Definition Sep Ira

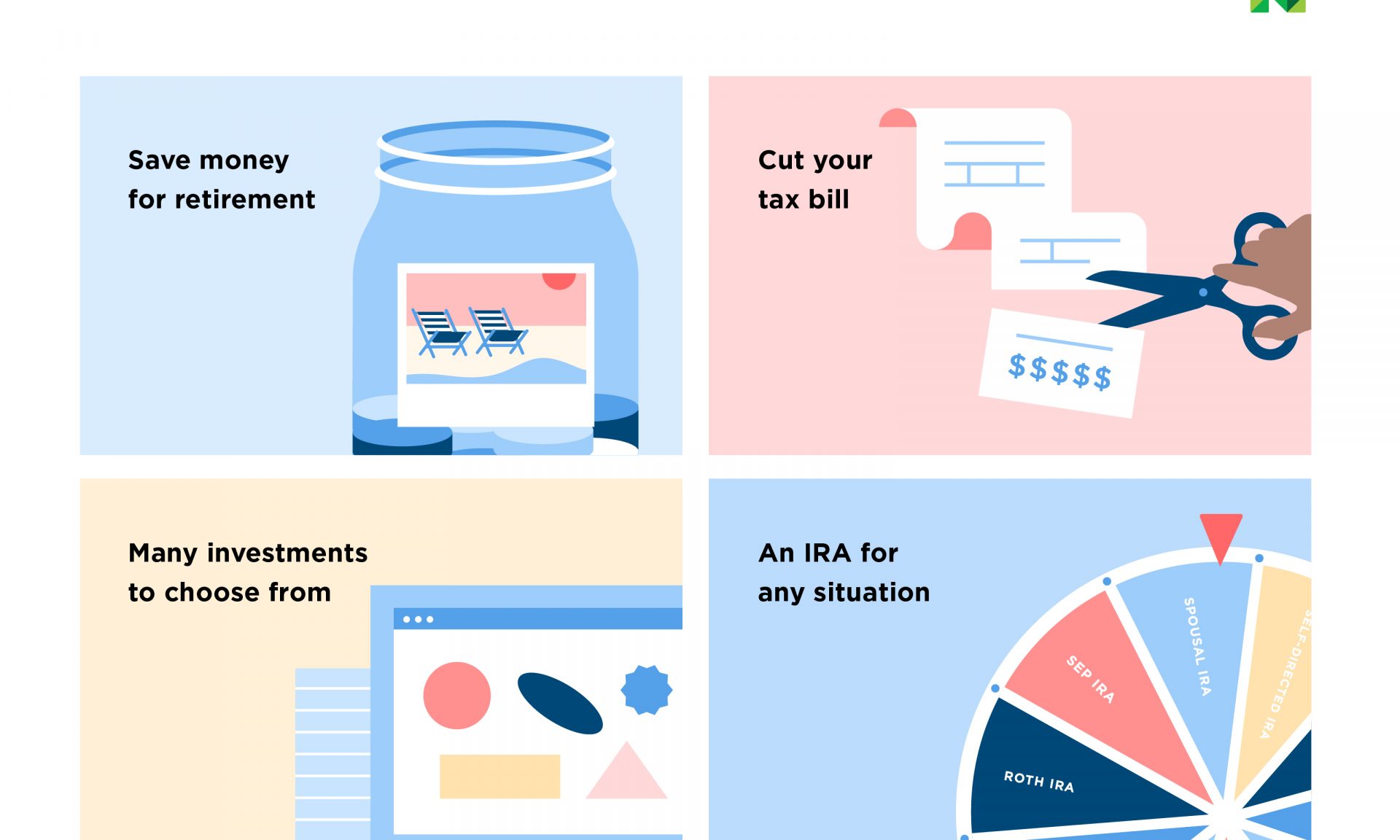

A simplified employee pension sep ira is a retirement savings plan established by employers including self employed people for the benefit of their employees and themselves.

Definition sep ira. The sep ira contribution deadline for 2021 tax year 2020 is april 15 2021. Participate in a sep plan who can participate benefits of participation plan contributions and. Choose a sep plan learn the basics of a sep plan. Sep ira pros and cons.

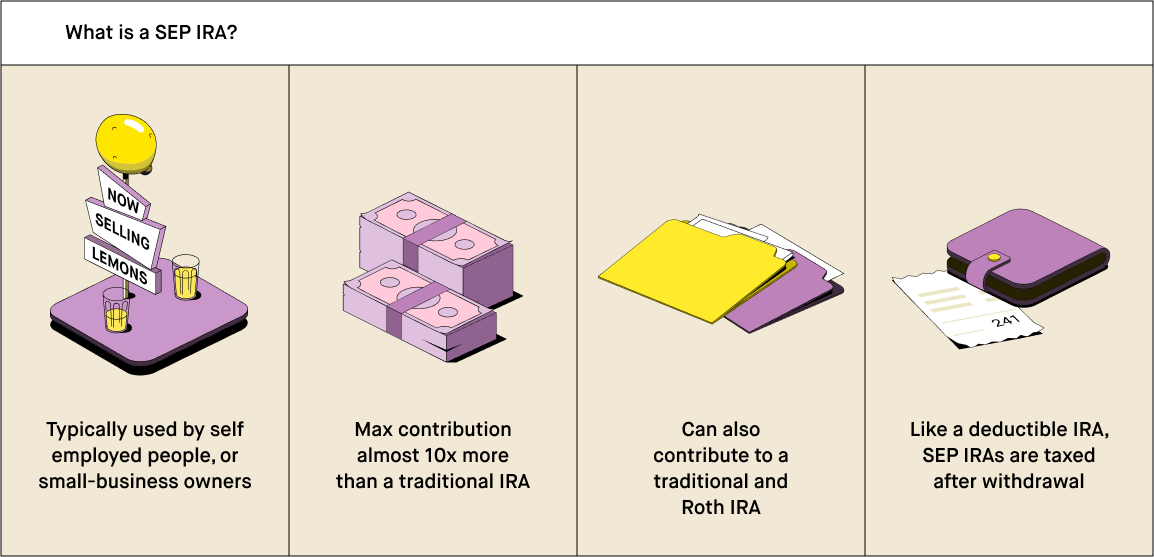

Sep iras are used by small businesses and self employed individuals. A simplified employee pension individual retirement arrangement sep ira is a variation of the individual retirement account used in the united states sep iras are adopted by business owners to provide retirement benefits for themselves and their employees. Wages tips and other compensation from the employer subject to income tax withholding under section 3401 a amounts described in internal revenue code section 6051 a 8 including elective contributions made under a simple ira plan and. There are no significant administration costs for a self employed person with no employees.

Establish a sep plan set up a sep plan. For an individual who is not self employed compensation included in determining sep contributions includes. A sep plan allows employers to contribute to traditional iras sep iras set up for employees. A simplified employee pension individual retirement account is a variation of the individual retirement account used in the united states.

A sep ira is a type of individual retirement account established by employers to which employers make tax deductible contributions on behalf of all. The sep ira contribution deadline for 2020 tax year 2019 is july 15 2020. Like most products there are pros and cons of sep iras that should be taken into consideration before opening an. A sep ira is a traditional ira that allows employers to set up a retirement account for their employees or themselves if they re self employed with relatively little effort.

Sep iras are one of many ways to save for retirement. A business of any size even self employed can establish a sep. A simplified employee pension ira or sep ira is a type of traditional ira that lets self employed people and small business owners save up to 57 000 in 2020 56 000 in 2019 toward retirement.

:max_bytes(150000):strip_icc()/iStock-512752254.kroach.IRA-7de1faaad37c4812a2221cd938a88810.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Collateralized_Debt_Obligation_CDO_Sep_2020-01-cfa91faa89b145ce859268b3b77c871b.jpg)