Dti For Va Loans

Ultimately if your debt ratio is too high you won t have enough disposable income to qualify for the loan.

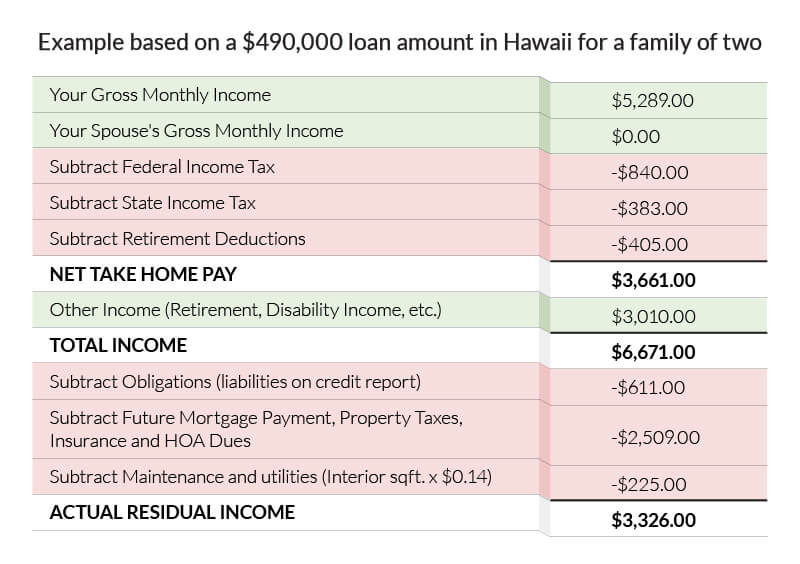

Dti for va loans. The disposable income is where lenders really focus. Even though the va doesn t put a lot of emphasis on debt ratios they do play a role. In such cases it s best to ask your lender how much loan you could qualify for under your current dti calculations and proceed from there. Generally speaking va eligible home buyers will need to have a dti of 41 or lower to get approved.

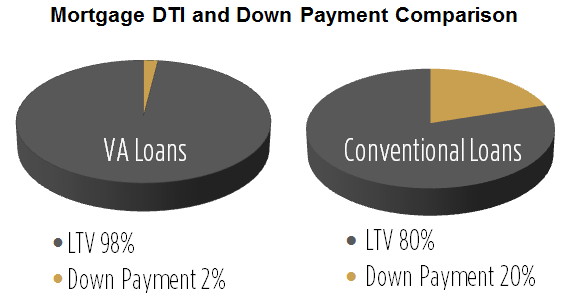

Normally the front end dti back end dti limits for conventional financing are 28 36 the federal housing administration fha limits are 31 43 and the va loan limits are 41 41. 41 percent of 8 000 is 3 280. Loan programs generally have a maximum allowable dti and it s difficult for a home buyer to get approved with a ratio of over 50. Va dti manual underwriting guidelines for high dti borrowers.

Potential military homeowners can qualify for a va home loan provided their debt to income ratio meets va and lender standards although the debt to income ratio or dti ratio is an important part of your financial history that va loan lenders examine it s only one of several va loan qualifications. There is really no set va dti manual underwriting guidelines. You can get a va loan with a dti of up to 60 in some cases. This means that there is too much debt by 387 according to va standards.

If you are applying for a va jumbo loan the cap is usually 41 percent but could differ with lenders. Some borrowers can t spare the extra waiting time for one reason or another. There s not a single set of requirements for conventional loans so the dti. Here are examples of compensating factors.

If you are trying to get approved for a va loan but have a high dti you may find it difficult. Only certain types of debts and income count toward your dti ratio. If your dti is too high when you are thinking about submitting your va loan application consider waiting a while longer to lower your balances. However most manual underwriting va loans should not exceed 55 dti.

If we divide 3 667 by 8 000 monthly income the answer is 46 or a 46 debt ratio. These are expenses like mortgages car loans student loans credit card debt and more. Va loans don t require a down payment and they often have more lenient dti requirements. In order to get dti as high as 55 or higher borrowers should have two or more compensating factors.

Calculating dti ratio for a va loan.