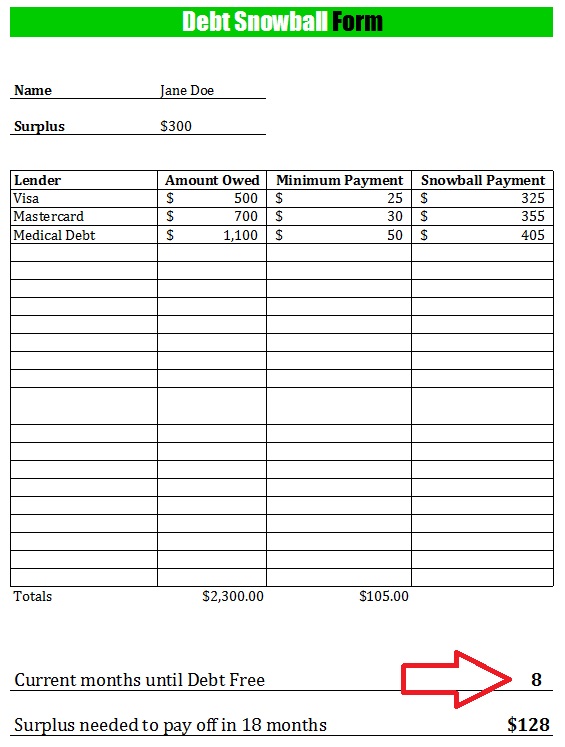

Dave Ramsey Debt Snowball Form

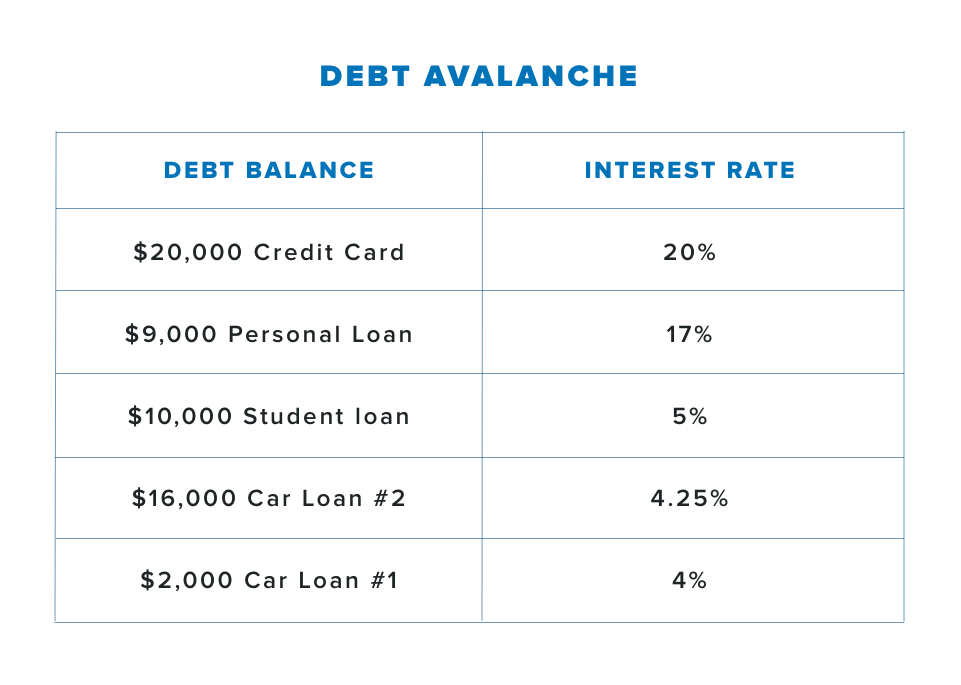

Had it been the other way around i e.

Dave ramsey debt snowball form. There are five simple steps for the debt snowball method of paying of debt. If you are not familiar with the debt snowball method then please read the steps involved in a debt snowball repayment plan. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Somewhere around the time you have half your debts paid off you ll be tempted to use the extra money to increase your monthly budget.

Dave ramsey created a free debt snowball form which you can use to keep track of your snowball progress. And while dave ramsey popularized the debt snowball method he didn t actually create it. Using the debt snowball method to pay off debt. The dave ramsey snowball concept works because it targets the lowest debt first.

What is a debt snowball. Get your debt snowball rolling. List all of your debts smallest to largest and use this sheet to mark them off one by one. This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand.

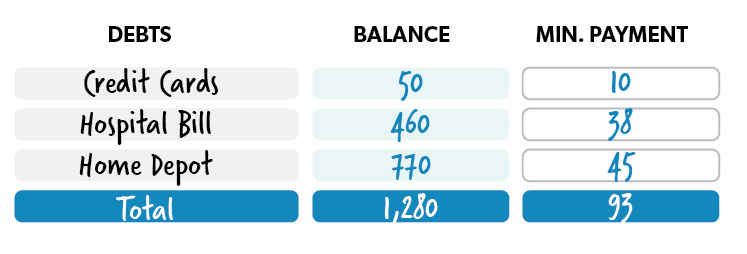

Pro rata debt list form. The debt snowball method is a way of paying off debt from the smallest to the largest debt. Use the debt snowball method to pay off credit cards student loans and more. It allows you to stay motivated by focusing on quick wins.

It happens to everyone. When my wife and i were paying off 46k of debt we actually didn t use a debt snowball worksheet but looking back i think it really could have helped us. Instructions for using the debt snowball excel worksheet on the debt snowball worksheet review and edit row 2 by entering the names of all accounts where you have outstanding debt with the account with the lowest balance first followed by the next account with. The debt snowball is the most common iteration.

We would like to show you a description here but the site won t allow us. Targeting the largest loan first john and jane would have remained stuck with a monumental amount for a long time. I first learned about the debt snowball method from reading a dave ramsey book and from his financial peace university course. When the smallest debt is paid in full you roll the money you were paying on that debt into the next smallest balance.

If you can t pay your debts in full each month this form helps you calculate how much each creditor gets paid right now. As each debt is paid off the amount paid towards the next debt grows. This is the fun one. The debt snowball method is a debt reduction strategy where you pay off debt in order of smallest to largest gaining momentum as you knock out each balance.