E Trade Commission Fee

Stock trades all trades are a flat rate 0 for broker assisted trades add 25 to the total order.

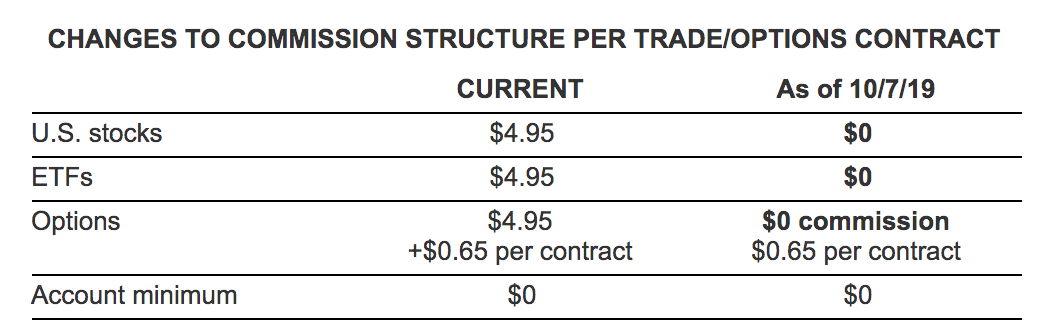

E trade commission fee. When trading during pre and post market hours an ecn fee of 005 per share is added to the regular commission rate. E trade joined rivals charles schwab and td ameritrade by eliminating commissions for its trading customers. There is no e trade monthly fee for managing trader s account no inactivity fees for ira s and there is also no per share fee. Zero is the hottest number in the online brokerage industry.

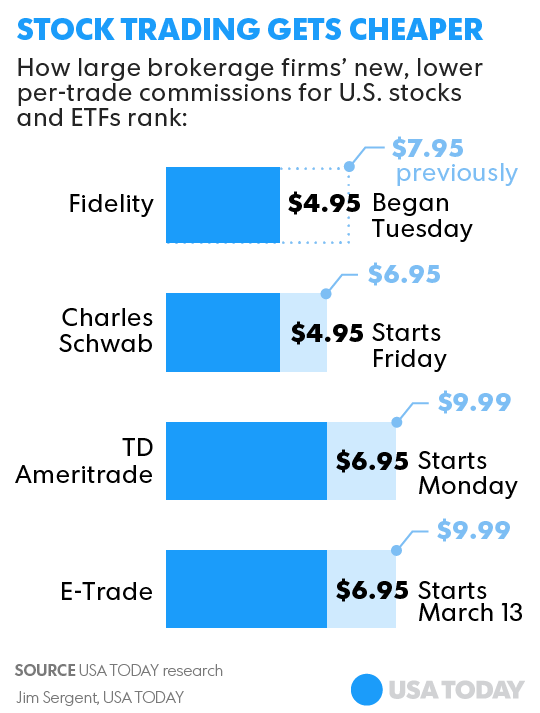

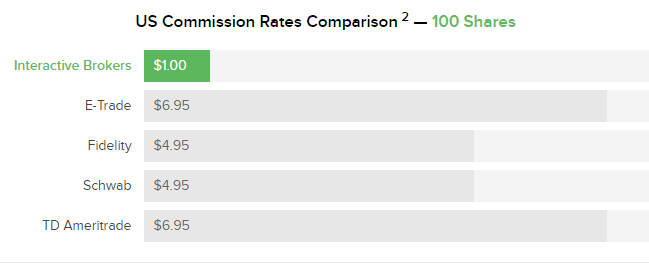

When you eventually decide to close out of your trade you will likely pay another 20 commission fee which means the round trip cost of the trade is 40 or 4 of your initial cash amount. The move comes within a week of interactive brokers charles schwab and td ameritrade all dropping their commission. Mutual funds are charged 19 99 for a transaction fee. The standard options contract fee is 0 65 per contract or 0 50 per contract for customers who execute at least 30 stock etf and options trades per quarter.

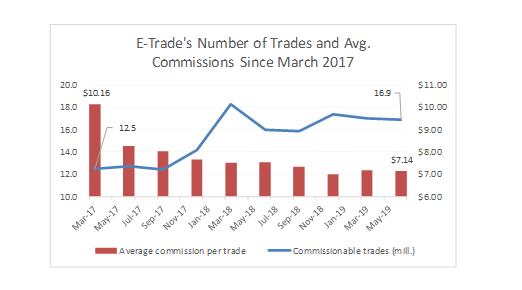

E trade fees per trade vary according to each transaction type. Stock etf and options trades. E trade charges 0 commission for online us listed stock etf and options trades. For the six months ending june 30 2019 commission revenue made up 17 7 of e trade financial corp s net revenue so this is a significant hit though not as big as td ameritrade s 32.

E trade is getting rid of commission fees on u s. E trade charges no commission for online trades of stocks etfs and options. Key facts on e trade fees. Exclusions may apply and e trade reserves the right to charge variable commission rates.

A forced margin liquidation fee occurs when e trade securities llc liquidates a position s on behalf of a customer in order to meet minimum margin account balance requirements. Closing of an account fee requires a 25 fee.