Credit Union Business Line Of Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Inventory with advance rates determined by underwriting.

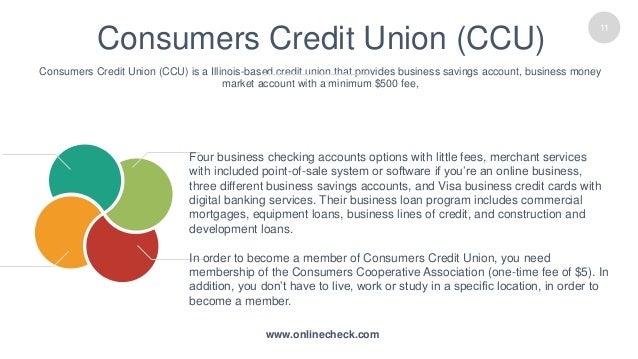

Credit union business line of credit. 1 a personal line of credit must be linked to a united federal credit union checking account. Business loans also subject to credit approval. Our lines of credit provide you with all the options you need. Business loans are limited to businesses located in md va and dc.

3 eligible collateral may include. An affordable way to tap into money when your business has unexpected expenses. 2 a line of credit transfer fee will be charged when funds are transferred by united whether by a teller or automated transfer to your linked checking account to cover an overdraft. Our business line of credit is always there when you need it whether to pay bills cover an unexpected expense or reach for the stars.

In today s business world having access to cash can be a valuable asset. An atlantic union bank business line of credit can help you cover expenses in a pinch. It can also allow you to leap at unexpected opportunities such as a supplier offering discounts. A business line of credit loc can be a great tool to keep your business healthy during times when you need some extra cash.

To help the application process applicants should bring tax returns for the business and any business owners for the previous three years entity documents and collateral information if available. Visit any educators credit union branch to apply for a business loan or line of credit. With this sort of flexibility you ll always be ready to roll. Revolving lines of credit can help you manage fluctuating cash flow for seasonal working capital and are great for short term credit needs like purchasing inventory materials or equipment financing accounts receivable debt refinance and small projects.

You can rest easy with a business checking overdraft line of credit. A line of credit offers financial stability to your. In any business unexpected expenses happen and we can help protect you as well as offer you spending flexibility. A line of credit can help you cover payroll or payments while you re waiting to get paid from vendors or customers.

1 business line of credit is a credit product and rates are based on creditworthiness. Nasa federal credit union business loan eligibility requires business membership and the establishment of the par value of one share in either a business savings account or a business checking account. 2 rates are based on creditworthiness and will vary with the market based on the wall street journal prime rate. A business line of credit also gives you the flexibility of being able to.

This is a great option if you re looking for a product to help you balance expenses that may be higher than what a business credit card may allow.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)