Debt To Income Ratio For Mortgage Refinance

A homeowner with.

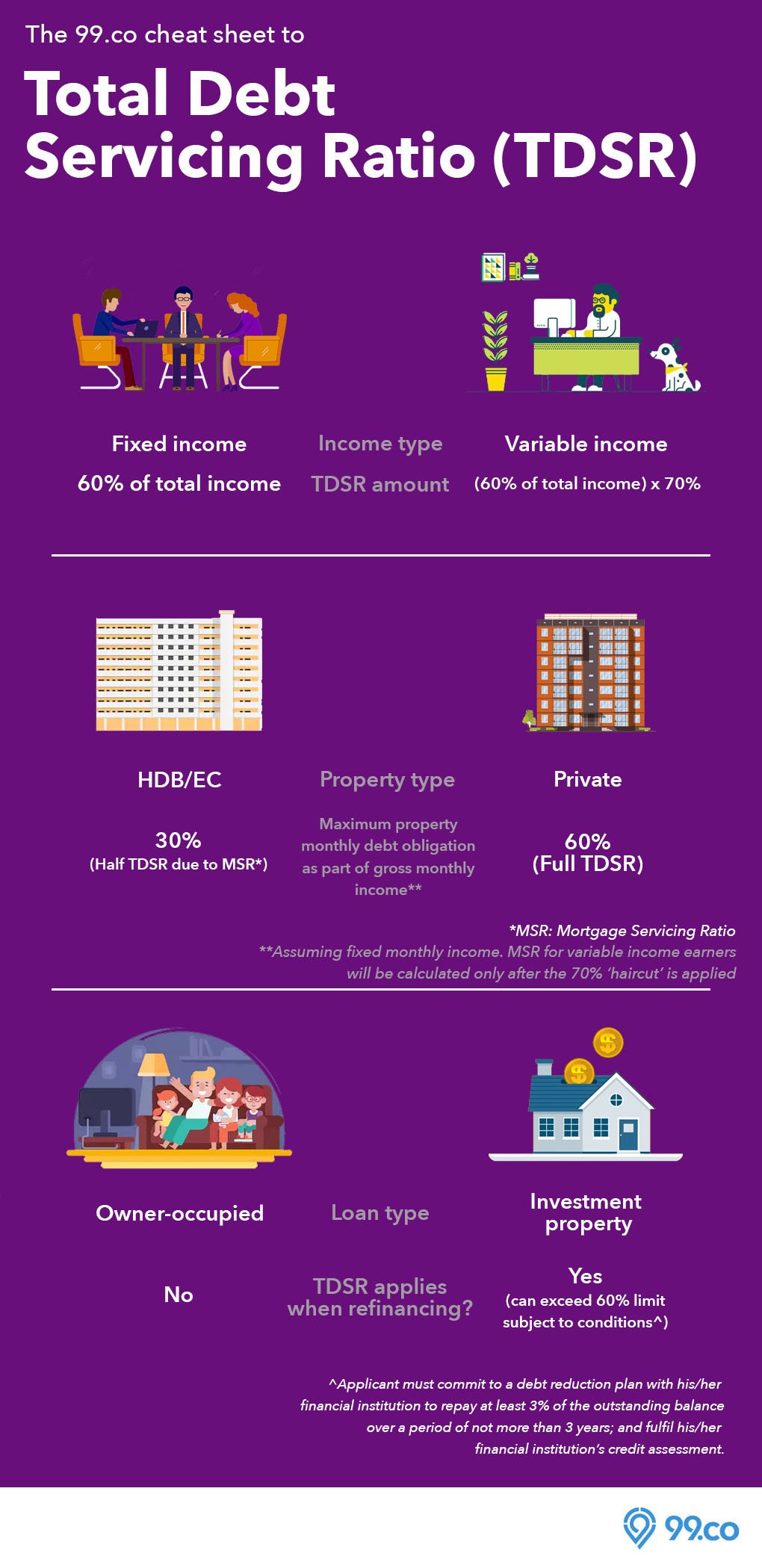

Debt to income ratio for mortgage refinance. Although under fha guidelines the maximum debt to income ratio to qualify for a home loan is 31 percent you still may qualify. The debt to income ratio is one. The 43 percent debt to income ratio is important because in most cases that is the highest ratio a borrower can have and still get a qualified mortgage. How to refinance a home with a high debt to income ratio.

There are ways to get approved for a mortgage even with a high debt to income ratio. The debt to income dti ratio is a personal finance measure that compares an individual s debt payment to his or her overall income. Your dti helps lenders gauge how risky you ll be as a borrower. The ideal debt to income ratio for mortgages.

There are some exceptions. While 43 is the highest debt to income ratio that a homebuyer can have buyers can benefit from having lower ratios. Some lenders will consider you for a loan despite a high debt to income ratio if you have a solid credit history and can show job stability over time. Refinancing student loans can actually decrease your debt to income ratio by lowering your monthly student loan payment.

In this example your debt to income ratio is 40. Suppose for instance your gross income is 5 000 per month and your debts are 2 000 per month. Debt to income ratio dti. Of course the lower your debt to income ratio the better.

Inquire about a federal housing administration fha refinance loan. D ebt to income ratio is simply the ratio of your monthly income to the amount of your debts. Try a more forgiving program such as an fha usda or va loan. Your debt to income ratio dti how much you pay in debts each month compared to your gross monthly income is a key factor when it comes to qualifying for a mortgage.

For instance a small creditor must consider your debt to income ratio but is allowed to offer a qualified mortgage with a debt to income ratio higher than 43 percent. This may be helpful for example if you want to get a mortgage to buy a home. The ideal debt to income ratio for aspiring homeowners is at or below 36.

/loan-to-value-ratio-315629_FINAL_v2-6fd1a550be4f4cd19dd4eea140143f44.png)

/DTIjpeg-5c5253f846e0fb000167ce85.jpg)