Does A 1031 Exchange Defer Depreciation Recapture

Visit our 1031 calculator to estimate how a 1031 exchange would work for you.

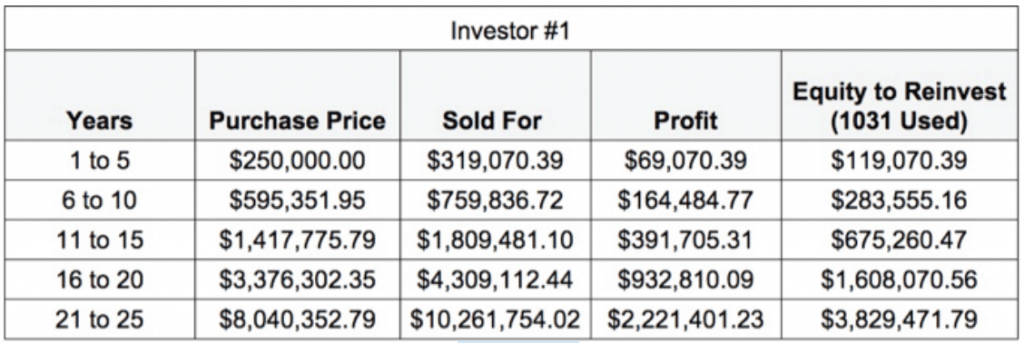

Does a 1031 exchange defer depreciation recapture. If you have questions about 1031 exchange depreciation recapture or anything regarding 1031 feel free to call me at 612 643 1031. This article will help you sort through the complex issues of depreciation and depreciation recapture and how they may affect your 1031 exchange transaction. Clients wanting to do a section 1031 exchange plan to avoid paying tax on the otherwise taxable gain. The tax bill to this investor would be 734 615.

However the irc section 1031 allows you to defer the payment of capital gain taxes and depreciation recapture if you structure your transaction as part of a like kind or 1031 exchange. The following discussion on the tax consequences of the depreciation recapture rules assumes that 1 your regular marginal income tax bracket is greater than 15 and 2 the real estate sold is the only business asset sold by you in the tax year of the sale. Depreciation you are required to deduct or write off a certain percentage of the cost of the structures and or improvements on your real property held for rental investment or use in your business as depreciation expense each year. Fortunately a 1031 exchange allows you to defer both the gain as well as the depreciation recapture so you can keep your money working for you.

However section 1031 is not the only hurdle to cross in achieving tax deferral. And you ll need to keep a running total over the years to keep track of your total depreciation. Depreciation and depreciation recapture issues are something that any investor should take into consideration when considering the plethora of options available in real estate investment as these issues can have a significant effect upon income tax as it applies to an investor s portfolio. Depreciation recapture issues in a 1031 exchange.

Therefore depreciation recapture is a significant factor in motivating an investor to participate in a like kind exchange. While capital gains tax rates are currently at historical lows tax rules require you to recapture the portion of the gain on the sale that relates to allowable depreciation over the period the asset was held. The portion attributed to depreciation recapture was nearly 135 000. Clients must also consider the impact of the recapture provisions of sections 1245 and 1250.

A 1031 exchange can help you avoid capital gains and depreciation recapture taxes but it adds.