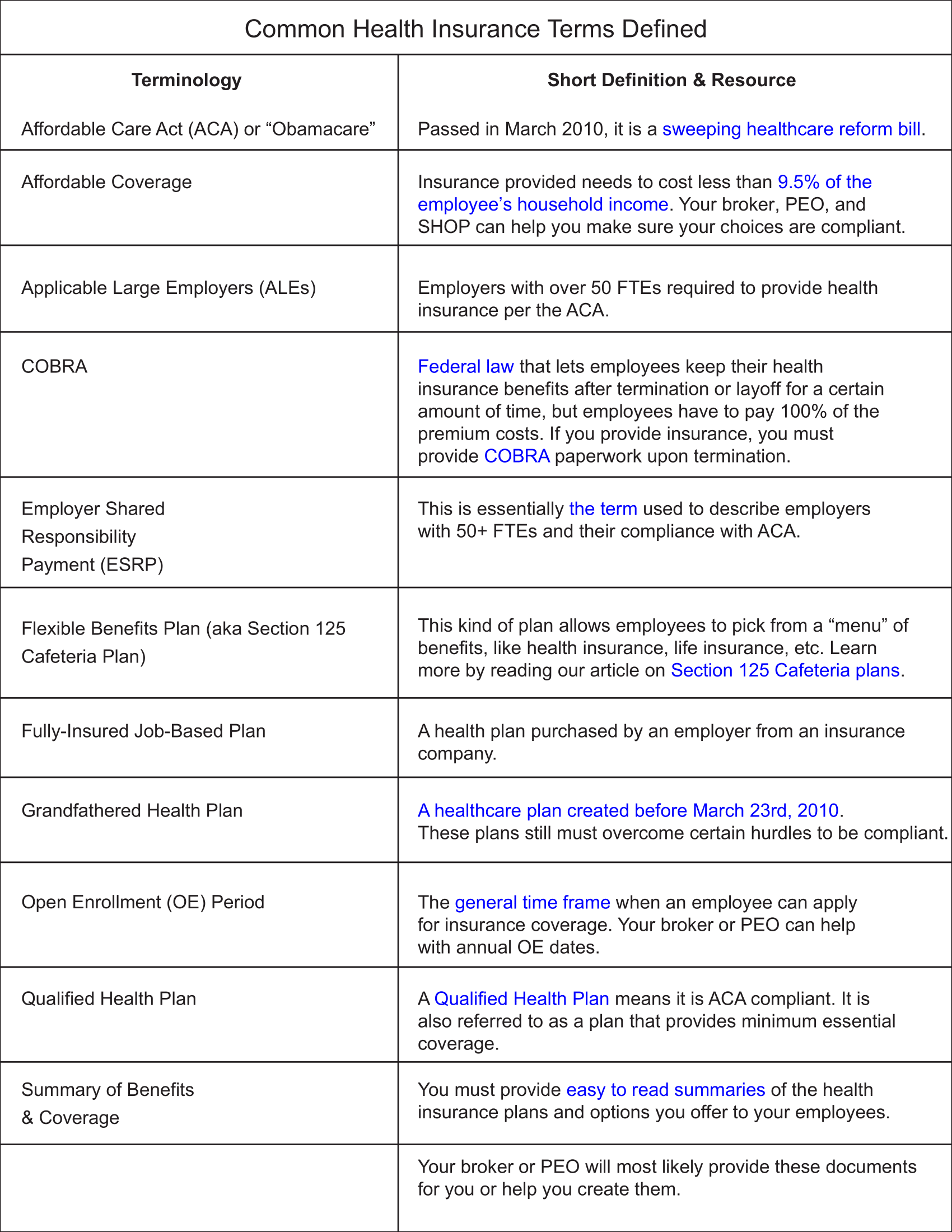

Employer Insurance Company

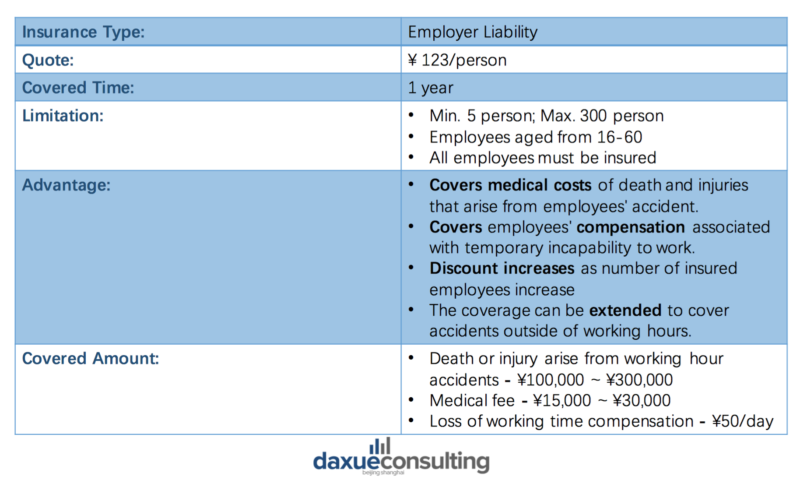

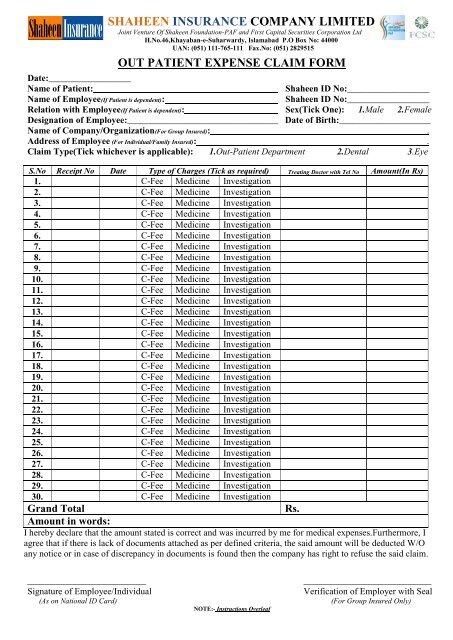

Employers liability insurance protects the employer if a worker is not covered by workers compensation or if they decide to sue the employer.

Employer insurance company. A workers compensation insurance company. It s legally required of all businesses with one or more employees. Employers liability insurance covers you and your business for compensation costs if an employee becomes ill or injured as a result of the work they do for you. A company purchases employers liability insurance.

Who needs employers liability insurance. Employers protective insurance company p o. All employees doing manual work regardless of salary level. Employers liability insurance is required by law for most businesses.

Employer who is not an investment holding company tax exempt body or service company that adopts the cost plus mark up basis of tax assessment can elect not to claim a tax deduction for the said group insurance premiums in the corporate business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. Box 859 honolulu hi 96808 808 784 3020. All employees doing non manual work earning a salary of 2 100 or less a month excluding any overtime payment bonus payment annual wage supplement productivity incentive payment and any allowance. Berkley corporation rated a superior by a.

Company profile page for bridgefield employers insurance co including stock price company news press releases executives board members and contact information. Who needs to be insured. If you are an employer you are required to buy work injury compensation insurance for.