Credit Score Mortgage Lenders Use

If your three fico scores were 700 709 and 730 the lender would use the 709 as the basis for its decision.

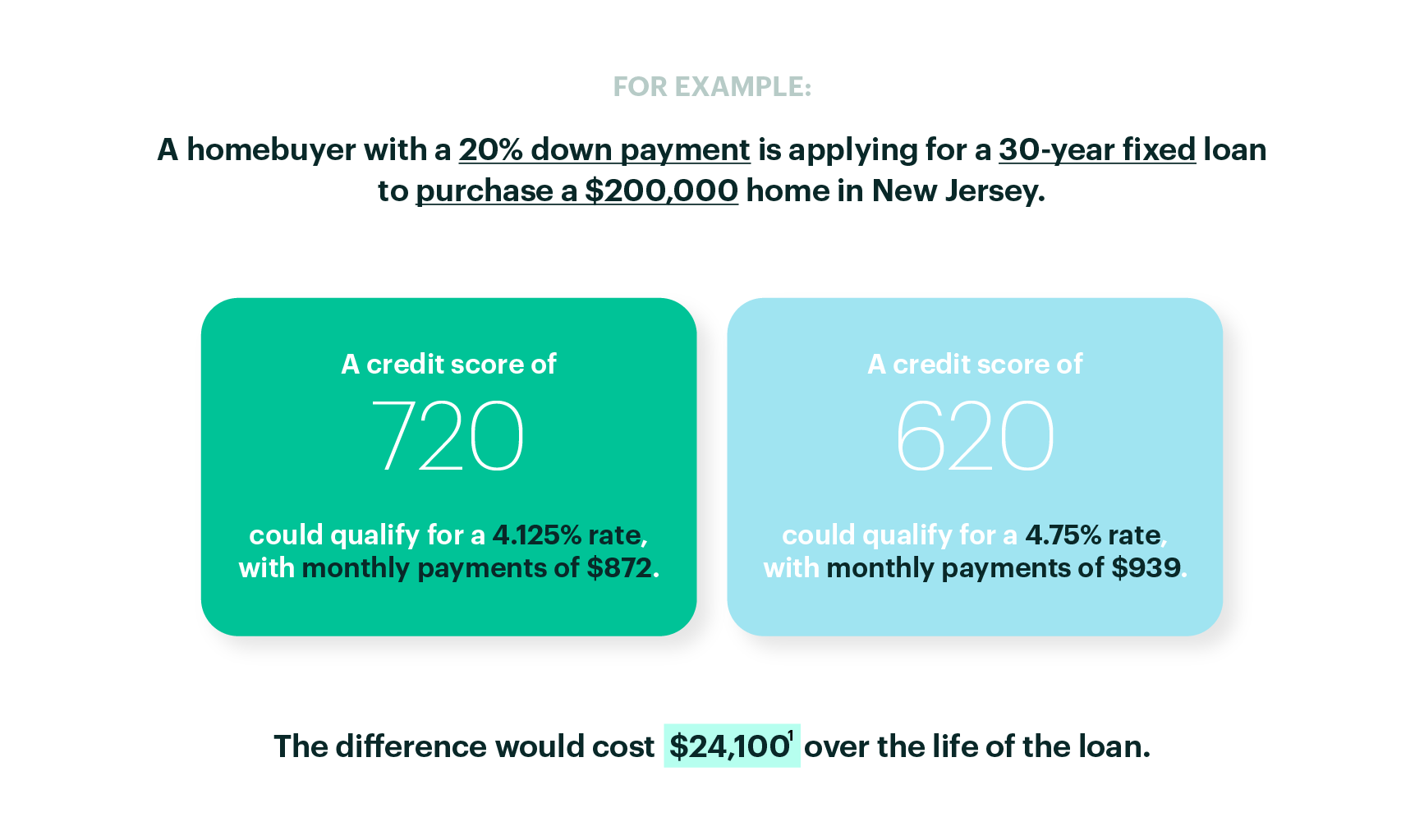

Credit score mortgage lenders use. Fico and vantagescores the two most familiar brands in the credit scoring world use different algorithms to arrive at your score. As you can see in this example using today s national rates a person with a fico score of 760 or better will pay 189 less per month for a 216 000 30 year fixed rate mortgage than a person with a fico score of 620 that s a savings of 2 268 per year. One recent mortgage applicant discovered a difference of more. Mortgage lenders typically use fico scores.

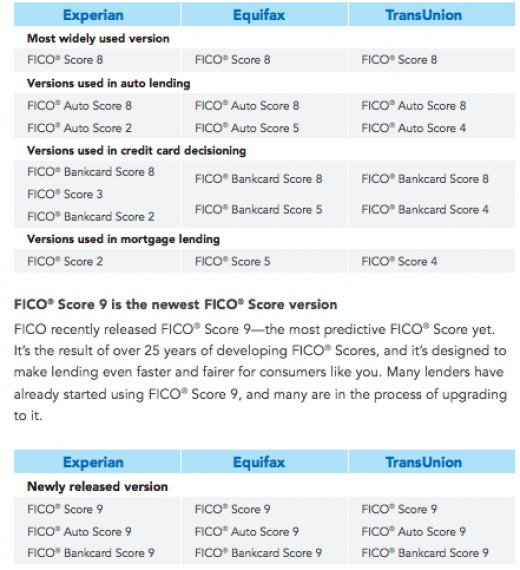

Mortgage lenders primarily use fico scores when reviewing loan applications but you have more than one fico score and lenders policies often differ regarding which version they use. Most lenders determine a borrower s creditworthiness based on fico scores a credit score developed by fair isaac corporation fico. You can see how essential it is to get your fico scores in the higher ranges if they are low and also how important it is to keep. You might be wondering why mortgage lenders use the fico model.

And in a process that only exists in mortgage lending the lender bases its decision not on your highest credit score not on your lowest score but rather on the middle numeric score.

:max_bytes(150000):strip_icc()/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png)

:max_bytes(150000):strip_icc()/GettyImages-1041512942-a2f1ac7907a5458ea2f3bef5f98cb887.jpg)

/GettyImages-1010887214-26dd25cce68e4127aedf46ec71f0c1cd.jpg)