Homeowners Insurance Limits

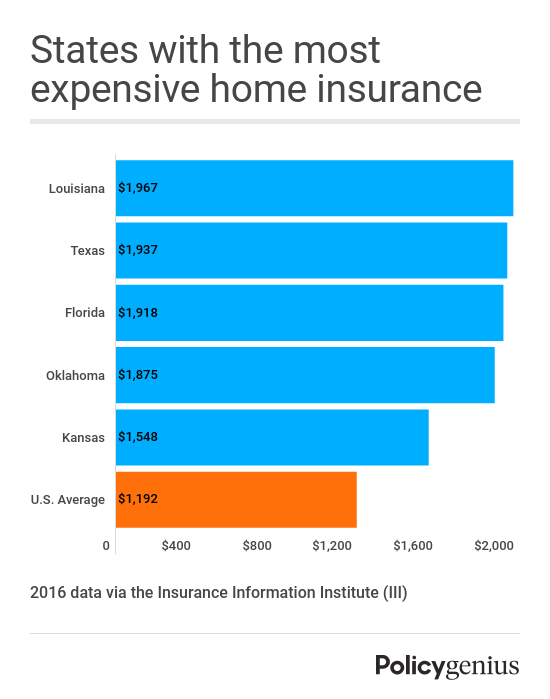

You will see annual average rates based on a 1 000 deductible for each liability limit of 100 000 300 000.

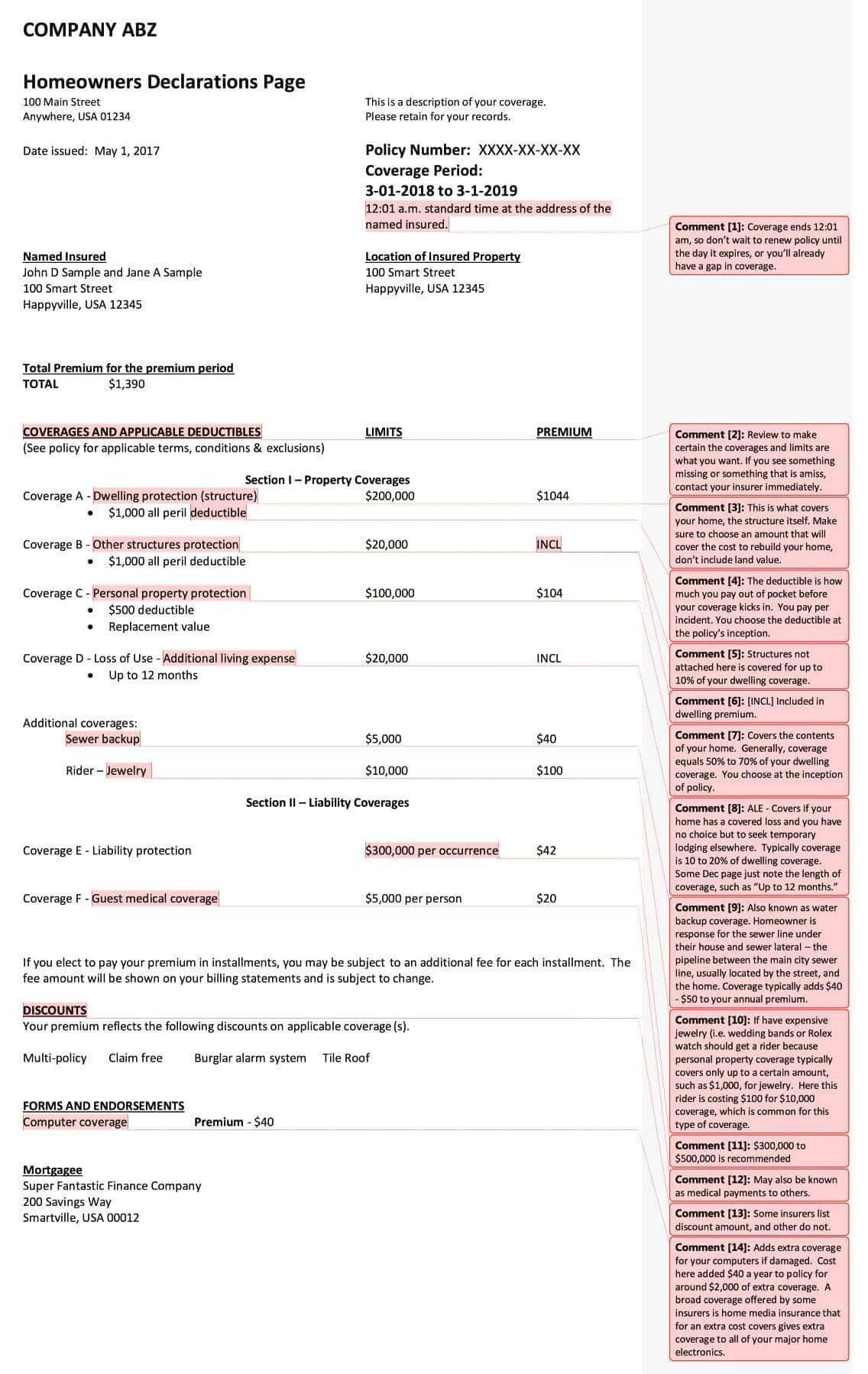

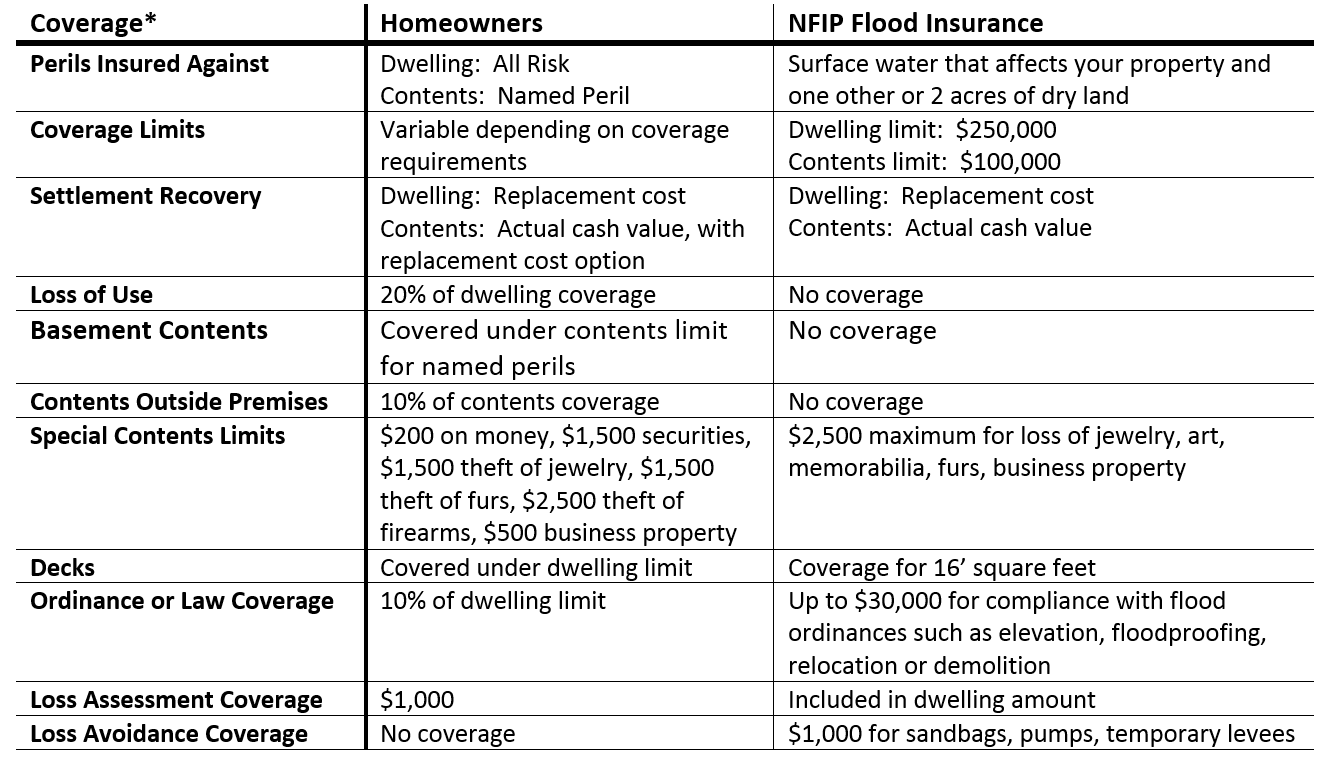

Homeowners insurance limits. Liability is the greatest buy in the insurance world so purchase as much as possible. However if you own a condo your ale coverage amount may be up to 50 of your dwelling coverage limit. Consider also how renters insurance or a homeowner policy covers an entire household. Determine if the personal property limits in your policy suit your needs.

Many experts recommend that homeowners pay additional premiums in order to get coverage limits between 300 000 to 500 000 in order to have adequate protection for themselves their families and their homes. Are all dogs covered under my homeowner s insurance. So if your policy has a 500 000 dwelling coverage limit your ale coverage limit would be 150 000. For example if you choose a 200 000 policy on.

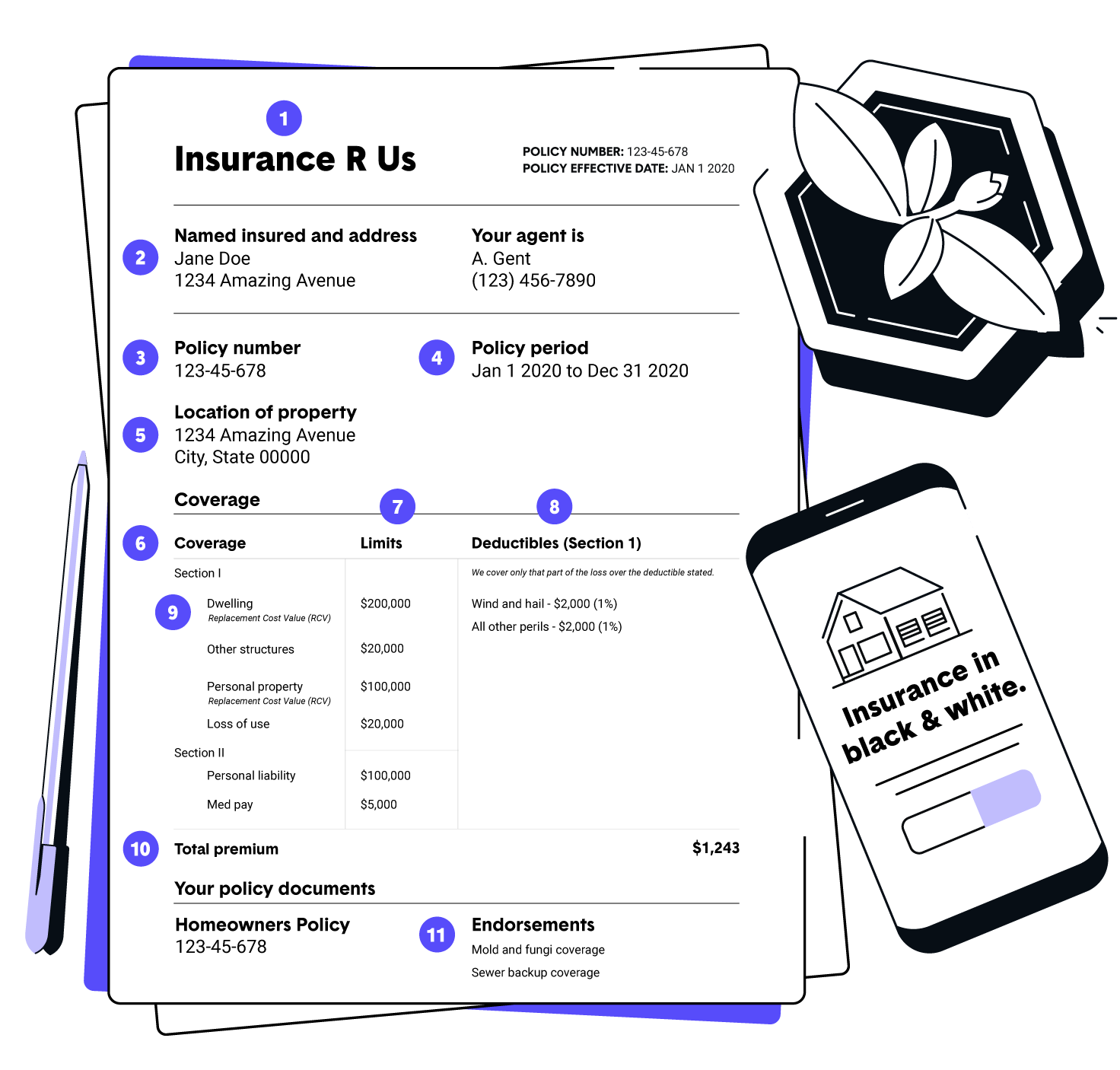

Standard policies will usually limit coverage b to 10 of the replacement cost of the home which is also the general industry s minimum recommendation for homeowners. An insurance limit is the maximum amount of money an insurer will pay toward a covered claim. The costs of homeowners insurance depend on a number of factors including the coverages you select features of your home and the value of your personal belongings. Standard policies include 100 000 worth of liability coverage but these limits can be extended to provide greater protection.

While the situation may have been different back when the policy was written a person in 2020 doesn t need to be rich to have a few hundred dollars. But you should buy at least 300 000 and 500 000 if you can. There may also be extra costs for additional coverage or increased coverage limits. Many standard homeowners insurance policies have a limit of 1 000 to 2 000 for jewelry.

The higher your coverage limit the higher your premium may be. For example an outdated policy limit might limit the maximum cash payable to 200 or 500. Enter a dwelling coverage of 200 000 300 000 400 000 500 000 or 600 000. Limits often apply to different types of coverage within a policy.

For standard homeowners insurance policies and renters insurance policies the limit is typically 30 of your dwelling coverage limit.

:max_bytes(150000):strip_icc()/insurance-endorsement-or-rider-2645729-FINAL-5bdb553b46e0fb00518eef20.png)