How Much Can I Be Preapproved For A Mortgage

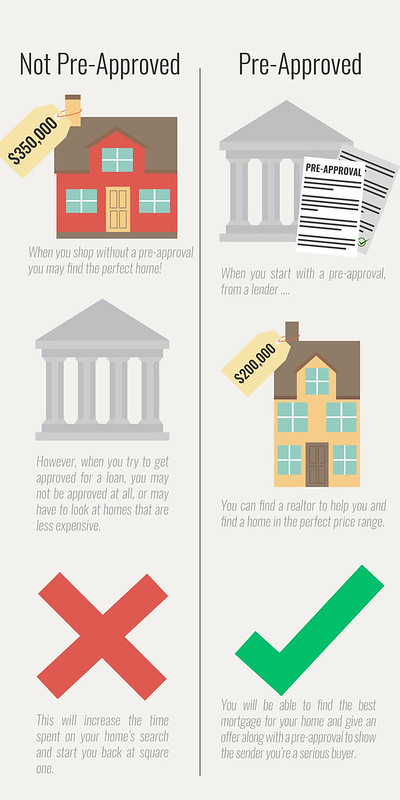

A mortgage preapproval helps you understand how much house you can afford makes you more attractive to sellers and alerts you to problems that may affect your ability to get a loan.

How much can i be preapproved for a mortgage. Lock in an interest rate for 60 to 120 days depending on the lender. Based on your income expenses and the loan you selected. With all of that the lender can make a fairly informed estimate about how much house you can afford. That s a really good question karl.

You selected an adjustable rate mortgage or arm. It does not guarantee that you ll get a mortgage loan for that amount. How much can i actually get pre approved for a mortgage. Technically what we look at is we d look at a bunch of different factors when we re looking at the.

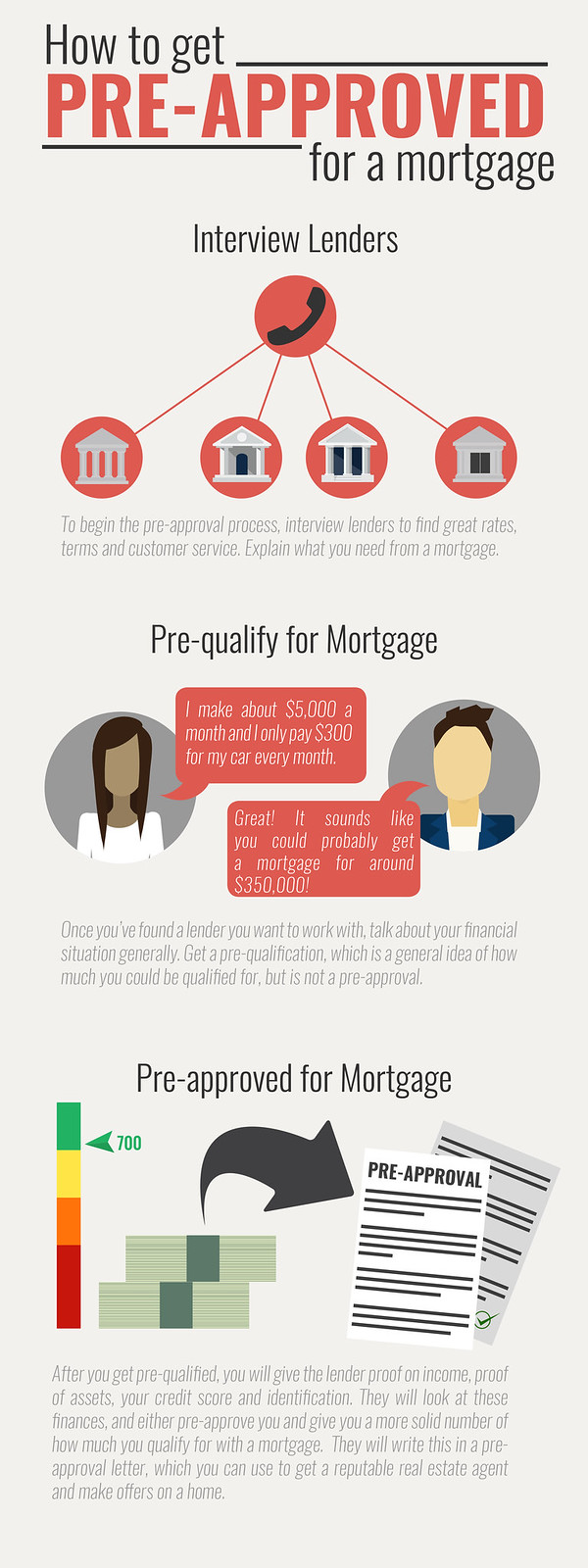

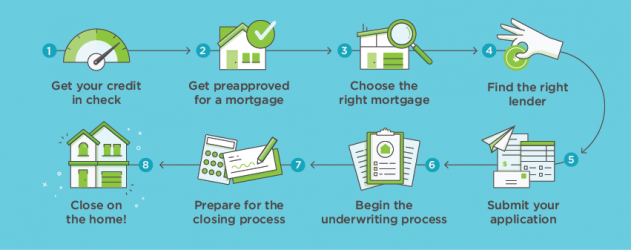

Preapproval is the process of determining how much money you can borrow to buy a home. So mo how much if i go right now 00 00 30 and talk to you or a mortgage specialist what s the maximum i can get pre approved. To get preapproved you ll need to provide your lender with documents they ll use to verify your personal employment and financial information. With a pre approval you can.

The pre approval amount is the maximum you may get. This assessment is based on things like credit score income debts and employment history. We suggest that all buyers get pre qualified or pre approved prior to starting their new home search. Your mortgage preapproval is a document that states that the lender is prepared to move.

Before you can get serious about buying a home you need to get pre approved for a mortgage which means providing a lender with these five things. Mortgage insurance expenses which you may have to pay if your down payment is less than 20 are not included in this calculation. But a pre approval is much more valuable. When you are pre approved for a mortgage it means a lender has determined how much you can borrow the loan programs that you may qualify for as well as the interest rate you qualify for.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)