Homeowners Insurance In Pa

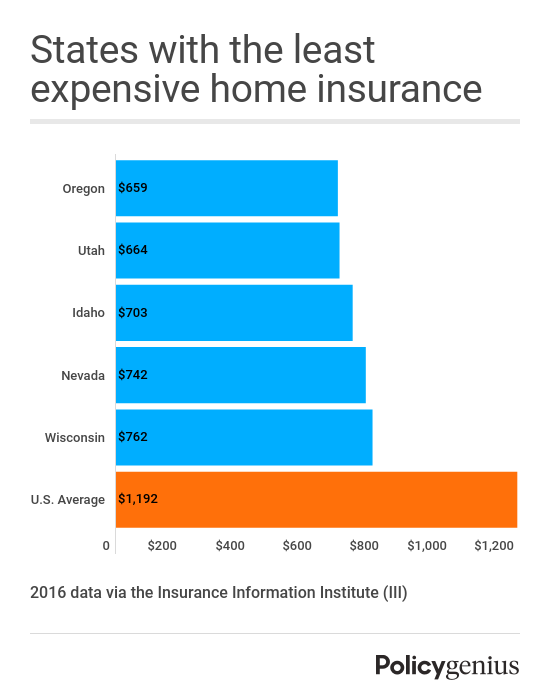

Average home insurance cost by state.

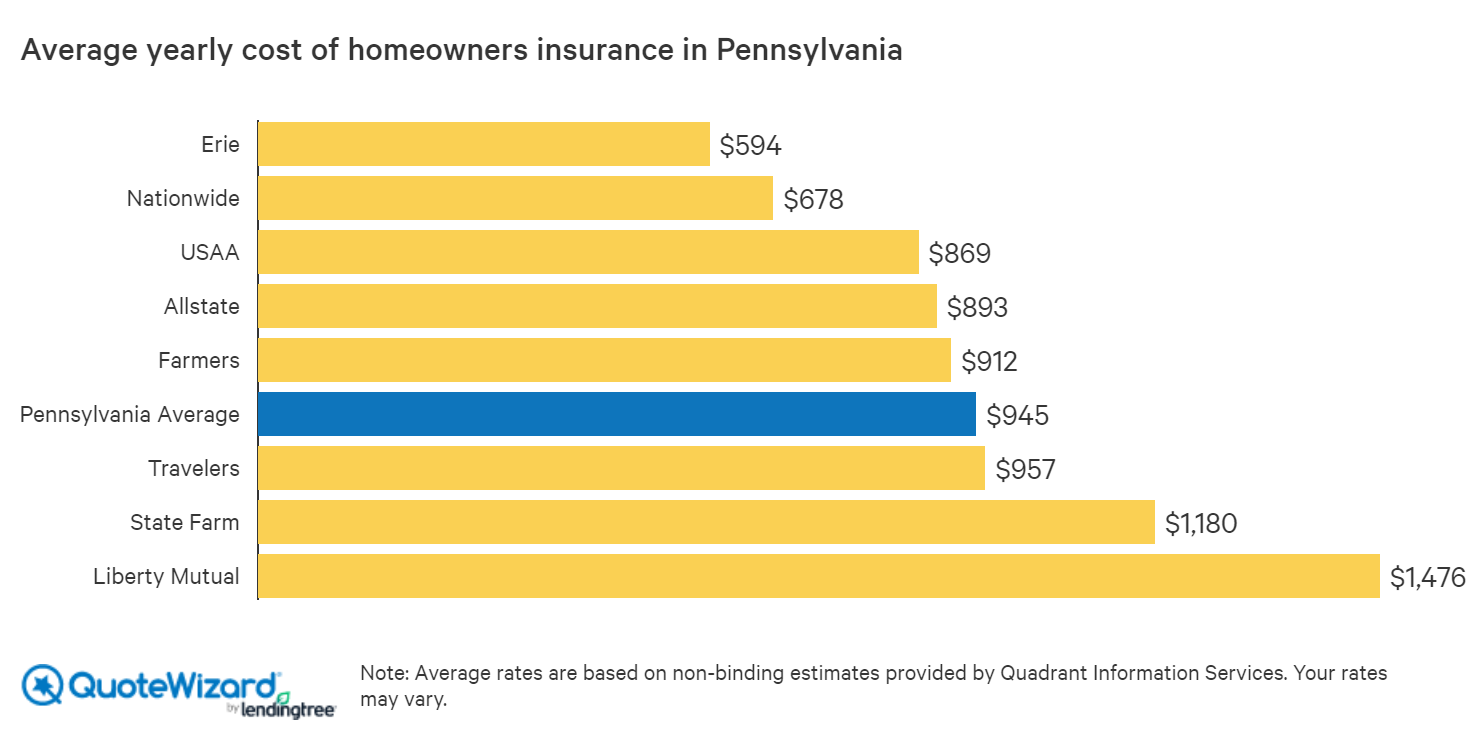

Homeowners insurance in pa. Pennsylvania s average home insurance rate with 200 000 dwelling coverage that includes a 1 000 deductible and 100 000 liability is 801 which is 35 percent below the national average. The average home insurance premium for owner occupied homes is 1 211 according to 2019 data from the national association of insurance commissioners naic. Out of the five most popular homeowners insurance companies in pennsylvania allstate is the cheapest homeowners insurance option on average for a pennsylvania home worth about 200k. Pennsylvania national mutual casualty insurance company or penn national specializes in pennsylvania home and auto insurance and offers its products in 11 states.

Nationwide s pennsylvania home insurance can cover you in the event of theft certain natural disasters water backup damage and more. Get a pennsylvania home insurance quote and start protecting your home today. What is the average cost of home insurance in pennsylvania. The house s foundation walls and roof dwelling protection may also help cover other structures that are attached to the home such as a garage or a deck against certain risks.

Pa home insurance laws and faq. Your cost will depend on a variety of. In the table below you can compare average homeowners insurance rates for a 200k home from the top five largest companies in pennsylvania by market share. To find out which is the best option for you compare coverage options and.

That s a savings of 427. Their average annual premium is affordable for pennsylvania residents and the company offers many options for additional coverage such as identity theft loss assessment personal umbrella policy and personal injury. Erie insurance state farm amica mutual and chubb are all among the best pennsylvania homeowners insurance companies. And with our home insurance discounts members can save even more on our affordable rates.

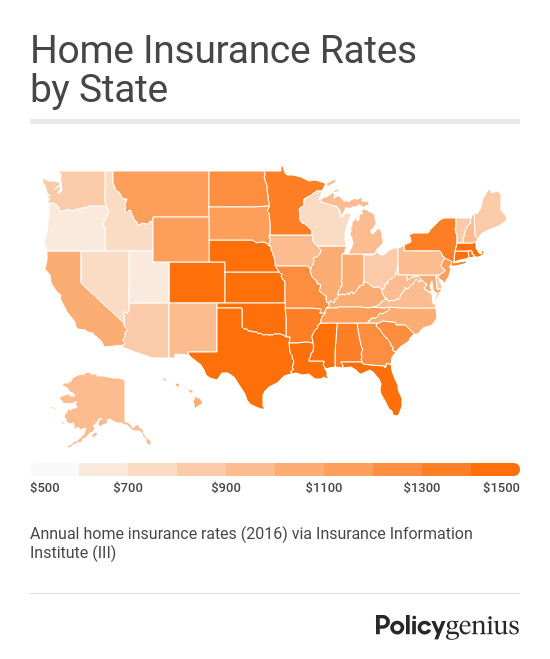

While many factors go into calculating your rate where you live is chief among them. Even if you don t own a home but rather rent an apartment you can purchase renters insurance to cover your personal belongings. A homeowner s insurance policy will cover your family s personal belongings your home and the contents of your home such as furniture appliances rugs clothing etc. Even though the premium amounts are more affordable than compared to the national average as the rates increase in pennsylvania for home insurance we could easily see the rates shoot past the national.

Homeowners in states that are prone to hurricanes hail storms tornadoes and earthquakes tend to pay the most for home insurance.