Examples Of Insurance Companies

This is a great example of iot in insurance pushing insurers to increasingly become lifestyle companies or advisers.

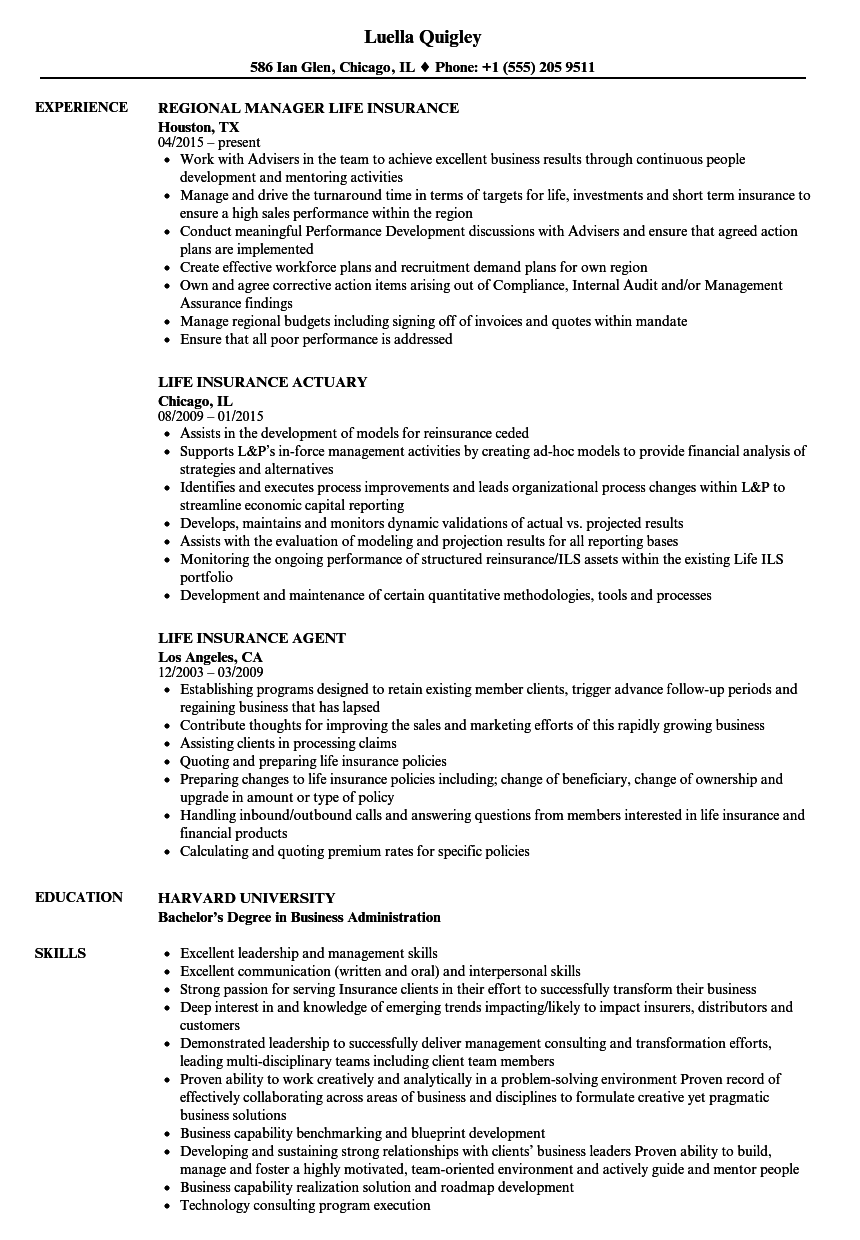

Examples of insurance companies. Here is a brief explanation of each of these different types of insurance companies and the specific specialty risks insured and other unique attributes. Insurance is a shield that protects and secures your business from any possible risks. At that time reports. For each statement i have underlined the meat of the value statement.

Insurance heavyweight john hancock was one of the first to leverage the power of wearable devices partnering with vitality to distribute free fitbits to customers so that they could track their well being. 160 million individuals are insured through employer sponsored health insurance. About 15 million individuals buy health insurance on their own. Blue cross and blue shield health insurance companies.

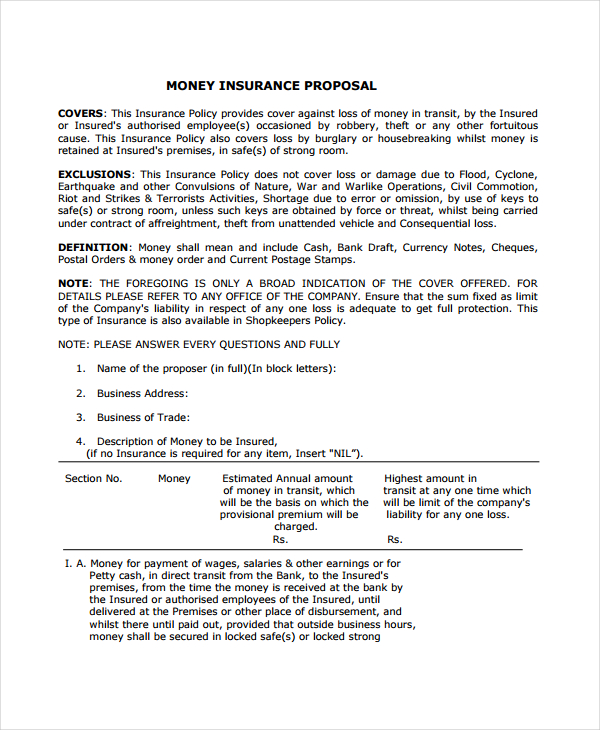

Overall insurance surveys are beneficial both to the company as well as the clients and hold the capacity to bring major changes if analyzed properly. Insurance surveys are the best mediums for the company to assess the problems encountered by the clients. Here are some the reasons why insurance policies are helpful in your business. Insurance companies are most often organized as either a stock company or a mutual company.

Some of the different types of insurance companies include. Non blue commercial health insurance. Insurance is a means of protection from financial loss. All of these terms will resonate with corporate finance people researching insurance providers.

A well known captive insurance company made headlines in the wake of the 2010 british petroleum oil spill in the gulf of mexico. Standard lines excess lines captives direct sellers domestic alien mutual companies stock companies lloyds of london and more. Private health insurance is primarily funded through benefits plans provided by employers. Insurance has proven to be useful as a shield in all the uncertainties that could happen in your business.

Protection and security and reduction of business losses. In a mutual company policyholders are co owners of the firm and enjoy dividend income based on. Examples of captive insurance companies. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

:max_bytes(150000):strip_icc()/2063610v1-5beb281d46e0fb002d7a4f2a.png)