Debt Tax

Unpaid taxes always attract penalty.

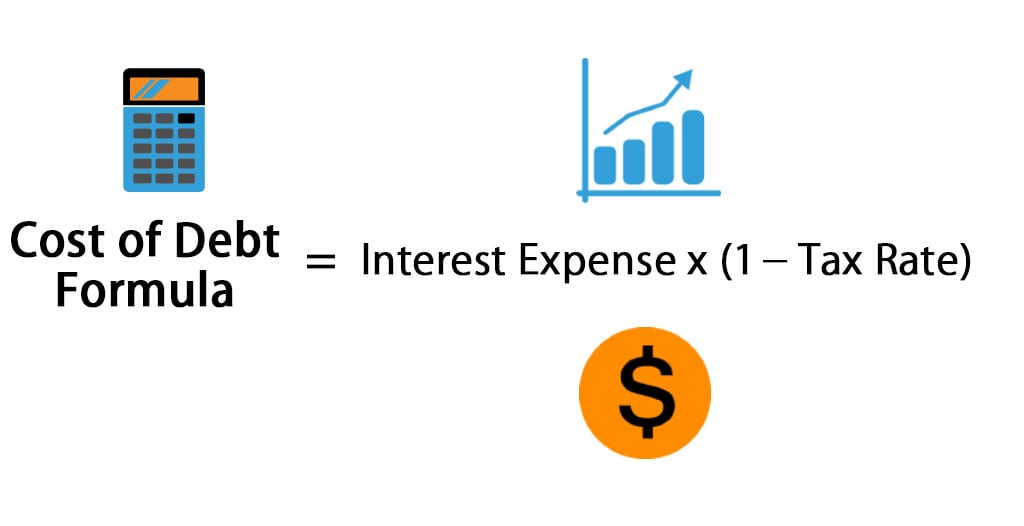

Debt tax. In the context of corporate finance the tax benefits of debt or tax advantage of debt refers to the fact that from a tax perspective it is cheaper for firms and investors to finance with debt than with equity under a majority of taxation systems around the world and until recently under the united states tax system citation needed firms are taxed on their profits and individuals are taxed. Each month the irs charges not only penalty on tax debt but also interest on the total tax debt. 3 tax treatment of business expenses q r 4 tax treatment of business expenses s z for more information on how to make tax adjustments such as adding back non deductible business expenses to arrive at the income that is chargeable to tax please refer to preparing a tax computation. The government also has the ability to garnish wages and place levies on property for unpaid tax debt.

However it would have less room for new spending in the coming years than the current government has planned with national finance spokesman paul goldsmith denying the move equates to spending cuts. We call this release. On 3 january 2020 he sold shares he had owned for more than 12 months for 20 000. At most the irs can charge 25 penalty on the total tax debt amount.

Debt associated with the failure to pay taxes to the federal or state government on earned income. Supporting your business through coronavirus. The debt is a tax related liability. Sometimes the internal revenue service will allow.

The national party has unveiled its fiscal plan for the 2020 election abandoning its original debt target and proposing a temporary tax cut to stimulate new zealand s covid stricken economy. On 1 july 2019 josef had available net capital losses from earlier years of 9 000. Taxdebts can help you work through your issues and give you the guidance you need. Officially national favours cuts of some as yet unknown description while labour favours a small tax hike.

The shares had a cost base no indexation of 7 500. In contrast to fee help tuition costs being deductible student debt under the hecs help scheme has specifically been rejected as a tax deduction under section 26 20 of the income tax assessment. Unpaid tax debt can cause stiff penalties and even jail time in the united states. In certain circumstances we can permanently remove some or all of an individual s tax debt.

If your company is experiencing financial difficulties swift action and expert support is crucial. The irs usually charges a 0 5 penalty on the total tax debt amount for failure to pay. We can only release you from payment of particular tax debts where paying those debts would leave you not able to provide for yourself your family or others for whom you are responsible. How tax debt increases with time.