How Does Refinancing Student Loans Work

Lenders that offer student loans.

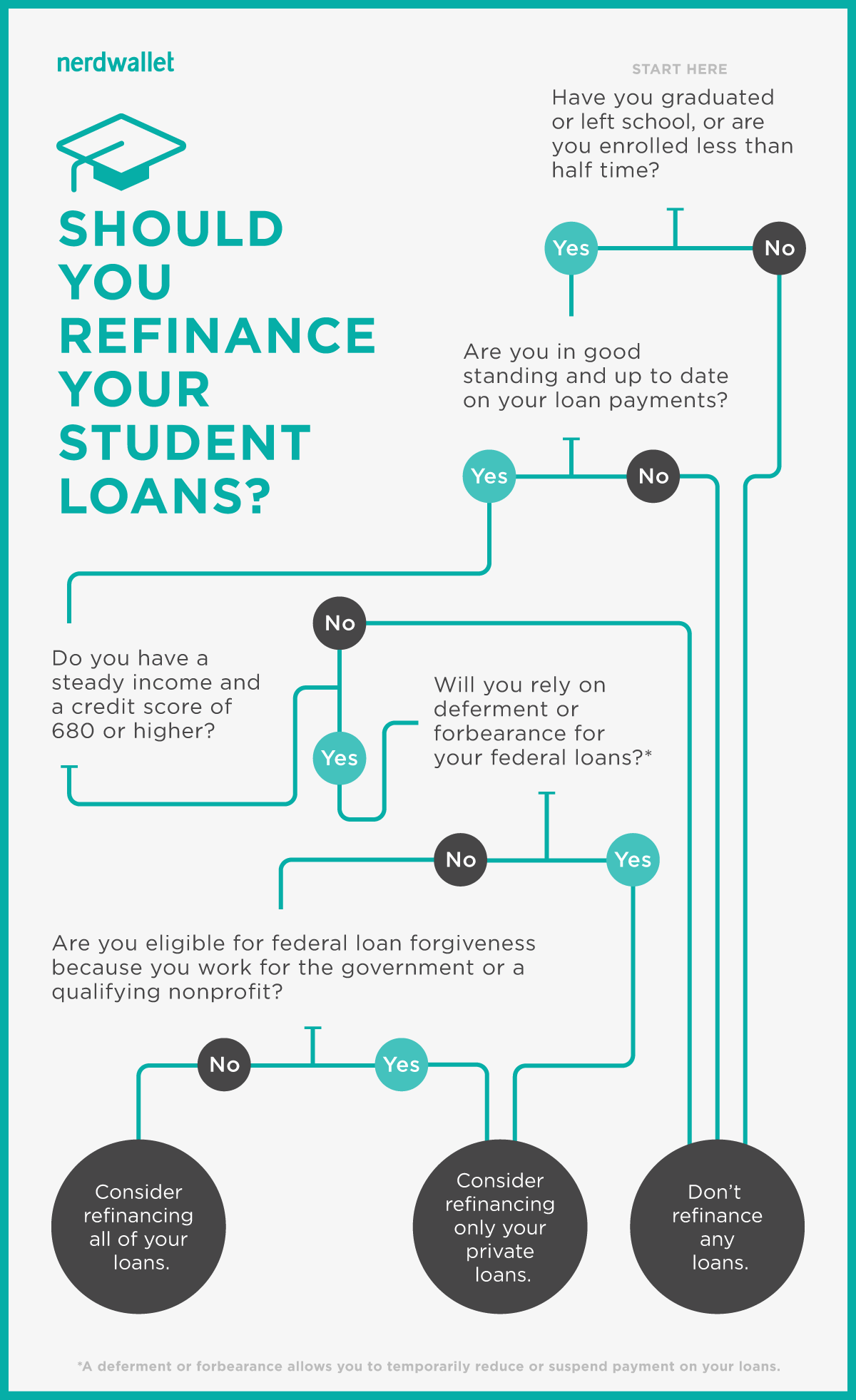

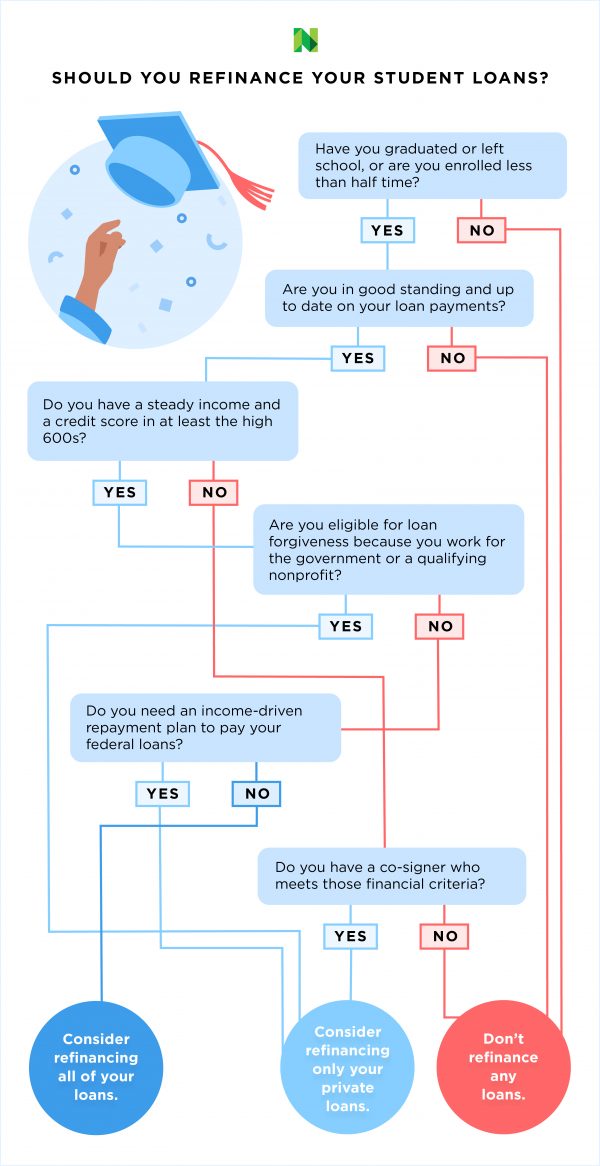

How does refinancing student loans work. Is cosigner release an option. Student loans can be a great target for refinancing. Student loan refinancing can mean big savings in the right circumstances. It might make sense to consolidate multiple other loans into a single loan if you can get a lower interest rate than what you re currently paying.

Refinancing student loans can be a great way to save money on interest and change your repayment terms to ones that work better for you. Sofi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as income based repayment or income contingent repayment or paye. With the federal reserve slashing rates and the london interbank offered rate libor at a record low you can get a low variable or fixed rate loan. A new private company typically a bank credit union or online lender pays off the student.

You d have the loan paid off in 15 less years. Here s how it works. That means lender a will lose all the interest you re paying on that loan while lender b will gain it. Do i need a cosigner.

When to refinance student loans depends on whether you ll find a rate that makes a difference in your life. But if you didn t graduate with a degree there is hope to refinance student loans. When it comes to federal student loans interest rates are determined by the federal government in relation to current economic conditions at the time the loan originated. There are two main types of student loans available to borrowers.

How to lower your interest rate with student loan refinancing if you have an older federal student loan and want to lower your rate student loan refinancing may be a solution for you. How does refinancing work for student loans. If you do struggle to afford your student loan payments at any point help is out there. In the case of federal student loans the federal government acts as the lender.

Licensed by the department of business oversight under the california financing law license no. For example you might want to refinance a 30 year home loan into a 15 year home loan that comes with higher monthly payments but a lower interest rate. When you refinance a student loan you ll more than likely change lenders. Many lenders will allow you to refinance student loans with a cosigner who meets their lending requirements adding a cosigner could also help you snag a better student loan refinance rate than.

Many student loan refinancing companies may require that you have a college degree or a degree from an eligible institution.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)